Switching Health Insurance Mid Year Deductible

This process is called a deductible credit transfer. Heres the tricky part about organizations renewing the health plan mid-year.

Savingsaccounts Jpg Compound Interest Money Personal Finance Books High Deductible Health Plan

Savingsaccounts Jpg Compound Interest Money Personal Finance Books High Deductible Health Plan

Barring these qualifying events you must wait until open enrollment to make policy changes.

Switching health insurance mid year deductible. You may be able to change health plans mid- year or get other high deductible help. If they so chose an employer can commonly change plans. They can also limit mid-year elections based on FSA amounts that are already reimbursed.

Read on to learn more about how life changes called qualifying life events may allow you to add or subtract the people on your plan or even change the plan itself. Switching health plans mid-year usually means starting over with a new deductible. There are few circumstances that qualify you to change your health insurance plan mid-year.

Open enrollment isnt the only time you can change your health insurance coverage. With very few exceptions you can cancel your health insurance plan at any time for. Shouldnt the deductible be prorated to half of the annual deductible.

Switching your health insurance involves two steps. The short-term policy usually does not meet the requirements for the Affordable Are Act. What would happen to my money in the account if I switch to a plan that doesnt qualify for an HSA.

Each health plan is governed by the terms of its policy. Also with a Special Enrollment Period You can change health plans any time if you experience a qualifying life event like losing other coverage having a baby moving or getting married. Insurance is a contract after all.

I have a high-deductible health plan and use a Health Savings Account HSA. For example if by June youve already met your current health insurance providers 1000 deductible your next covered medical expenses should be paid 100 percent by your health plan minus any copayments or co-insurance youre required to pay. Is your Obamacare plan too expensive to use because of a high deductible.

Lets say your employer decides to drop the group health plan and give employees a monthly amount to spend on individual health insurance this is called a Defined Contribution. Choose your active application under Your Existing Applications Select Report a Life Change from the left-hand menu. If an employee does not meet some requirement under a plan the insurer is entitled to hold the employee to the consequences of that failure such as not giving him or her credit for a deductible.

When you sign up for new health insurance at your new employers you may have. You can change your Marketplace health coverage February 15 through May 15 due to the coronavirus disease 2019 COVID-19 emergency. If you change plans for instance from group to individual or health insurance companies during the calendar year your deductible amount resets meaning you dont get credit for the money you put toward your deductible amount thus far.

After all youre only getting health insurance for half of the year if you enroll mid-year. As with mid-year changes to health insurance plans employers can allow one both or no changes. You may be able to switch health insurance mid year or you may have to wait for the next open enrollment period.

Log in to your Marketplace account. If a health insurance plan member has paid toward his or her deductible and then switches plans some companies allow that paid portion of the deductible to transfer to the new health plan. When changing Health Insurance companies mid-year can the deductible paid be transferred in whole or part to the new company.

If he or she chooses a high-deductible option with a mid-year anniversary date most employees will never satisfy the deductibles. In a recent Money Girl article and podcast called How to Save Money on Healthcare With an HSA I discussed the. Lets look at an example of how this works.

If you dont select the same health plan then your deductible will start over as soon as your new plan takes effect. Read through the list of changes and click Report a Life Change to get started. May 1st 2010 we started using health insurance provide by husbands company which came with a 6000 deductible.

Canceling your current plan and signing up for a new plan. It may seem unfair to have to pay your entire deductible if you dont sign up for health insurance until the middle the year. Marriage acquiring a child moving away from the area served by your Health Maintenance Organization HMO losing health insurance coverage or changing employment status.

Select the kind of change you want to report. The short-term insurance policy will cost less but is catastrophic insurance which means you will have a high deductible to meet before it starts covering your medical bills. If you switch plans midyear you may have to start all over again with paying down your deductible and working toward reaching your annual out-of-pocket maximum spending limit.

Outside of Open Season you can make changes due to certain events called qualifying life events QLEs The most common QLEs for changing enrollment type or plan are.

Is A Health Insurance Premium Tax Deductible With Llc Legalzoom Com

Is A Health Insurance Premium Tax Deductible With Llc Legalzoom Com

How Much Can You Save With A Higher Deductible Health Insurance Plan

How Much Can You Save With A Higher Deductible Health Insurance Plan

6 Important Facts That You Should Know About Medical Insurance Deductible Medical Insurance Deductible Insurance Deductible Medical Insurance Health Insurance

6 Important Facts That You Should Know About Medical Insurance Deductible Medical Insurance Deductible Insurance Deductible Medical Insurance Health Insurance

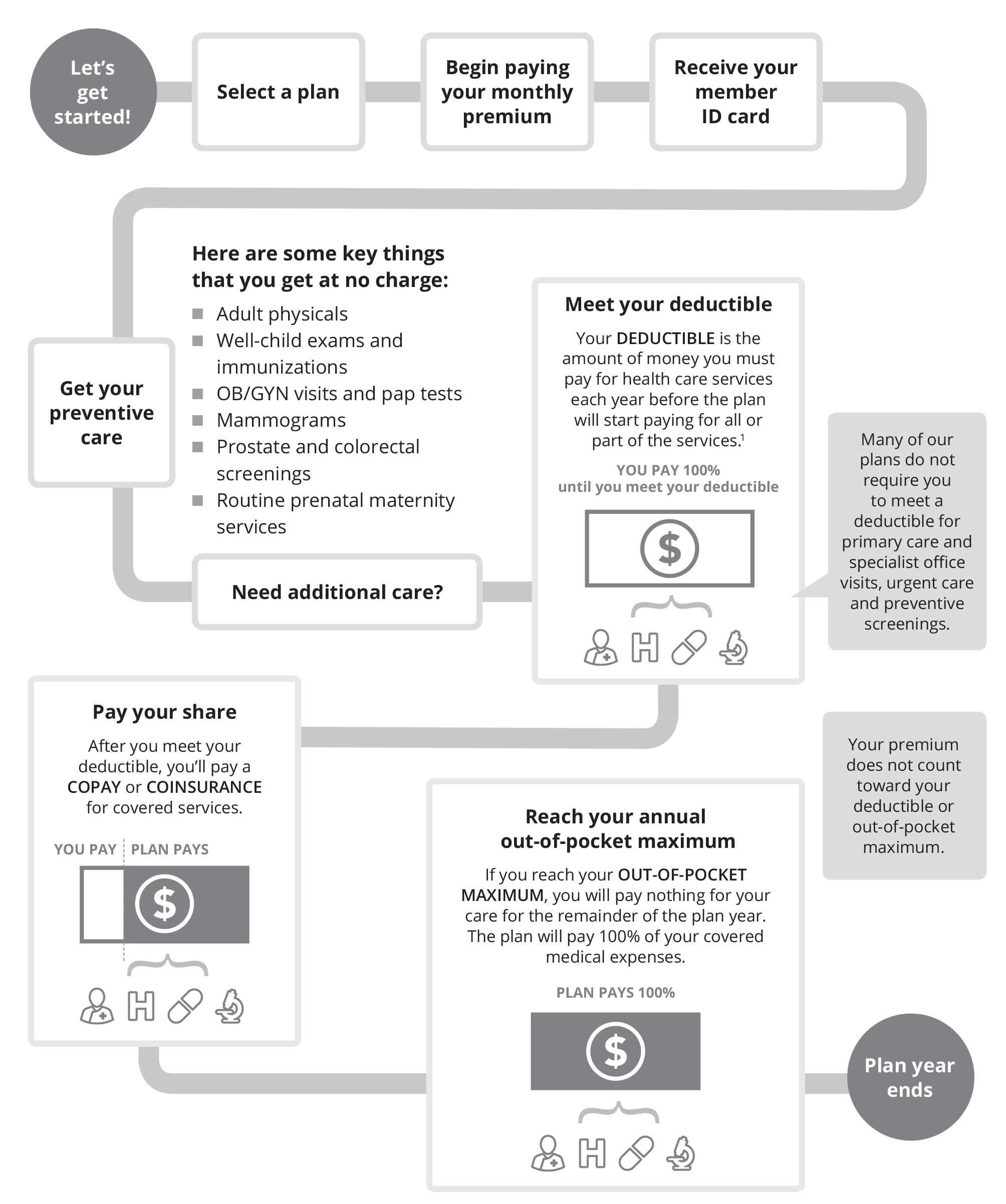

How A Deductible Works For Health Insurance

How A Deductible Works For Health Insurance

Deductible Maryland Health Connection

Deductible Maryland Health Connection

This Year We Switched To An Hsa With A High Deductible Plan Yay The Chance To Spend Less On Health Health Care Insurance Money Lessons Keeping Kids Healthy

This Year We Switched To An Hsa With A High Deductible Plan Yay The Chance To Spend Less On Health Health Care Insurance Money Lessons Keeping Kids Healthy

A Beginner S Guide To S Corp Health Insurance The Blueprint

A Beginner S Guide To S Corp Health Insurance The Blueprint

5 Ways To Cover Costs When You Can T Afford Your Insurance Deductible Insurance Deductible Healthcare Costs Deduction

5 Ways To Cover Costs When You Can T Afford Your Insurance Deductible Insurance Deductible Healthcare Costs Deduction

Today S Term Is Health Savings Account Or Hsa Connected To An Hdhp An Hsa Lets You Save Money For Medic Health Savings Account Changing Jobs Travel Insurance

Today S Term Is Health Savings Account Or Hsa Connected To An Hdhp An Hsa Lets You Save Money For Medic Health Savings Account Changing Jobs Travel Insurance

Open Enrollment Series Part 2 What S A Deductible Anyway And 4 Other Health Insurance Terms You Need To K Open Enrollment Content Insurance Health Insurance

Open Enrollment Series Part 2 What S A Deductible Anyway And 4 Other Health Insurance Terms You Need To K Open Enrollment Content Insurance Health Insurance

Health Insurance Plans Health Mybenefits Department Of Management Services

Health Insurance Plans Health Mybenefits Department Of Management Services

What Is A Deductible Here S How A Deductible Works When You Get A Health Insurance Plan Deductible What Health Insurance Plans Health Insurance How To Plan

What Is A Deductible Here S How A Deductible Works When You Get A Health Insurance Plan Deductible What Health Insurance Plans Health Insurance How To Plan

Health Insurance Costs Carefirst Bluecross Blueshield

Health Insurance Costs Carefirst Bluecross Blueshield

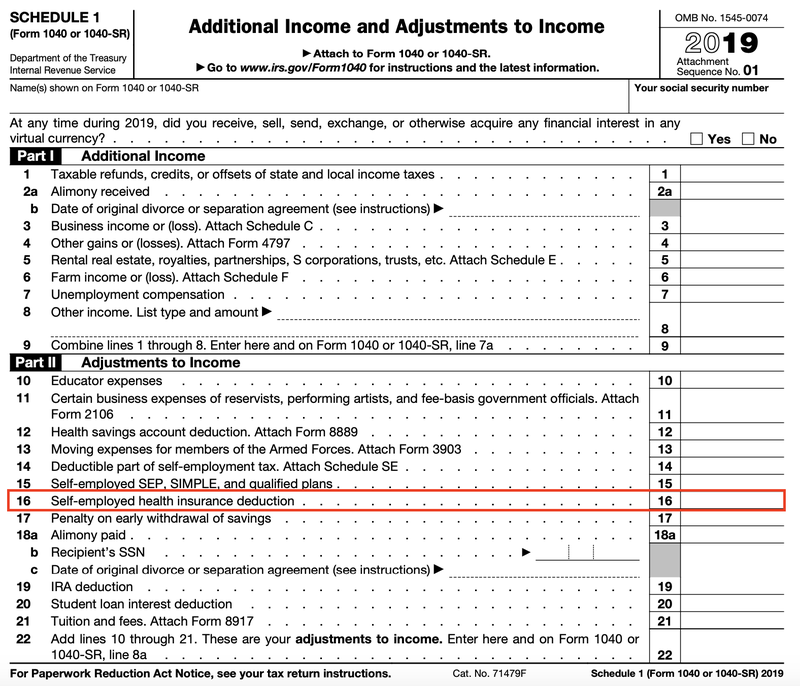

What Is The Self Employed Health Insurance Deduction Ask Gusto

What Is The Self Employed Health Insurance Deduction Ask Gusto

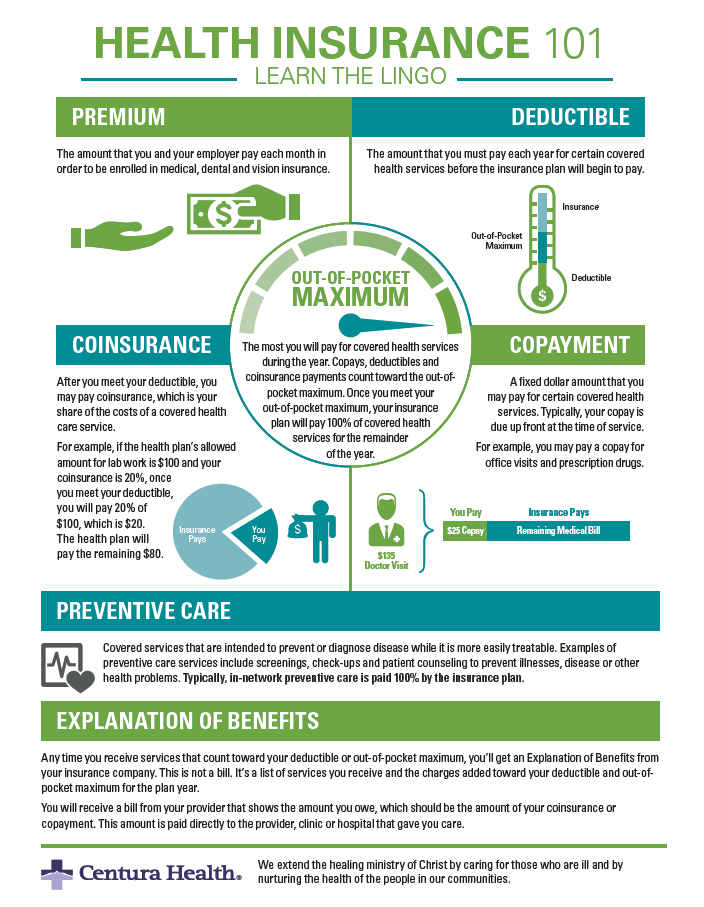

Insurance Coverage Centura Health

Insurance Coverage Centura Health

Comparison Of A Medicare Supplement Plan And An Medicare Advantage Plan Medicare Advantage Medicare Supplement Plans Medicare Supplement

Comparison Of A Medicare Supplement Plan And An Medicare Advantage Plan Medicare Advantage Medicare Supplement Plans Medicare Supplement

5 Ways To Cover Costs When You Can T Afford Your Insurance Deductible Insurance Deductible Health Insurance High Deductible Health Plan

5 Ways To Cover Costs When You Can T Afford Your Insurance Deductible Insurance Deductible Health Insurance High Deductible Health Plan

What Is A Health Insurance Deductible Daveramsey Com

What Is A Health Insurance Deductible Daveramsey Com

Updating Deductibles Met And Benefits Used Mid Year Deduction Insurance Car Insurance

Updating Deductibles Met And Benefits Used Mid Year Deduction Insurance Car Insurance

Post a Comment for "Switching Health Insurance Mid Year Deductible"