Insurance Underwriting Decision-making Process

Underwriting of the future. Connected devices particularly wearable devices will revolutionize the underwriting process making it more effective faster and cheaper.

What Is Digital Transformation In Insurance A Guide To Intelligent Process Automation In Insurance Digital Transformation What Is Digital Automation

What Is Digital Transformation In Insurance A Guide To Intelligent Process Automation In Insurance Digital Transformation What Is Digital Automation

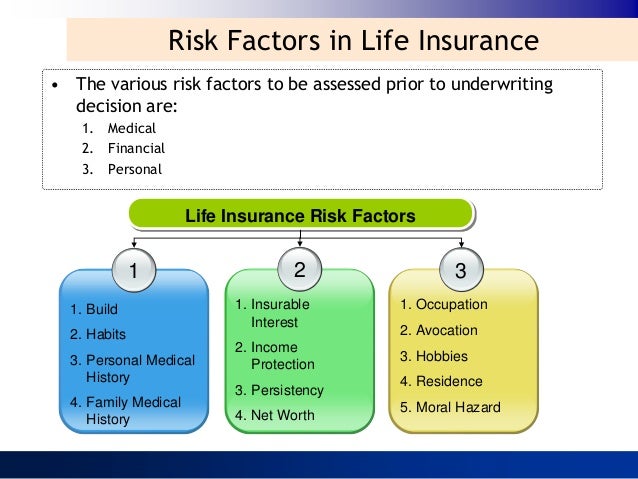

Evaluating loss exposures- the gathering of information about an applicants loss exposures.

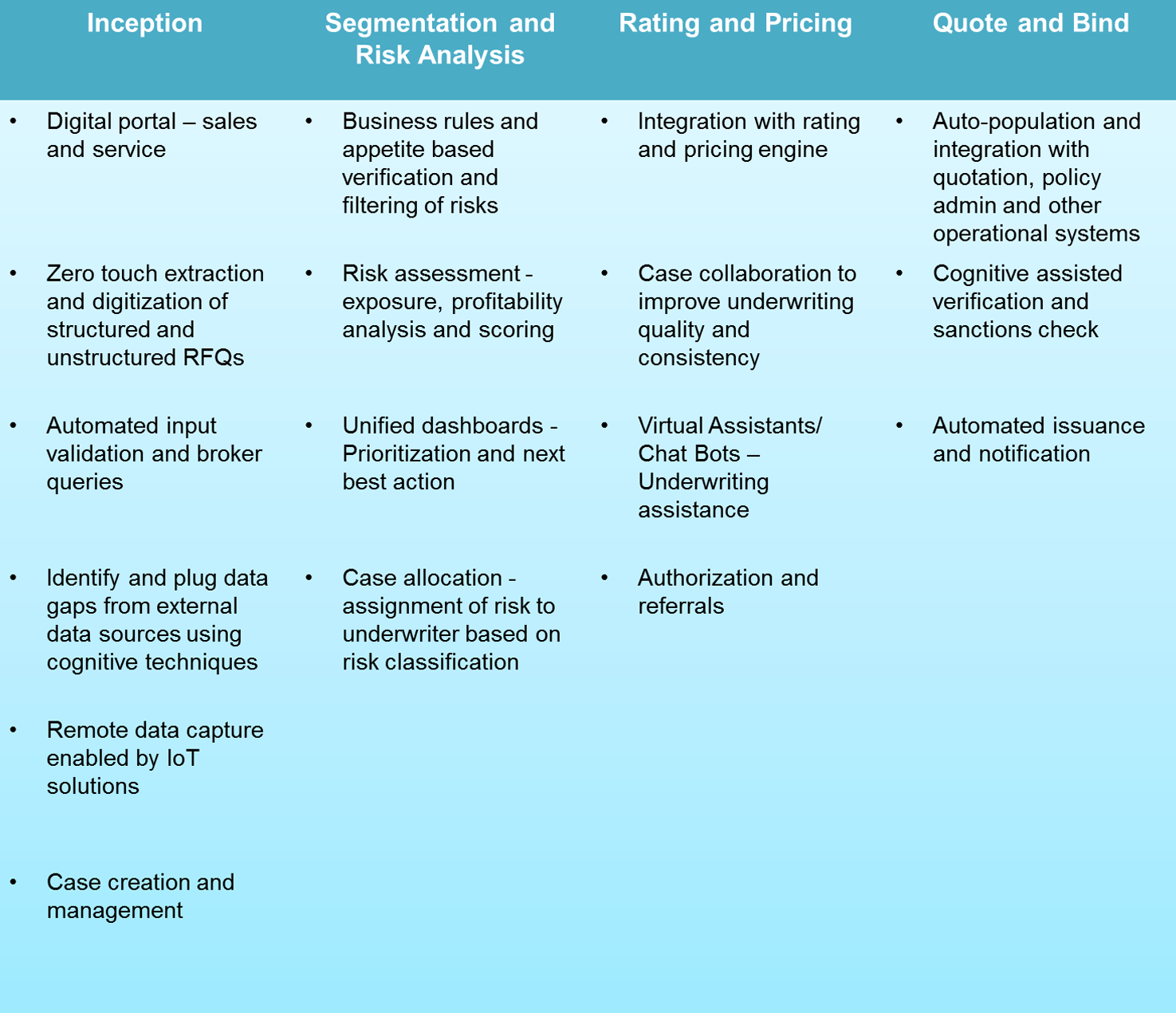

Insurance underwriting decision-making process. The process gauges how likely it is that the insured will make a costly claim and whether the insurer will lose money by issuing the policy. 3 Respondents cited greater use of automation alternative data and artificial intelligence AI as the top three changes they need to make in the underwriting process to stay resilient through 2021 and set the stage for growth in future years figure 1. The underwriting engine difference Munich Res underwriting engine should not be mistaken with traditional policy administration systems which have a wide scope and enormous capabilities to cover the needs of the whole value chain.

Approved with preferred rates Do you want to save thousands of dollars on your life insurance. 5 Underwriting Decisions Good News or Bad News 1. Using AI in commercial underwriting can help here too.

Embedding underwriting strategies in day-to-day decisions Technology solutions such as integrating third-party data in application information or utilizing underwriting rules and account. In its most basic sense underwriting refers to the process of determining the issuing of an insurance policy. The underwriters job can include conducting research investigating details and weighing the known risk factors to determine if insurance coverage or a loan will be issued.

These devices can help insurers leverage real-time data to provide outcome-based services for their customers and improve the underwriting process. The traditional underwriting processes is reliant on underwriters who are tasked with manually collecting combining and reviewing documentation. Insurance underwriting is an assessment of how risky it would be for an insurer to issue coverage to a certain individual or company given that individuals or companys unique circumstances.

Underwriters assess the degree of risk of insurers business. With the introduction of new and varied data sources underwriters are challenged to collect and combine the right mix of available data and strategically and appropriately apply it to risk assessment customer experience and policy turnaround time. In that process an underwriter evaluates the risk of the applicant.

Underwriters need to look in greater depth to decide their priority. Each insurance company has its own underwriting guidelines and standards for who they will and will not insure. You can with preferred.

The process that ensues at the insurance company may involve a medical exam many manual references of data and a decision process that is performed by an underwriting expert. By planning ahead purchasing insurance early in life and keeping yourself healthy you can positively influence the underwriting process and buy a feature-packed policy at a lower premium. New data and technology is expected to drive underwriting transformationa likelihood recognized by 200 insurance executives from around the world surveyed for Deloittes 2021 insurance outlook.

Underwriting decisions based on current and historical data. Get a Flexible Life Cover for your changing needs. Underwriting is a sophisticated decision making process that involves interpreting data to determine if a company will take on a financial risk.

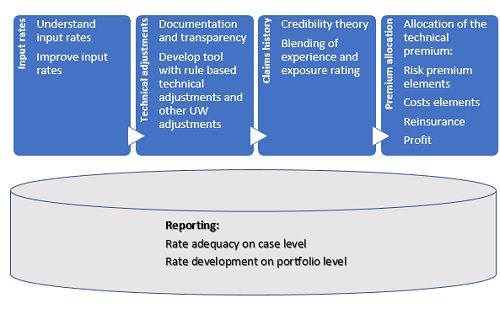

The underwriting process helps insurers fix accurate premiums based on the policyholders risk exposure. During this evaluation the underwriter will decide how much coverage will be offered to the applicant as well as how much premium the insured should pay for the particular amount of coverage. For a new customer and possibly new risk the underwriter and underwriting team will perform their due diligence and research the customer insurance risk gather historical information and review the information that the broker andor insured has provided.

The underwriting process is the method of determining that the company continues to function within workable boundaries. Underwriting helps to set fair borrowing rates for loans establish appropriate premiums and create a market for. Some of the main factors that underwriters use to determine risk in an insurance policy are.

To make an underwriting decision there are six steps. The mortgage underwriting process can take anywhere from a few days to a few weeks depending on whether the underwriter needs additional information from the borrower what demand is like for the. Key Takeaways Underwriting is the process through which an individual or institution takes on financial risk for a fee.

Optimization and forecasting technologies can assist in assigning these submissions to the most appropriate underwriter. The insurance underwriting process The insurance underwriting process relies heavily on statistical analysis to determine the risk of individuals who want to sign up for a policy with an insurance provider. Approved at standard rates The most common underwriting decision is the approval of the application at standard rates.

It automates the underwriting process and makes this decision consumable via RESTful API calls which over time will ease the integration into client systems. Underwriting Process Underwriting has been defined as determining what loss exposures will be insured for what amount of insurance at what price and under what conditions.

How Does Life Insurance Underwriting Work Coverage Com

How Does Life Insurance Underwriting Work Coverage Com

Image Result For Insurance Underwriter Scorecard Service Level Agreement Business Process Operational Excellence

Image Result For Insurance Underwriter Scorecard Service Level Agreement Business Process Operational Excellence

Underwriting Learn More About The Capital Raising Process

Underwriting Learn More About The Capital Raising Process

How Insurance Technology Helps Disrupting The Underwriting Process In The Insurance Sector By Inmediate Io Medium

How Insurance Technology Helps Disrupting The Underwriting Process In The Insurance Sector By Inmediate Io Medium

9 Insurance Startups Improving Underwriting Nanalyze

9 Insurance Startups Improving Underwriting Nanalyze

Cyber Risk Analytics Cyber Overvue Advisen Ltd Risk Analytics Underwriting Commercial Insurance

Cyber Risk Analytics Cyber Overvue Advisen Ltd Risk Analytics Underwriting Commercial Insurance

Trade Credit Accounts Receivable Insurance Trade Credit Insurance Accounts Receivable Accounting

Trade Credit Accounts Receivable Insurance Trade Credit Insurance Accounts Receivable Accounting

5 Explanation Letter Points Of Origins Word Template Lettering Letter Templates

5 Explanation Letter Points Of Origins Word Template Lettering Letter Templates

![]() U S P C Personal Lines Insurance Underwriting Process Contractual And Compliance Perspectives Perr Knight

U S P C Personal Lines Insurance Underwriting Process Contractual And Compliance Perspectives Perr Knight

The Future Of The Underwriting Process In The Digital Age Accenture Insurance Blog

The Future Of The Underwriting Process In The Digital Age Accenture Insurance Blog

Questions You Should Mortgage Lenders Freeandclear Mortgage Process Mortgage Interest Rates Mortgage Lenders

Questions You Should Mortgage Lenders Freeandclear Mortgage Process Mortgage Interest Rates Mortgage Lenders

General Insurance Penguin Insurance Underwriting Process Flow Chart Flow Chart Process Flow Process Flow Chart

General Insurance Penguin Insurance Underwriting Process Flow Chart Flow Chart Process Flow Process Flow Chart

The Importance Of Developing Technical Underwriting Scandinavian Insurance Quarterly

The Importance Of Developing Technical Underwriting Scandinavian Insurance Quarterly

Ai In Front Office Processes Process Improvement Front Office Improve

Ai In Front Office Processes Process Improvement Front Office Improve

General Insurance Penguin Insurance Underwriting Process Flow Chart Flow Chart Process Flow Process Flow Chart

General Insurance Penguin Insurance Underwriting Process Flow Chart Flow Chart Process Flow Process Flow Chart

Automated Insurance Underwriting Systems Benefits

Automated Life Insurance Underwriting Guarantees The Future Success Munich Re Topics Online

Automated Life Insurance Underwriting Guarantees The Future Success Munich Re Topics Online

Lic Ipo Mega Disinvestment Plan Life Insurance Corporation How To Plan Underwriting

Lic Ipo Mega Disinvestment Plan Life Insurance Corporation How To Plan Underwriting

Post a Comment for "Insurance Underwriting Decision-making Process"