Can I Cash Out My Supplemental Life Insurance

Cash value A source of funds Not all life insurance can provide a source of supplemental retirement income. Most supplemental life insurance policies through work are group term life insurance and coverage is conditional on your employment.

Simple 5 Types Of Insurance You Should Think About As A Business Owner Life Insurance Policy Term Life Buy Life Insurance Online

Simple 5 Types Of Insurance You Should Think About As A Business Owner Life Insurance Policy Term Life Buy Life Insurance Online

That benefit comes in the form of a cash payment which can be paid out in one lump sum or in increments depending on what the policyholder wants.

Can i cash out my supplemental life insurance. Under most circumstances it is not recommended to surrender policy to access the cash value during life. This is only possible with types of permanent insurance which include whole life universal and variable life insurance policies. The other is a universal life.

Some permanent life insurance policies accumulate cash value. When you decided to make this decision you must be ready for several financial implications towards it. Because the policy carries.

Yes you can cash out a universal life insurance policy. In 2007 I purchased two insurance policies from an insurance agent who was a member of my Rotary Club. The employer might even.

Additionally when you withdraw or borrow money from the cash value account of a life insurance policy you dont have to sell the asset as you do with stocks bonds or certificates of deposit CDs. This means you can withdraw your basis the amount you have paid in premium or borrow money from the policy without having to pay taxes. For each the following factors should be taken into account before cashing out.

When your whole life insurance policy has cash value you can take a loan up to the cash value from your insurance company. Only permanent life insurance such as whole life universal life and variable life has a cash value account that grows over time tax-deferred. You wont have to go through an application process or credit check.

Zero net cost loans wash loans spread loans direct recognition loan and participation loans. The total amount paid out is reflective of the. Here are some common terms to look for.

That means the value of the policy will grow each year tax-deferred until it matches the face value of the policy. Here are the biggest benefits of buying supplemental life insurance through your employer. Borrow from your life insurance policys cash value If you want to keep your life insurance policy in force so your beneficiaries receive a payout when you die but need money now taking out a loan from your policys cash value is a great option.

No term life insurance pays a death benefit to your beneficiary if you die within the policys term. The cash can generally be accessed via loans or withdrawals and can be used for a variety of purposes. There are three options available when deciding to cash out or cash in a whole life policy.

The Social Security Administration does not have the right to interfere with your ability to purchase new life insurance coverage. If you have cash value life insurance that has accumulated surrender values then you can borrow money from your policy or withdraw basis generally after the 15th year of the policy All cash value life insurance policies have loan provisions that assess an interest rate charge. Permanent life insurance as its name implies covers you for your entire life.

Employers get a group insurance rate similar to group health insurance which can be lower than individual life insurance rates that you might find elsewhere. Benefits of Supplemental Life Insurance Through an Employer. Supplemental life insurance is similar to a group term life insurance policy but is typically more limited.

These may include tax liabilities which are the most common ones. CEO Outlook Life Inc Most of the US. The Cashing Out Options.

If you are receiving Supplemental Security Income you can purchase a new life insurance policy. Group term life insurance carries no cash value and is intended solely as a supplement to personal savings individual life insurance or social security death benefits. However depending on the policys portability you may be.

These types of policies build up cash value as policyowners make premium payments over time. If you have one of the original UL policies that were not guaranteed and is now using your cash value to supplement the premium you may find cashing it out and getting a new policy is your best option. Whole life policies present similar coverage shortfall challenges.

The limits will depend on your particular policy. Yes you can cash out your life insurance before you die. It doesnt have cash value while youre alive.

One policy is term insurance with a 150000 death benefit. Most whole life policies cover individuals for their lifetime and build up a cash value which allows the insured to cash out the. Surrendering the policy for the cash value means that the policy will be canceled immediately upon cashing out.

However cashing out your life insurance policy comes with its own consequences. Any amount you have not paid back by the time you die will be deducted.

The Midlife Crisis Life Insurance Challenge Universal Life Insurance Life Insurance Types Term Life

The Midlife Crisis Life Insurance Challenge Universal Life Insurance Life Insurance Types Term Life

Most Recent Cost Free Supplemental Health Insurance Healthinsurance Ideas The Best Heal Life Insurance Marketing Best Health Insurance Life Insurance Quotes

Most Recent Cost Free Supplemental Health Insurance Healthinsurance Ideas The Best Heal Life Insurance Marketing Best Health Insurance Life Insurance Quotes

Let Me Put You Under Aflac S Wing Life Insurance Facts Aflac Aflac Insurance

Let Me Put You Under Aflac S Wing Life Insurance Facts Aflac Aflac Insurance

404 Error Life Insurance Term Life Permanent Life Insurance

404 Error Life Insurance Term Life Permanent Life Insurance

Life Insurance Helps To Provide For Your Dependents When You Re No Longer Around To Do So One Var Insurance Marketing Life Insurance Marketing Life Insurance

Life Insurance Helps To Provide For Your Dependents When You Re No Longer Around To Do So One Var Insurance Marketing Life Insurance Marketing Life Insurance

Protecting My Family Whole Life Insurance Life Insurance Facts Life Insurance Quotes

Protecting My Family Whole Life Insurance Life Insurance Facts Life Insurance Quotes

/life_insurance_87614098-5bfc37104cedfd0026c3e06a.jpg) 6 Ways To Capture The Cash Value In Life Insurance

6 Ways To Capture The Cash Value In Life Insurance

Finalexpense Final Expense Insurance Life Insurance For Seniors Final Expense

Finalexpense Final Expense Insurance Life Insurance For Seniors Final Expense

Collateral Assignment Life Insurance Policy Sample Form Life Insurance Policy Insurance Policy Insurance

Collateral Assignment Life Insurance Policy Sample Form Life Insurance Policy Insurance Policy Insurance

What Is Cash Value Life Insurance Daveramsey Com

What Is Cash Value Life Insurance Daveramsey Com

How Do You Get A Life Insurance Policy You Have To Be Insurable It S Highly Advisable Tha Life Insurance Quotes Life Insurance Policy Life Insurance Facts

How Do You Get A Life Insurance Policy You Have To Be Insurable It S Highly Advisable Tha Life Insurance Quotes Life Insurance Policy Life Insurance Facts

What Is Universal Life Insurance Daveramsey Com

What Is Universal Life Insurance Daveramsey Com

Www Buylic In Life Insurance Facts Life And Health Insurance Health Insurance Humor

Www Buylic In Life Insurance Facts Life And Health Insurance Health Insurance Humor

Permanent Life Insurance Options Forbes Advisor

Permanent Life Insurance Options Forbes Advisor

Pin On Life Insurance And Investments

Pin On Life Insurance And Investments

Learn More About Philam Life Health Invest Plus Call 09175079031 0432776181 Finan Insurance Investments Life Insurance Marketing Life Insurance Facts

Learn More About Philam Life Health Invest Plus Call 09175079031 0432776181 Finan Insurance Investments Life Insurance Marketing Life Insurance Facts

I Challenge You To Take 10 Minutes Go To Google And Type Whole Life Insurance Quotes O Whole Life Insurance Whole Life Insurance Quotes Life Insurance Quotes

I Challenge You To Take 10 Minutes Go To Google And Type Whole Life Insurance Quotes O Whole Life Insurance Whole Life Insurance Quotes Life Insurance Quotes

How Does Whole Life Insurance Work Cash Value Explained

How Does Whole Life Insurance Work Cash Value Explained

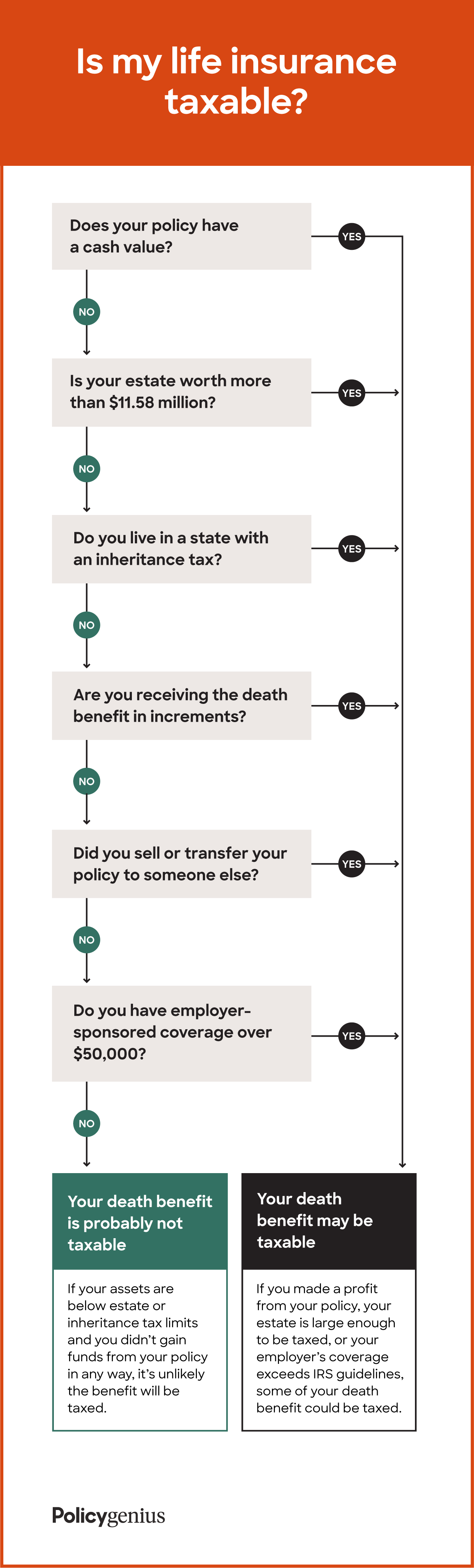

Is Life Insurance Taxable Policygenius

Is Life Insurance Taxable Policygenius

Post a Comment for "Can I Cash Out My Supplemental Life Insurance"