What Does Individual/family Deductible Mean

The family deductible can be reached without any members on a family plan meeting their individual deductible. In a more traditional type of health plan each family member has an individual deductible ie an embedded deductible and the family as a whole has a family deductible.

5 Fantastic Vacation Ideas For Colorado Health Insurance Colorado Health Insurance Https If Health Insurance Plans Health Insurance Health Insurance Broker

5 Fantastic Vacation Ideas For Colorado Health Insurance Colorado Health Insurance Https If Health Insurance Plans Health Insurance Health Insurance Broker

Your health plans family deductible is how much money you must pay out of pocket for all covered family members combined before the plan assists with some medical costs.

What does individual/family deductible mean. There is a caveat. So if you meet your 500 individual deductible and you have a 1000 family deductible youve already contributed half of the required funds. She loves that her building has a gym and pool because she likes to stay in shape.

Each family member has an individual deductible. As an example consider a plan with a 4000 individual deductible and an 8000 family deductible. The nice part of a family deductible is that individual deductibles paid are applied to the family deductible as well.

Your deductible is the amount of money you pay out-of-pocket for covered health care services before your insurance company pays anything. As an example you have a 500 deductible and have your first doctors visit of the year. For a family of two the family deductible is usually equal to the sum of the individual deductibles.

The amount the insurance company pays after you meet the deductible will depend on your coinsurance percentage. High-deductible health plans can lead to a. The family deductible helps to keep overall costs more manageable especially for a larger family.

In a health plan with an embedded deductible no single individual on a family plan will have to pay a deductible higher than the individual deductible amount. The single deductible is embedded in the family deductible so no one family member can contribute more than the single amount toward the family deductible. Courtney 43 is a single lawyer who just bought her first home a condo in Midtown Atlanta.

For example if you have a 2000 yearly deductible youll need to pay the first 2000 of your total eligible medical costs before your plan helps to pay. Deductible Coinsurance In addition to your monthly premium your deductible is the amount of money you have to pay out-of-pocket for covered medical expenses before your insurance company starts helping with costs. The individual deductible is the amount of expenses that one individual must accumulate before their deductible is met.

When you sign up for a plan you may be able to choose between a high or low deductible plan. The family deductible is the amount that the all covered family together must accumulate before the deductible is met for all family members. If your deductible says 5001500 that means each individual on the plan has a maximum 500 deductible.

A deductible is the amount you pay each year for most eligible medical services or medications before your health plan begins to share in the cost of covered services. Family plans have both individual and family deductibles. Per HealthCaregov the government defines a plan as an HDHP if the individual deductible is at least 1350 or a family deductible is at least 2700.

Once your family deductible is met full plan benefits kick in for every member of your family regardless of whether. When a family has coverage under one health plan there is an individual deductible for each family member and family deductible that applies to everyone. Everything paid toward individual deductibles is also credited toward the family deductible.

Generally plans with a higher deductible will have lower premiums because you spend more of your own money on care and the insurance company pays less. A higher deductible plan means lower monthly payments. A deductible is the amount youre responsible for paying for health care before your insurance takes over.

Family plans may have two deductibles. The first deductible is what is called an embedded deductible meaning that there are two deductible amounts within one plan. For example lets say you have five family members an individual deductible of 1500 and a family deductible of 3000.

Thanks to the Affordable Care Act also known as the ACA or Obamacare certain preventive services usually are not subject to a deductible. After you meet this deductible individual deductibles for covered family members wont apply anymore. If the plan uses embedded deductibles a single member of the family would have met the deductible once he or she had paid 4000.

An example of how it works. A deductible is simply the total youll pay out-of-pocket for health care services before a plan begins paying for those expenses. If your health plan covers you along with other dependents you may have an individual deductible which applies to each person and a family deductible which applies to the whole family.

A deductible is the amount you pay out-of-pocket for covered services before your health plan kicks in. Once youve reached your out-of-pocket maximum your plan covers 100 of costs for the rest of the year. The second number refers to the maximum deductible for all members of the plan.

You may also have multiple deductibles such as one just for prescription drugs. Deductibles might range anywhere from about 0 to 8550 for an individual or 0 to 17100 for a family. The family has a deductible too.

The family deductible can vary depending on your plan but is often about the sum of two individual deductibles. All individual deductibles funnel into the family deductible. For example the family deductible might be 2000 and each individual deductible might be 350.

How Much Does Individual Health Insurance Cost Ehealth

How Much Does Individual Health Insurance Cost Ehealth

How A Deductible Works For Health Insurance

How A Deductible Works For Health Insurance

Some Things To Be Aware Of When Purchasing Health Insurance Health Insurance Policies Affordable Health Insurance Health Insurance

Some Things To Be Aware Of When Purchasing Health Insurance Health Insurance Policies Affordable Health Insurance Health Insurance

What S The Difference Between Family And Individual Deductibles

What S The Difference Between Family And Individual Deductibles

Health Savings Accounts Infographic Savings Account Health Savings Account Buy Health Insurance

Health Savings Accounts Infographic Savings Account Health Savings Account Buy Health Insurance

Do You Understand How The Donut Hole Works In Medicare Luckily It S Going To Disappear By 2020 So That You Pay Only 25 Medicare Health Insurance Insurance

Do You Understand How The Donut Hole Works In Medicare Luckily It S Going To Disappear By 2020 So That You Pay Only 25 Medicare Health Insurance Insurance

What Happens After I Meet My Deductible Ehealth Insurance

What Happens After I Meet My Deductible Ehealth Insurance

Https Www Aetna Com Sbcsearch Getmysbc T 14033231 D 01 01 2017

What Is A Family Health Insurance Plan Ehealth

What Is A Family Health Insurance Plan Ehealth

Https Www Securitylife Com Personal Plans Agnt Sltc9vmh Dental And Vision Insurance Dental Insurance Plans Dental Insurance

Https Www Securitylife Com Personal Plans Agnt Sltc9vmh Dental And Vision Insurance Dental Insurance Plans Dental Insurance

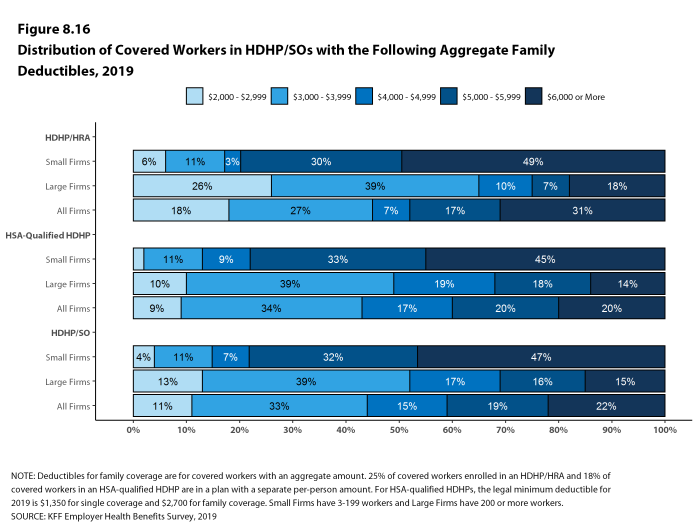

Section 8 High Deductible Health Plans With Savings Option 9335 Kff

Section 8 High Deductible Health Plans With Savings Option 9335 Kff

Family File Dental Insurance Plans Cheap Dental Insurance Dental Business

Family File Dental Insurance Plans Cheap Dental Insurance Dental Business

Co Insurance Co Insurance Medical Insurance Insurance

Co Insurance Co Insurance Medical Insurance Insurance

How To Get Health Insurance On The New York State Exchange What To Consider Where To Look How To Do It Done Family Income Health Insurance How To Get

How To Get Health Insurance On The New York State Exchange What To Consider Where To Look How To Do It Done Family Income Health Insurance How To Get

March 2013 Newsletter In This Issue 4 Key Tax Changes In 2013 Small Business Health Care Tax Credit H3 Welln Health Care Wellness Tips Health Care Reform

March 2013 Newsletter In This Issue 4 Key Tax Changes In 2013 Small Business Health Care Tax Credit H3 Welln Health Care Wellness Tips Health Care Reform

What Does It Mean To Have A Family Deductible

What Does It Mean To Have A Family Deductible

What Do The New Tax Changes Mean For You Infographic In 2020 Mortgage Infographic Change Meaning Standard Deduction

What Do The New Tax Changes Mean For You Infographic In 2020 Mortgage Infographic Change Meaning Standard Deduction

Dunkin Donuts Benefits Enrollment Poster Design By Twolinestudio Com Open Enrollment Flyer Flyer Design Templates

Dunkin Donuts Benefits Enrollment Poster Design By Twolinestudio Com Open Enrollment Flyer Flyer Design Templates

Post a Comment for "What Does Individual/family Deductible Mean"