Insurance Companies Are Financial Intermediaries Meaning They

A financial intermediary offers a service to help an individual firm to save or borrow money. Simply put a financial intermediary is an entity that helps connect people and institutions that need money with those that have money.

Graphics For Trade Finance Presentation Explaining Export Import Diagrams Letter Of Credit Process Payment Template Ppt Trade Finance World Map Template Finance

Graphics For Trade Finance Presentation Explaining Export Import Diagrams Letter Of Credit Process Payment Template Ppt Trade Finance World Map Template Finance

They act as intermediary between savers and users investment of funds.

Insurance companies are financial intermediaries meaning they. The classic example of a financial intermediary is a bank that consolidates deposits and uses the funds to transform them into loans. Both banks and insurance companies are financial intermediaries. Many people use insurance companies as institutions in which they invest most of their savings.

They provide credit analysis services. Insurance companies outsource claim management or some aspects thereof to TPA with an aim to provide a quick turnaround to end customers. It saves time and effort for both parties by creating an economy of scale.

Financial intermediaries like banks are asset based or fee based on the kind of service they provide along with the nature of the clientele they handle. INSURANCE COMPANIES AS FINANCIAL INTERMEDIARIES 29 of business while new companies unburdened by investments bearing low yields expanded their share of the life insurance annuity and pension businesses. Savings and Credit Associations.

Financial intermediaries serve as middlemen for financial transactions generally between banks or funds. The first reason is that they receive funds from their clients for further investment. Traditionally insurance intermediaries have been categorized as either insurance agents or insurance brokers.

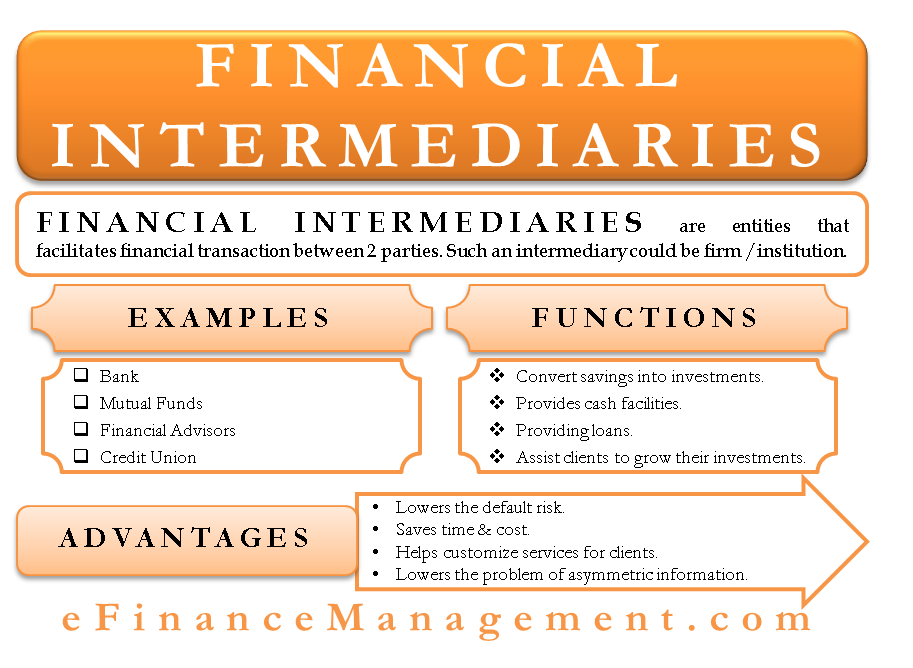

The job of financial intermediaries is to connect borrowers to savers. Funds flow from ultimate lenders to ultimate borrowers either directly or indirectly through financial institutions. Financial Intermediaries Meaning Functions And Importance A financial intermediary is an entity that facilitates a financial transaction between two parties.

Such an intermediary or a middleman could be a firm or an institution. A financial intermediary is a financial institution such as bank building society insurance company investment bank or pension fund. An insurance company ensures its customers against certain risks such as the risk of having.

Financial Intermediaries Definition A financial intermediary is a financial institution that connects surplus and deficit agents. Asset based financial intermediaries are institutions like banks and insurance companies whereas fee based financial intermediaries provide portfolio management and syndication services. Some examples of financial intermediaries are banks insurance companies pension funds investment banks and more.

Such institutions as investment banks commercial banks financial services corporations credit unions pension funds life insurance companies mutual funds exchange traded funds hedge funds and private equity companies play a key role in. Life insurers also acquired new assets promising greater or more flexible returns often accompanied by more risk. A financial intermediary helps to facilitate the different needs of lenders and borrowers.

By ensuring that each customer pays appropriate premiums the intermediary protects the insurers ability to cover losses while protecting the customers against overpayments. Functions performed by financial intermediaries. Another reason why these institutions can be found as financial intermediaries is that these.

These are firms that take the funds of many savers and then give the money as a loan in form of mortgage and to other types of borrowers. The primary role of intermediaries is to prevent adverse selection. However their functions are different.

They act as an intermediary between the insurance provider the policyholder and a service provider for example a hospital in the case of health insurance and a mechanic in case of motor insurance. These can be seen as business entities which accept deposits from the depositors or investors lenders by allowing them low interest on their sum. Simply put they help lenders meet borrowers and buyers meet sellers without either parties having to actually meet.

Examples of financial intermediaries 1. Creditors provide a line of credit to qualified clients and collect the premiums of debt instruments such as loans for financing homes education auto credit cards small businesses and personal needs. Financial intermediary is the organization which acts as a link between the investor and the borrower to meet the financial objectives of both the parties.

Several market participants interact in developed markets to organize the exchange of funds from buyers to sellers. A financial Intermediary is an Institution that acts as a middleman in financial transactions. Insurance Intermediaries Insurance intermediaries facilitate the placement and purchase of insurance and provide services to insurance companies and consumers that complement the insurance placement process.

Meaning of Financial Intermediaries FIs. A few financial intermediaries examples are commercial banks insurance companies pension funds financial advisors credit unions and mutual funds. These entities help people and institutions access money.

Definition of financial intermediaries. Insurance companies are considered as financial intermediaries for several reasons. Financial intermediaries FIs are financial institutions that intermediate between ultimate lenders and ultimate borrowers.

The hypothesis of financial intermediaries adopted by mainstream economics offers the following three major functions they are meant to perform. These intermediaries help create efficient markets and lower the cost of doing business.

Good Mutual Fund Advisor Investment Advisor Mutuals Funds Investing

Good Mutual Fund Advisor Investment Advisor Mutuals Funds Investing

Decentralized Finance Is A Continuum Finance Fintech Startups Capital Market

Decentralized Finance Is A Continuum Finance Fintech Startups Capital Market

Valuation Methods Three Main Approaches To Value A Business Intended For Business Value Assess Valuing A Business Business Valuation Business Budget Template

Valuation Methods Three Main Approaches To Value A Business Intended For Business Value Assess Valuing A Business Business Valuation Business Budget Template

Financial Intermediaries Intelligent Economist

Financial Intermediaries Intelligent Economist

Differences Between Ulip And Mutual Fund Mutuals Funds Life Insurance Policy Mutual

Differences Between Ulip And Mutual Fund Mutuals Funds Life Insurance Policy Mutual

Hostile Takeover Efinancemanagement Com Finance Investing Financial Management Financial Strategies

Hostile Takeover Efinancemanagement Com Finance Investing Financial Management Financial Strategies

Pin Oleh Serick Sam Di El Datafono Y Tpv Virtual Keuangan Investasi

Pin Oleh Serick Sam Di El Datafono Y Tpv Virtual Keuangan Investasi

Https Www Nlsbanking Com Mobileagencybanking Teraagency Is A Comprehensive Agency Banking Platform That Enables Bank Banking Services Mobile Banking Banking

Https Www Nlsbanking Com Mobileagencybanking Teraagency Is A Comprehensive Agency Banking Platform That Enables Bank Banking Services Mobile Banking Banking

Mutual Funds Archives Ezmart4u Real Estate Investment Trust Mutuals Funds Portfolio Professional

Mutual Funds Archives Ezmart4u Real Estate Investment Trust Mutuals Funds Portfolio Professional

Know How To Start And Stop Sip Online Mutuals Funds Systematic Investment Plan Sip

Know How To Start And Stop Sip Online Mutuals Funds Systematic Investment Plan Sip

Yankee Bonds Meaning Benefits Vs Eurobonds Good Investment Or Not Investing Best Investments Financial Management

Yankee Bonds Meaning Benefits Vs Eurobonds Good Investment Or Not Investing Best Investments Financial Management

Know About Tax On Mutual Fund And Taxation Rules Mutuals Funds Investing Fund

Know About Tax On Mutual Fund And Taxation Rules Mutuals Funds Investing Fund

Lecture 4 Liquidation Of Companies Youtube Lecture Research Paper Company

Lecture 4 Liquidation Of Companies Youtube Lecture Research Paper Company

Insurance Quotes Online Life Insurance Insurance Ads Insurance Humor Life Insurance Policy

Insurance Quotes Online Life Insurance Insurance Ads Insurance Humor Life Insurance Policy

What Is A Direct Plan Mutual Funds Sahi Hai How To Plan Fund Management Mutuals Funds

What Is A Direct Plan Mutual Funds Sahi Hai How To Plan Fund Management Mutuals Funds

Graphics For Trade Finance Presentation Explaining Export Import Diagrams Letter Of Credit Process Payment Template Ppt Trade Finance World Map Template Finance

Graphics For Trade Finance Presentation Explaining Export Import Diagrams Letter Of Credit Process Payment Template Ppt Trade Finance World Map Template Finance

Overview Of Indian Financial System Financial Financial Institutions Financial Instrument

Overview Of Indian Financial System Financial Financial Institutions Financial Instrument

Financial Intermediaries Meaning Functions And Importance

Financial Intermediaries Meaning Functions And Importance

What Are Financial Intermediaries Gocardless

What Are Financial Intermediaries Gocardless

Post a Comment for "Insurance Companies Are Financial Intermediaries Meaning They"