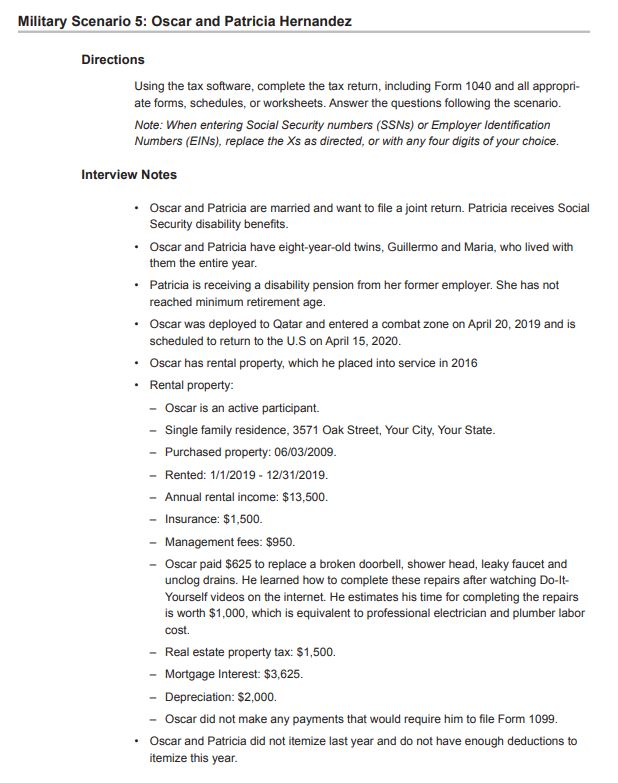

Oscar Insurance Tax Form

Medical coverage providers will be issuing Form 1095-B. If you want to see if you qualify for a premium tax credit based on your final income you can complete Form 8962 to find out.

Oscar Health Insurance Rx Pharmacy Member Portal Login Telemed

Oscar Health Insurance Rx Pharmacy Member Portal Login Telemed

Youll use this form to reconcile to find out if you used more or less premium tax credit than you qualify for.

Oscar insurance tax form. Prescription Drug Prior Authorization Form - Oscar. Form 1095-A is used to report certain information to the IRS about individuals who enroll in a qualified health plan through the Marketplace. Store this form with your important tax information.

Form 1095-A is your proof that you had health insurance coverage during the year and its also used to reconcile your premium subsidy on your tax return using Form 8962 details below. They are forms 1095-A 1095-B and 1095-C. A 1095-B is a form used to let the IRS know that you had health insurance during a particular tax year.

Youll need it to complete Form 8962. Look for Form 1095-A. When completing your return you will be asked if you had full-year coverage line 61 on Form.

When you complete Form 8962 Premium Tax Credit you will use the information on Form 1095-A to reconcile advance payments of the premium tax credit and to verify that you had health coverage for the entire year. If you have not yet enrolled in OSCAR select Enroll Now. Form 1095-B is filed directly with the IRS.

USDOT - Enter your USDOT Number. Received a Form 1095-C Employer-Provided Health Insurance Offer and Coverage Insurance from your employer reflecting coverage your employer offered even if you chose not to take that coverage. Premium tax credits are sometimes known as subsidies discounts or savings Form 8962 Premium Tax Credit PDF 110 KB Form 8962 instructions PDF 348 KB Form 1095-A Health Insurance Marketplace Statement.

Learn more about your taxes if you paid full price for a Marketplace plan. You should wait to file your income tax return until you receive that form. The Oscar health insurance company formed in 2012.

The Marketplace is required to send Form 1095-A by January 31 2020 listing the advance payments and other. If you dont qualify for a premium tax credit you dont have to include Form 8962 when you file your income taxes. Oscar was designed with a certain group in mindthose who do not qualify for Medicaid Medicare or employer benefits.

If you had coverage through the exchange then you can reach out to them with questions about the document. If you had coverage directly through Oscar off-exchange and would like a copy for your records you can request one from Oscar using the following. These forms help determine if you the required health insurance under the Act.

Oscar Insurance Forms and Notices - California Heres where you can find Oscars policies plan benefits coverage information certificates appeals drug formulary HIPAA authorization forms member rights privacy practices and many other important notices. The copy that you receive is for your information only. Enrollment in Oscar depends on contract renewal.

Enter only numbers andor letters no dashes must be 9 to 11 characters. It comes from the Marketplace not the IRS. Premium tax credit were made to your insurance company to reduce your monthly premium payment you must attach Form 8962 to your return to reconcile compare the advance payments with your premium tax credit for the year.

You should retain a copy of the form but should not attach it when submitting your tax return. Password - Enter your current OSCAR password. If anyone in your household had Marketplace coverage in 2017 you can expect to get a Form 1095-A Health Insurance Marketplace Statement in the mail by mid-February.

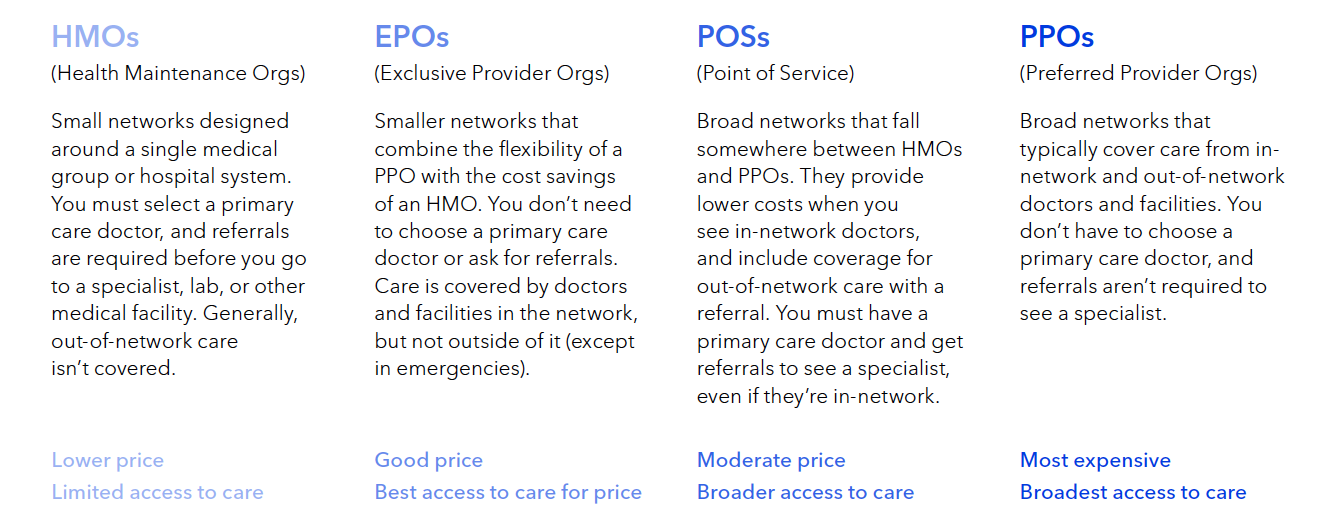

You do not need a paper copy of this form to file your taxes as your insurer will file it with the IRS on your behalf. NYS Tax ID - Enter your FEIN federal employer identification number including the suffix numbers or SS if applicable. The Affordable Health Care Act introduced three new tax forms relevant to individuals employers and health insurance providers.

That means youll compare the premium tax credit you used in 2015 with the tax credit you actually qualify for based on your final income. Information about Form 1095-A Health Insurance Marketplace Statement including recent updates related forms and instructions on how to file. Had 2017 Marketplace coverage.

This form includes details about the Marketplace insurance you and household members had in 2020. Will use Form 1095-C to determine your eligibility for the premium tax credit if you enrolled in coverage through the Marketplace. Oscar is an HMO with a Medicare contract.

You will receive Form 1095-A Health Insurance Marketplace Statement which provides you with information about your health care coverage. You will use Form 1095-C to verify that your employer coverage was unaffordable for you. If you or your family received advance payments of the premium tax credit through the Health Insurance Marketplace you must complete Form 8962 Premium Tax Credit with your return.

Form 1095-A is essential for preparing your tax return if you received a premium subsidy or if you paid full price for coverage through the exchange and want to claim the premium subsidy on your tax return. The SilverFit program is provided by American Specialty Health Fitness Inc a subsidiary of American Specialty Health Incorporated ASH. Once everything is correct youll use Form 1095-A to figure out your final premium tax credit and reconcile any part of this that you used in advance to lower your premiums.

For individuals who bought insurance through the health care marketplace this information will help to determine whether you are able to receive. It was created in the wake of the Affordable Care Act ACA. If you or any family members enrolled in self-insured employer coverage you may receive Form 1095-C showing this coverage.

Http Payerlist Claimremedi Com Enrollment Oscar 20835 Pdf

How And Why To Switch Your Individual Health Insurance Plan This Open Enrollment

How And Why To Switch Your Individual Health Insurance Plan This Open Enrollment

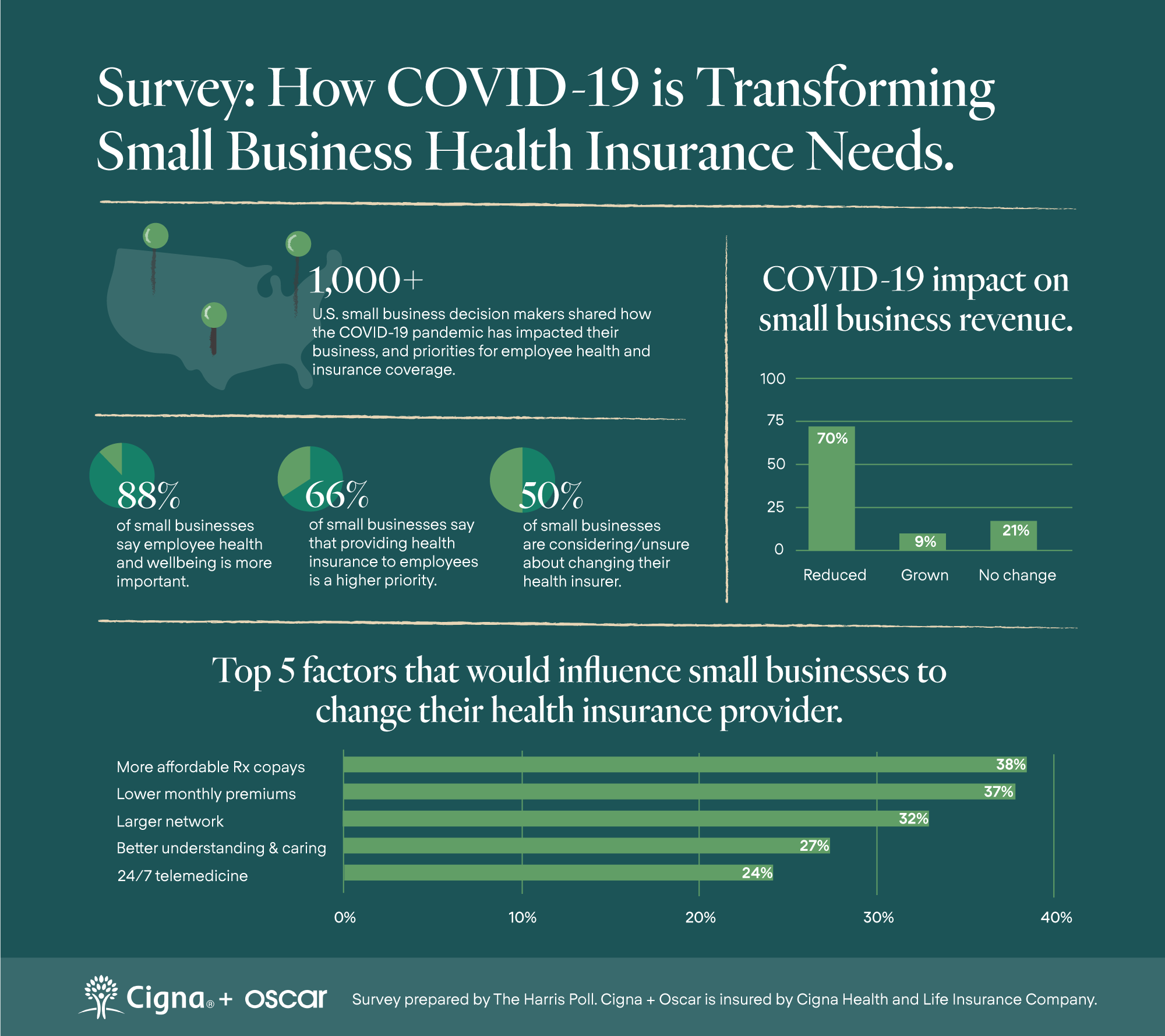

Business Enrollment Oscar Health

Business Enrollment Oscar Health

Compare Oscar S Individual Health Insurance Plans

Hi Oscar Simple Form Health Insurance Companies Health Insurance First Health

Hi Oscar Simple Form Health Insurance Companies Health Insurance First Health

What S The Onboarding Process For Oscar Small Business Health Insurance

What S The Onboarding Process For Oscar Small Business Health Insurance

Buying Your Own Health Insurance Here S Your 2021 Open Enrollment Checklist The Oscar Blog

New York State Of Health Nysoh Oscar Faq Handy Health Insurance Definitions

New York State Of Health Nysoh Oscar Faq Handy Health Insurance Definitions

Https Www Hioscar Com Asset C O Benefits Admin Resource Good To Know Guide

How Do I Get A Quote For An Oscar Individual Plan Oscar Faq

Rather Than Say The Pictures Are Blurry I Can T Chegg Com

Rather Than Say The Pictures Are Blurry I Can T Chegg Com

Why California Brokers Should Pay Attention To Oscar Hfc

Why California Brokers Should Pay Attention To Oscar Hfc

How To Read Your Oscar Explanation Of Benefits Oscar Rx

Https Assets Ctfassets Net Plyq12u1bv8a 7w0nu7corukisuqg4qo4uu 26b38fa912de5aec1841d04f551fbac5 Oscar Business Admin Guide Pdf

Https Hmpi Org 2017 09 08 Scenario Planning Tools For Organizations Struggling With Healthcare Reform Uncertainty The Case Of Oscar Health Insurance Pdf 839

Open Enrollment Choosing A 2021 Health Plan That Works For You

Post a Comment for "Oscar Insurance Tax Form"