Performance Bond Insurance Uk

Surety for FTSE 250 companies large privately held companies corporate with a need for surety from Chubb Is a bond or a guarantee provided by a bank or insurer covering the beneficiary against the default of the bonded or guaranteed company. For those who arent familiar with bonds weve written a Fact Sheet with more detailed information.

Construction Payment Bonds Vs Performance Bonds Levelset

Construction Payment Bonds Vs Performance Bonds Levelset

With over 30 years of specialist Surety experience we are perfectly positioned to assist clients of all sizes to obtain a full range of bonds and guarantees for projects in the UK and around the world.

Performance bond insurance uk. A performance bond is usually issued by a bank or an insurance company both of which act as a surety. It provides security to the owner that in the event of your default the owners losses and damages will be paid under the bond subject to a stated maximum amount. A performance bond is issued to one party of a contract as a guarantee against the failure of the other party to meet obligations specified in the contract.

As a Contractor you may be asked to provide a guarantee for the satisfactory completion of a project Performance Bonds also know as a Surety Bond offer protection in the form of a set payment in the event that a contract is not completed to the specifications required. A Performance Bond is a form of security provided by a contractor to a developer. Many principal contractors now require a performance bond from their sub-contractors before awarding them a contract.

Performance Bonds are financial instruments of Guarantee. Bond Insurance Services Ltd established in 2006 focused on building a lasting reputation for reliability and professionalism. Our focus is providing leading advice for our clients.

A performance bond guarantees to your client that you will carry out and complete a project or sub-contract according to the terms and conditions of the contract. A performance bond is a guarantee for the satisfactory completion of a project. A financial guarantee linked to completion of a project.

Our Bond Insurance Policy protects UK exporters against demands for payment under a bond or a counter-guarantee that is. It consists of an undertaking by a bank or insurance company to make a payment to the employer in circumstances where the contractor has failed to fulfill the contract. They are usually used to provide a guarantee to one company the Beneficiary against another the Principal defaulting on its contractual obligations.

As the UKs leading Commercial Insurer we pride ourselves on understanding what customers need. This is typically a percentage of the Contract and can range from 5 to 20 in value with most Developers and Contractors requiring cover for 10 of the contract value. UK Surety Limited is an independent specialist in the UK Surety market.

Our ethos is based on around our clients positive outcome that they should be able to speak to their own dedicated account handler. Whether or not a performance bond is required will depend in the main on the perceived financial strength of the party bidding to win a contract as the most common concern relates to a. A performance bond or performance security is commonly used in the construction industry as a means of insuring a client against the risk of a contractor failing to fulfil contractual obligations to the client.

It is also referred to as a contract. It consists of an undertaking by a bank or insurance company to make a payment to the employer in circumstances where the contractor has defaulted under the contract. Sometimes referred to as a Surety Bond a Performance Bond is a form of security provided by a contractor to a developer.

The bank may also issue a counter-guarantee to a bank in the buyers country. Our approach is to bring the relevant expertise to build the right insurance solutions for UK business whether they are starting-up or growing to established large corporates to provide the right level of protection prevent losses and manage claims with professionalism and diligence. It will require having a collateral property or investment to back up the requirements of the surety agency.

It is common in construction and real estate development Private Government Projects. Performance Bond It is issued to one party of a contract as a guarantee against the failure of the other party to meet obligations specified in the contract. This includes performance bonds Highways Act bonds advanced payment bonds HM Custom Excise bonds pension bonds retention bonds environmental bonds rural payment agency guarantees and travel bonds.

We place all types of surety bond in the UK and Ireland and through our Gallagher network can arrange bonds in many other countries. The insurance market prefers to provide guarantee bonds that are conditional in nature and relate directly to the underlying contractual obligations. These can be arranged on an individual or agreed limitfacility basis Retention bonds.

Performance Bonds uk is the bond division of Peter Hill Credit Financial Risks Ltd. Marshs Surety Practice has the experience expertise and insurance market relationships to ensure you have sufficient bonding capacity at competitive terms. Managed by David Smith MRICS a Chartered Quantity Surveyor with over 30 years unique experience in constructionperformance bonding insurance broking and providing credit insurance solutions for construction sub-contractors.

Performance bonds can also be required from other parties to a construction contract. An alternative to your main contractor withholding a percentage of the contract value.

Surety Bonds A Brief Introductory Guide Insurance Business Uk

Surety Bonds A Brief Introductory Guide Insurance Business Uk

Construction Performance Bond What Is It And The Cost

Construction Performance Bond What Is It And The Cost

Performance Bonds In Construction C Link

Performance Bonds In Construction C Link

How Do I Call On A Performance Bond Comment Building

How Do I Call On A Performance Bond Comment Building

Why Contractors Need Surety Bond Insurance Companies Bond Insurance Bond Insurance Company

Why Contractors Need Surety Bond Insurance Companies Bond Insurance Bond Insurance Company

Georgia Wine Performance Or Tax Liability Surety Bond Doctors Note Bond Good Credit

Georgia Wine Performance Or Tax Liability Surety Bond Doctors Note Bond Good Credit

Performance Bond Or Guarantee Spot The Difference

Performance Bond Or Guarantee Spot The Difference

Differences Between Surety Bonds And Insurance Prosure Bond Insurance Insurance Bond

Differences Between Surety Bonds And Insurance Prosure Bond Insurance Insurance Bond

Frequently Asked Questions About Surety Bonds Suretybonds Com

Frequently Asked Questions About Surety Bonds Suretybonds Com

Surety Glossary Drs Bond Management

Free Bid Bond Free To Print Save Download

Free Bid Bond Free To Print Save Download

Surety Bond Definition Swiftbonds

Surety Bond Definition Swiftbonds

Performance Bond Surety S Equitable Subrogation Claim Against Owner Florida Construction Legal Updates How To Get Money Health Insurance Companies Money Change

Performance Bond Surety S Equitable Subrogation Claim Against Owner Florida Construction Legal Updates How To Get Money Health Insurance Companies Money Change

Sample Surety Bond Free Fillable Pdf Forms Debt Counseling Notes Template Bond

Sample Surety Bond Free Fillable Pdf Forms Debt Counseling Notes Template Bond

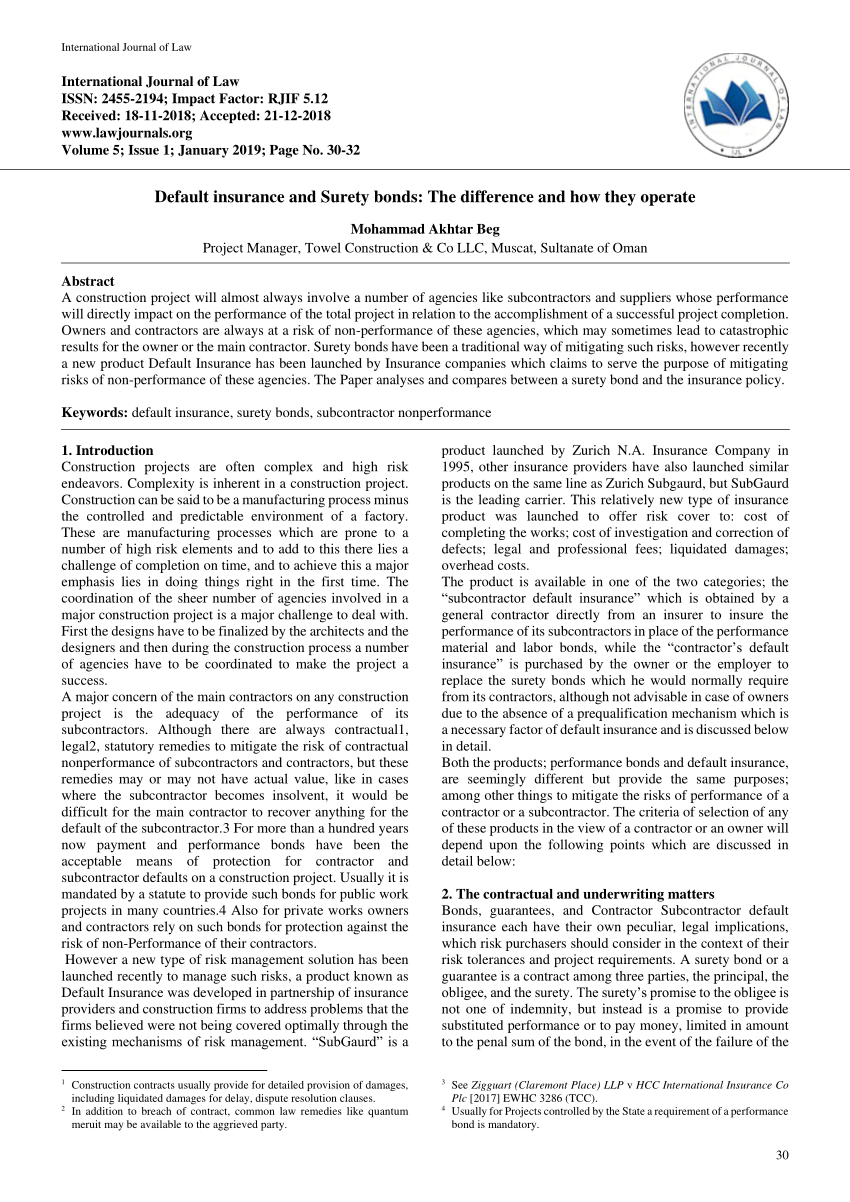

Pdf Default Insurance And Surety Bonds The Difference And How They Operate

Pdf Default Insurance And Surety Bonds The Difference And How They Operate

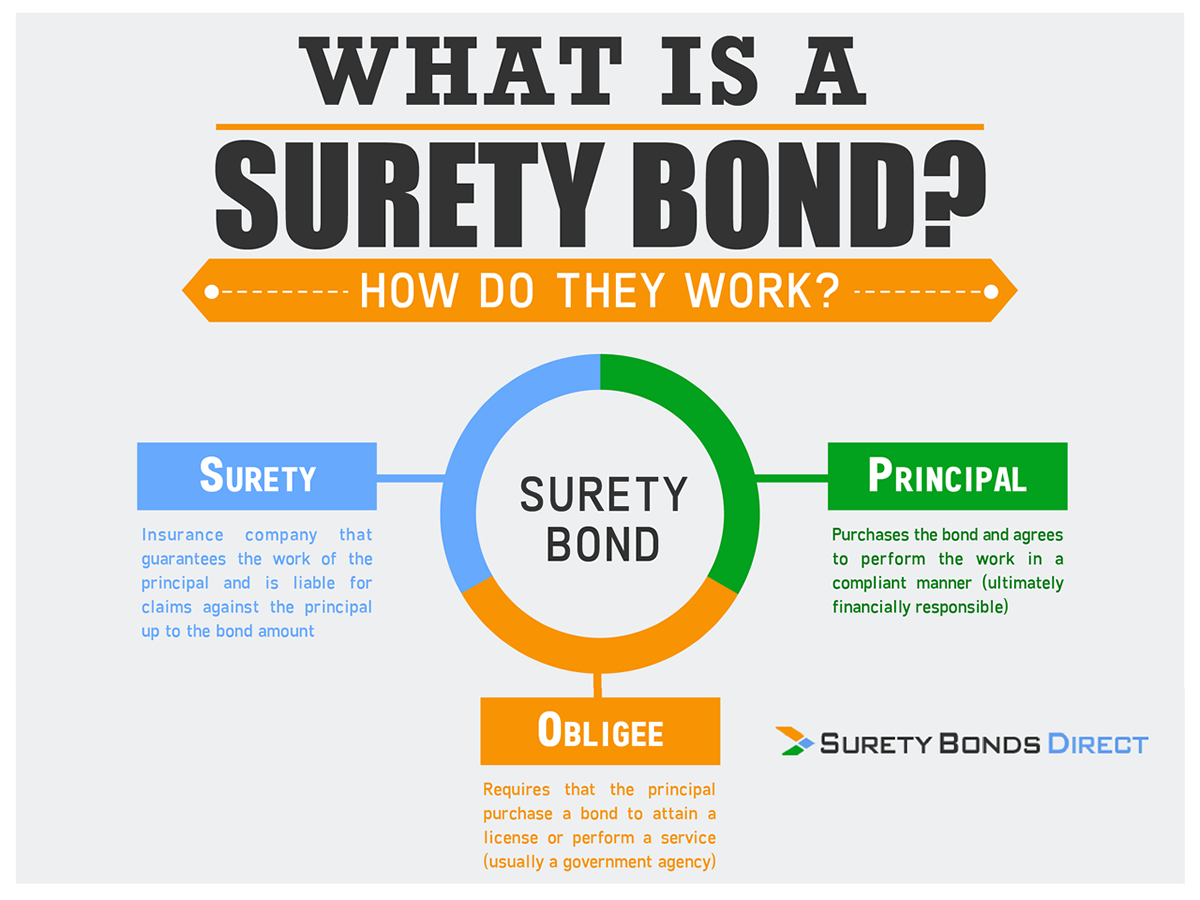

What Is A Surety Bond Surety Bonds Explained

What Is A Surety Bond Surety Bonds Explained

How Much Does A Surety Bond Cost 2021 Lance Surety Bonds

How Much Does A Surety Bond Cost 2021 Lance Surety Bonds

Post a Comment for "Performance Bond Insurance Uk"