Non Life Insurance Underwriting Process

Non-life underwriting and pricing in general 21. Proposed Insureds ages are from 1 month 1 day to 70 years of ages 70 years of age is only acceptable for certain insurance plans.

15 Ways Underwriters Determine Your Life Insurance Premium Quotacy

15 Ways Underwriters Determine Your Life Insurance Premium Quotacy

Individual carriers will vary in their underwriting requirements and process.

Non life insurance underwriting process. There is a real role for these measures in the context of climate change but not one that. Response to the EIOPA discussion paper on non-life underwriting and pricing in light of climate change Our reference. This guide is designed to help familiarize advisers with our life insurance underwriting process and to outline potential underwriting assessments for some of the most common medical conditions and non-medical risks Note that all possible underwriting decisions included in this guide are provided strictly for information purposes only.

On average the process usually takes about 2 months from start to finish. But once the process is complete all thats left is to confirm the premiums and sign the policy to put it in force. Therefore this guide will be refreshed as necessary.

During this period of global crisis global natural and man made. If medical issues are discovered during the exam the time for approval could extend to 6-8 weeks or longer depending on how long you take to schedule an additional medical exam. Non-life Insurance Underwriting Risks Underwriting risk is the risk of loss or of adverse changes in the value of insurance liabilities due to inadequate pricing and provisioning assumptions.

Unless you pursue a no exam policy the underwriting process can take anywhere from four to six weeks and relying on outside sources like a doctors office for an APS can add time. Insurance company the overall profitability depends significantly upon the quality of underwriting. Insurance underwriter using various underwriting tools and process are employed by insurers to asses both their new and existing business.

Underwriting is the act of accepting liability up to a specified amount in an insurance policy17. How long will the underwriting process take. Which is a non-profit trade group that can verify or dispute medical information.

One life insurance plan can be selected at a time with or without riders eg. To remain profitable it implies that insurers evaluate the risk of losses attached to the insured goods house car property or individuals drivers persons. The insurance underwriting process can take anywhere from 2 weeks to 5 months depending on the amount of information that the underwriter needs to gather and how quickly they receive the information from outside sources.

The short-term duration of non-life insurance contracts is also envisaged for the. That is why non-underwritten policies or in other words guaranteed issue no medical life insurance requires a two-year waiting period on non-accidental deaths. Every insurance company life or non life insurance has in its own organizing diagram a specialized department of underwriting.

Please make sure you have the most up-to-date underwriting charts and guidelines. No Exam Life Insurance Underwriting Process Simplified Issue. When an individual applies for insurance coverage he or she is essentially asking the insurance company to take on the potential risk of having to pay a claim in the future.

The life insurance underwriting process has multiple steps and usually takes two to eight weeks to complete. Insurance underwriting is defined as the process of choosing who and what the insurance. Its hard to even call this underwriting but there is still a quick process.

Insurance underwriting is the process of evaluating a companys risk in insuring a home car driver or an individuals health or life. Non-life Insurance Underwriting Risks Underwriting risk is the risk of loss or of adverse changes in the value of insurance liabilities due to inadequate pricing and provisioning assumptions. Insurance underwriting is the name given to the process of assessing your life insurance application.

Waiver of premium rider accidental rider hospital and surgical rider hospital. This involves finding out key details about you and is carried out by an insurance underwriter. It determines whether it would be profitable for an insurance company to take a chance on providing insurance coverage to an individual or business.

With the application and underwriting process. For fully underwritten policies the underwriting process usually takes 2-4 weeks. The underwriting process is an essential part of any insurance application.

New York Lifes Underwriting mission New York Lifes underwriting mission is to put good. Non-life Insurance Underwriting Risks Premium Risk and Catastrophe Risk. The underwriting rules are subject to change.

Non-life insurance underwriting risks are often divided into premium and catastrophe risks and reserve risk in order to separate the risks related to future claims of current insurance contracts and already incurred claims. Life insurance companies use underwriters to look at the information gathered about you and then figure how much of a risk it would be to sell you.

Application Process Process Flow Chart Business Flow Chart Underwriting

Application Process Process Flow Chart Business Flow Chart Underwriting

Insurance Underwriting Process Video Lesson Transcript Study Com

Insurance Underwriting Process Video Lesson Transcript Study Com

Lic Ipo Mega Disinvestment Plan Life Insurance Corporation How To Plan Underwriting

Lic Ipo Mega Disinvestment Plan Life Insurance Corporation How To Plan Underwriting

No Medical Exam Life Insurance

No Medical Exam Life Insurance

Mortgage Outsourcing Processing Underwriting Mortgagepro360 Mortgage Process Mortgage Loans Mortgage Loan Officer

Mortgage Outsourcing Processing Underwriting Mortgagepro360 Mortgage Process Mortgage Loans Mortgage Loan Officer

Insurance Quotes Online Life Insurance Insurance Ads Insurance Humor Life Insurance Policy

Insurance Quotes Online Life Insurance Insurance Ads Insurance Humor Life Insurance Policy

State Farm Life Insurance An Independent Agent S Review

State Farm Life Insurance An Independent Agent S Review

How To Get Term Life Insurance With Asthma Quickquote

How To Get Term Life Insurance With Asthma Quickquote

Mortgage Underwriting Support Services Underwriting Support Services Financial Firm

Mortgage Underwriting Support Services Underwriting Support Services Financial Firm

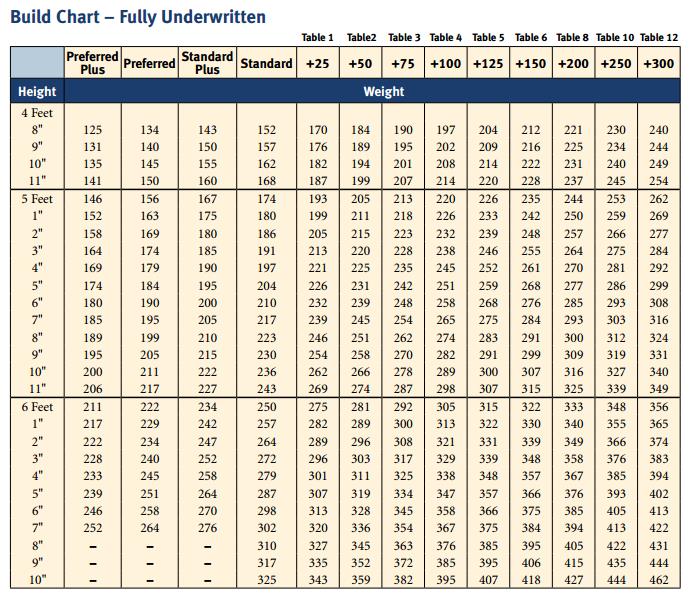

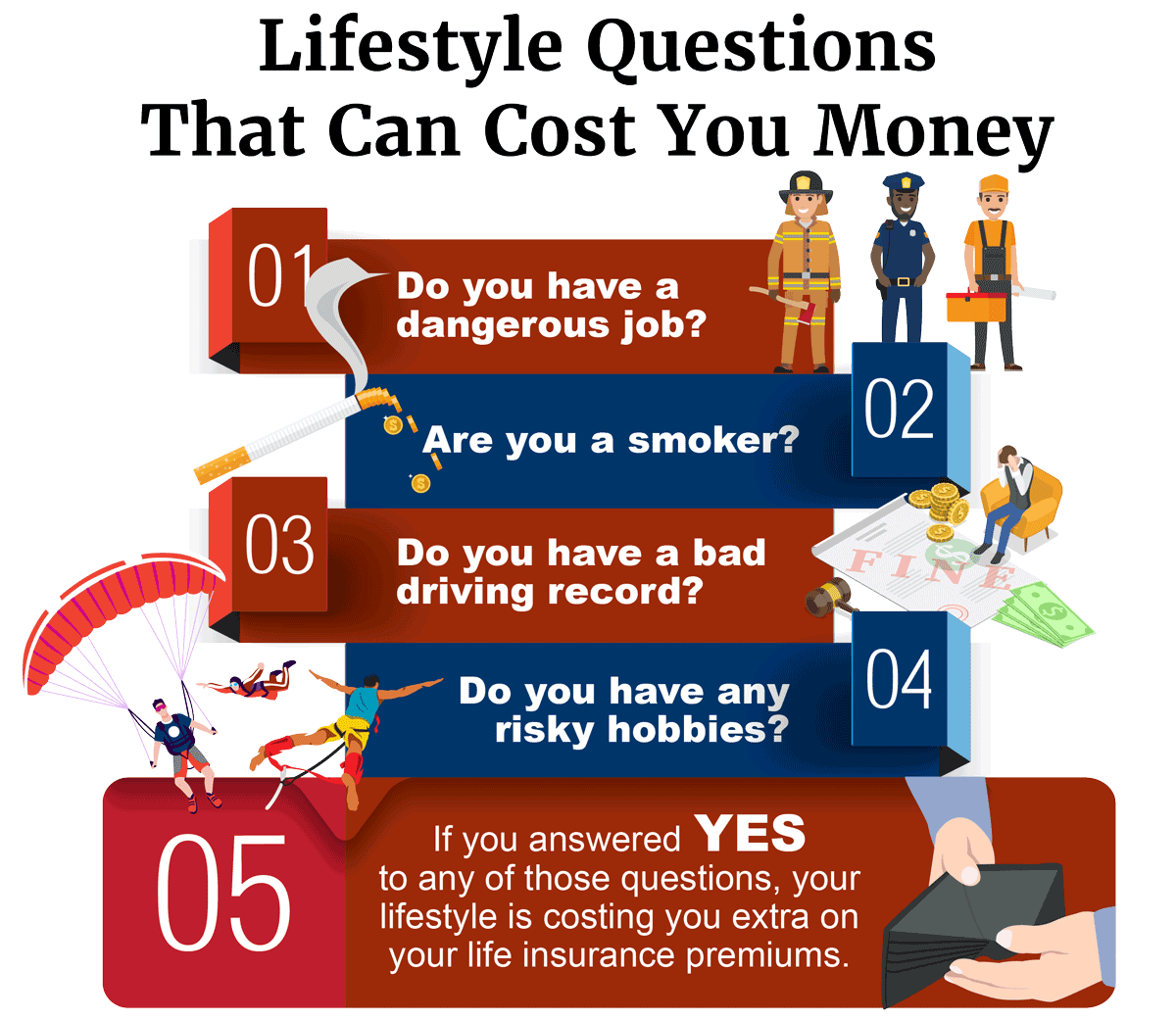

How Does My Weight Affect Buying Life Insurance Quotacy Q A Fridays Life Insurance Life Insurance Policy Online Life Insurance

How Does My Weight Affect Buying Life Insurance Quotacy Q A Fridays Life Insurance Life Insurance Policy Online Life Insurance

Https Www Unepfi Org Psi Wp Content Uploads 2019 02 Psi Guidance For Non Life Insurance Underwriting Pdf

American Amicable Term Life Insurance Costs Policy Details More

American Amicable Term Life Insurance Costs Policy Details More

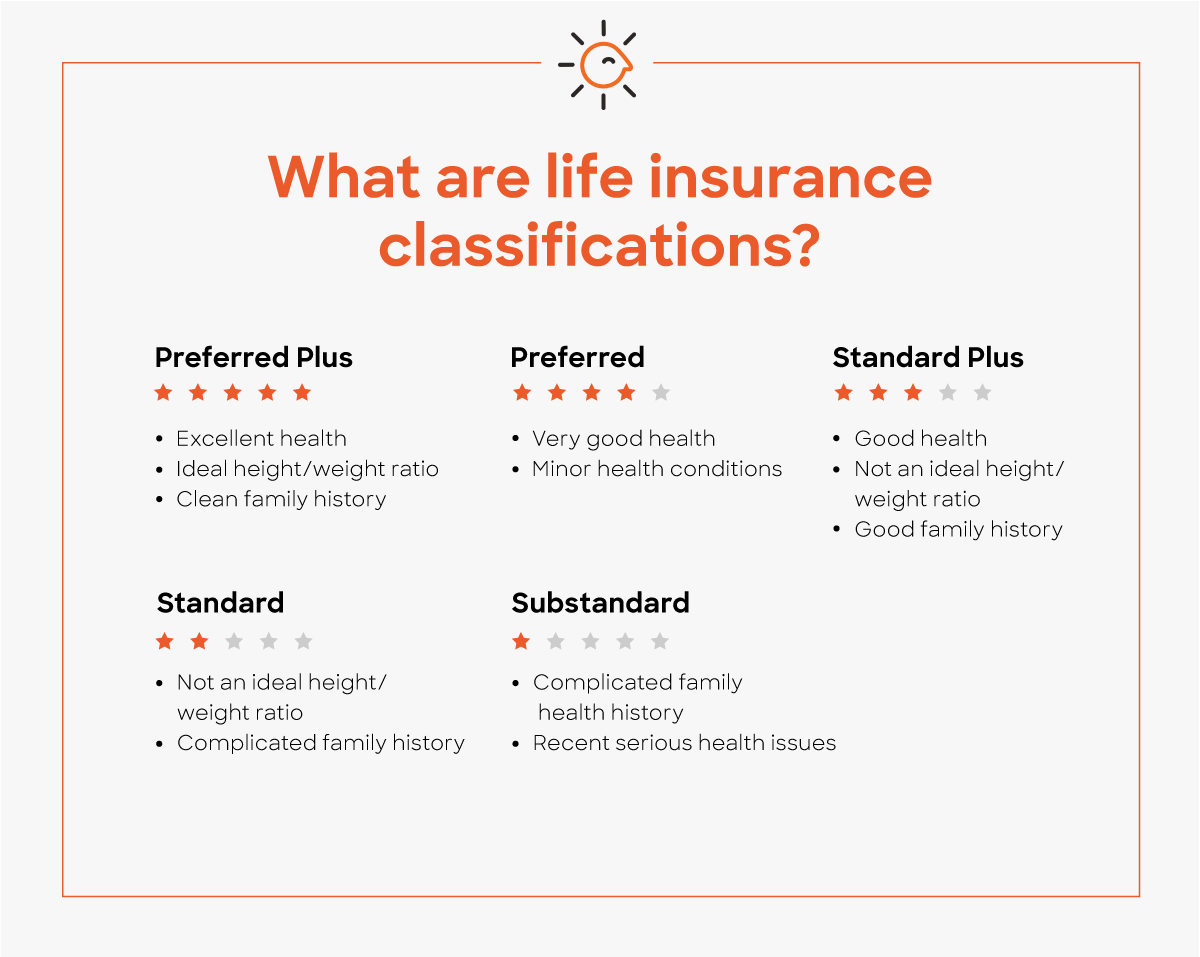

How Does Life Insurance Underwriting Work Tips That Help Riskquoter

How Does Life Insurance Underwriting Work Tips That Help Riskquoter

How Does Sleep Apnea Affect Life Insurance Rates Quotacy Life Insurance Rates Life Insurance Companies Life Insurance

How Does Sleep Apnea Affect Life Insurance Rates Quotacy Life Insurance Rates Life Insurance Companies Life Insurance

How To Read Your Life Insurance Policy Life Insurance Policy Life Insurance Buy Life Insurance Online

How To Read Your Life Insurance Policy Life Insurance Policy Life Insurance Buy Life Insurance Online

Life Insurance With Pre Existing Medical Conditions Policygenius

Life Insurance With Pre Existing Medical Conditions Policygenius

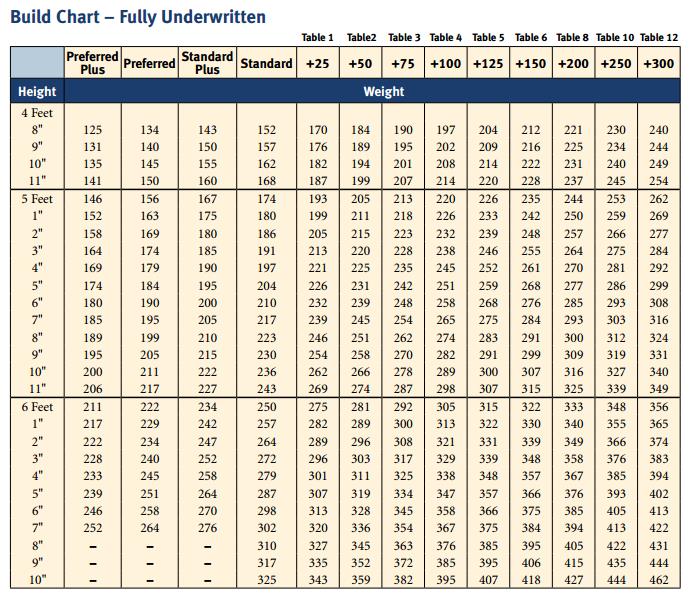

Life Insurance Underwriting Guidelines Quickquote

Life Insurance Underwriting Guidelines Quickquote

Post a Comment for "Non Life Insurance Underwriting Process"