Insurance Company Runoff Definition

An insurance firm is in run-off when it has stopped issuing new contracts of insurance. A run-off specialist uses its experience managing complex claims its specialized focus and its economies of scale to profitably.

What Is Run Off Insurance Blogging Inspiration About Me Blog Blog Biz

What Is Run Off Insurance Blogging Inspiration About Me Blog Blog Biz

In cases where an individual retires but the business continues to offer the same services the businesss indemnity insurance should protect the retiree against claims.

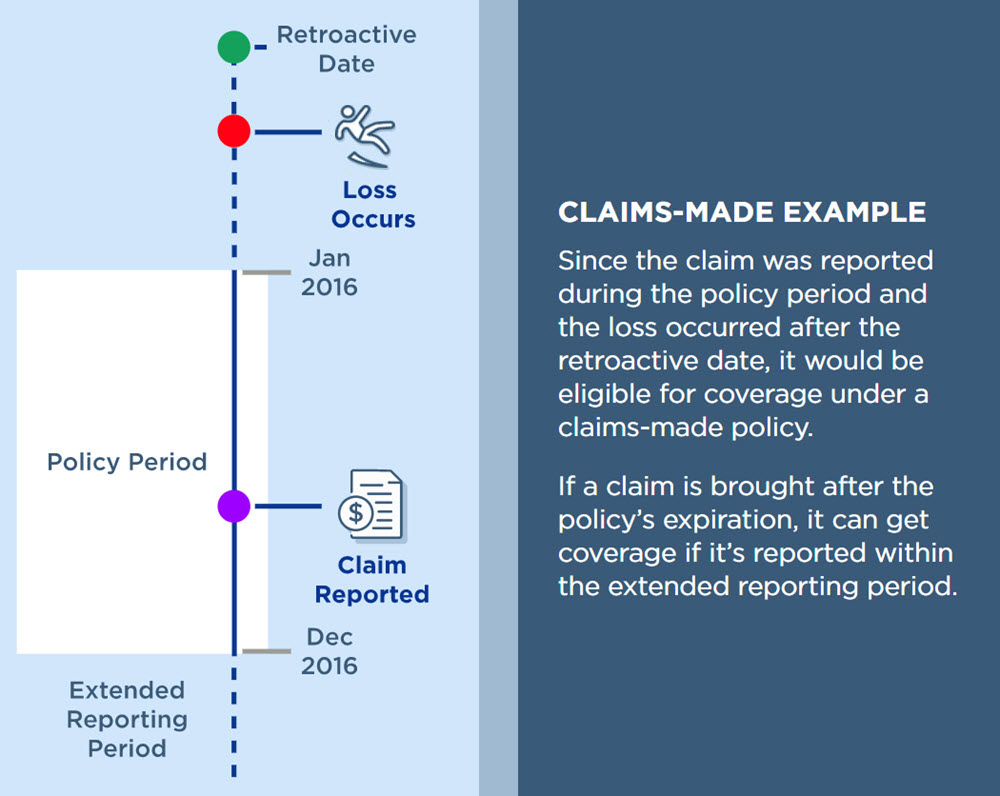

Insurance company runoff definition. Run-off insurance exists for the individual or business that no longer offers services. Heres a definition for runoff insurance A provision in a claims-made policy stating that the insurer remains liable for claims caused by wrongful acts that took place under an expired or canceled policy for a certain time period. Run-off premiums are calculated using a range of methods but all typically reflect the diminishing risk of executives receiving new claims over time.

In some business acquisitions the business making the purchase assumes complete liability for any claims against the work of the purchased business. A run-off policy is generally purchased in a one off transaction with insurers offering discounted rates to companies who purchase multiple years of coverage. Japan to a runoff reinsurer.

Runoff Provision a provision in a claims-made policy stating that the insurer remains liable for claims caused by wrongful acts that took place under an expired or canceled policy for a certain time period. Run-off or winding-up of portfolio consists in managing the incurred or possible claims of the insurance companies having ceased to write policies in one or several classes of business. Run-off insurance on the other hand is a type of insurance policy that provides liability coverage against claims made against companies that have been acquired merged or have ceased operations.

Health insurance run-off liabilities had been included it is likely that our US reserve estimates would have approximately doubled in size. And heres a specific example of how runoff insurance works. KPMG PWC In addition 300 bn life run-off.

Run-off business includes all former re-insurance policies with remaining liabilities but without new underwriting it is sometimes also called discontinued business or legacy Most re-insurers have run-off books for a broad range of reasons REASONS FOR EXISTENCE OF RUN-OFF BOOKS 6 Source. Ceasing to write any new business deal on a risk portfolio triggers the processing in real time of technical reserve stock until their total extinction. Sometimes the entire business will be sold to a company that specializes in buying companies or books of business in runoff.

Runoff is the term used to broadly describe the process an Insurance Reinsurance company follows when it has a block of business for which it makes future plans for handling the liability expected future claims that it. Runoff Business Insurance Term An operation which has been determined to be nonstrategic. Includes non-renewals of in-force policies and a cessation of writing new business where allowed by law.

Run-off specialists are reinsurance companies that acquire reserve liabilities to profitably manage the settlement and payout of claims until all of the liabilities are exhausted. A reinsurer in runoff may keep its staff typically claims management and accounting and manage its own runoff or it may hire a professional runoff administrator to handle the business. Tokio Marine Group in the sale of its global propertycasualty reinsurance runoff portfolio written by Tokio Marine Nichido Fire Insurance Co Ltd.

How does run off insurance work. Our estimate of run-off liabilities in the US is driven by general liability accident and financial loss and motor insurance. Run off insurance cover is a professional indemnity insurance policy which comes into effect when you or your employees stop trading and any claims made under it will relate to work carried out before the policy started.

Runoff insurance protects an acquiring company from legal claims made against a company being acquired or a company that has merged or ceased operations. However significant latent claims run-off liabilities remain. Run-Off insurance is designed to provide cover for former directors and officers in respect of claims for past acts occurring during their tenure on the board but have not yet materialized andor been reported to the insurer.

Most insurance policies will cover you for damage as a result of storm rainwater and run-off The exact definition of each of these words will depend on the wording of your policy but generally they mean. For example consider a policy written with a January 1 2015-2016 term and a 5-year runoff provision. A runoff policy applies for a certain.

A UK subsidiary of Fairfax Financial in its acquisition of Brit Insurance Limited an FSA regulated insurance company.

The Water Cycle Anchor Chart Add This Mini Anchor Chart To Your Student S Science Journals Science Experiments Kids Elementary Science Lessons Science Journal

The Water Cycle Anchor Chart Add This Mini Anchor Chart To Your Student S Science Journals Science Experiments Kids Elementary Science Lessons Science Journal

My Reinsurer Is In Runoff Expert Commentary Irmi Com

My Reinsurer Is In Runoff Expert Commentary Irmi Com

Soft Story Seismic Earthquake Solutions

Soft Story Seismic Earthquake Solutions

Surface Water Exclusions In The Homeowners Policy Expert Commentary Irmi Com

Surface Water Exclusions In The Homeowners Policy Expert Commentary Irmi Com

Skinny Ms Fitness Fitness Motivation Quotes Health Quotes Healthy Body

Skinny Ms Fitness Fitness Motivation Quotes Health Quotes Healthy Body

Publication Don T Fall Into The Gap Beware Of Run Out Coverage Under Stop Loss Policies

Publication Don T Fall Into The Gap Beware Of Run Out Coverage Under Stop Loss Policies

2019 Gmc Sierra Equipped With A Fabtech 6 System And Dirt Logic 2 5 Resi Coilovers Switchsuspension Gmc Trucks Sierra Gmc Trucks Gmc

2019 Gmc Sierra Equipped With A Fabtech 6 System And Dirt Logic 2 5 Resi Coilovers Switchsuspension Gmc Trucks Sierra Gmc Trucks Gmc

Background Info Step One Important Things Juila Alvarez Was Born In New York But Spent Most Of Her Life In Dominician Republic A Summative Writing Info

Background Info Step One Important Things Juila Alvarez Was Born In New York But Spent Most Of Her Life In Dominician Republic A Summative Writing Info

Green Roof Cross Section Extensive Over Shingles Sloped Metroverde Enioss01 Green Roof Design Green Roof Green Roof System

Green Roof Cross Section Extensive Over Shingles Sloped Metroverde Enioss01 Green Roof Design Green Roof Green Roof System

Protect Your Valuables At The Beach Pool Park Gym Or Home Attach This Travel Safe To A Chair Portable Safe Gadgets Technology Awesome Travel Accessories

Protect Your Valuables At The Beach Pool Park Gym Or Home Attach This Travel Safe To A Chair Portable Safe Gadgets Technology Awesome Travel Accessories

Run Off Definition Objectives And The Main Players

Run Off Definition Objectives And The Main Players

Claims Made Vs Occurrence Insurance Claims Made Policy The Hartford

Claims Made Vs Occurrence Insurance Claims Made Policy The Hartford

If You Need Advise With Flooddamage

If You Need Advise With Flooddamage

Surface Water Is It Covered In The Flood Insurance Policy

Surface Water Is It Covered In The Flood Insurance Policy

Run Off Coverage What Is It And When Do You Need It Discover D O

Run Off Coverage What Is It And When Do You Need It Discover D O

If Only I Had Super Powers Irregular Past Tense Verbs Verb Worksheets Irregular Past Tense

If Only I Had Super Powers Irregular Past Tense Verbs Verb Worksheets Irregular Past Tense

:max_bytes(150000):strip_icc()/GettyImages-1227386138-f43bd0e2dfc64d23a57256d53748a261.jpg)

Post a Comment for "Insurance Company Runoff Definition"