Insurance Reimbursement Accounting Entry

For scenario 1 you will create a reimbursement and add it to your payroll with the reimbursement amount. Reimbursement is compensation paid by an organization for out-of-pocket expenses incurred or overpayment made by an employee customer or another party.

Hope that makes sense.

Insurance reimbursement accounting entry. Gain contingency accounting applies in situations. The most reasonable approach to recording these proceeds is to wait until they have been received by the company. Receive the cash from the insurance company.

The underlying GAAP standard that addresses this issue is the Emerging Issues Task Force EITF issue number 01-14 Income Statement Characterization of Reimbursements Received for Out-of-Pocket Expenses Incurred. Insurance compensation received or receivable on the asset may either be offset against the loss or presented separately as other income. For scenario 2 you can make your expense billable to your client like in the screenshot.

Sometimes the insurance company will pay you less than the amount you paid. Insurance proceeds that would reimburse the entity for these losses. As a result the entity should record the costs to repair the damages only when incurred and should record estimated insurance proceeds only to the extent of the losses incurred.

If this is the case record the entries as. The journal entries below act as a quick reference for accounting for insurance proceeds. If a customer agrees to reimburse you for these expenses then you can record the reimbursed expenses as revenue.

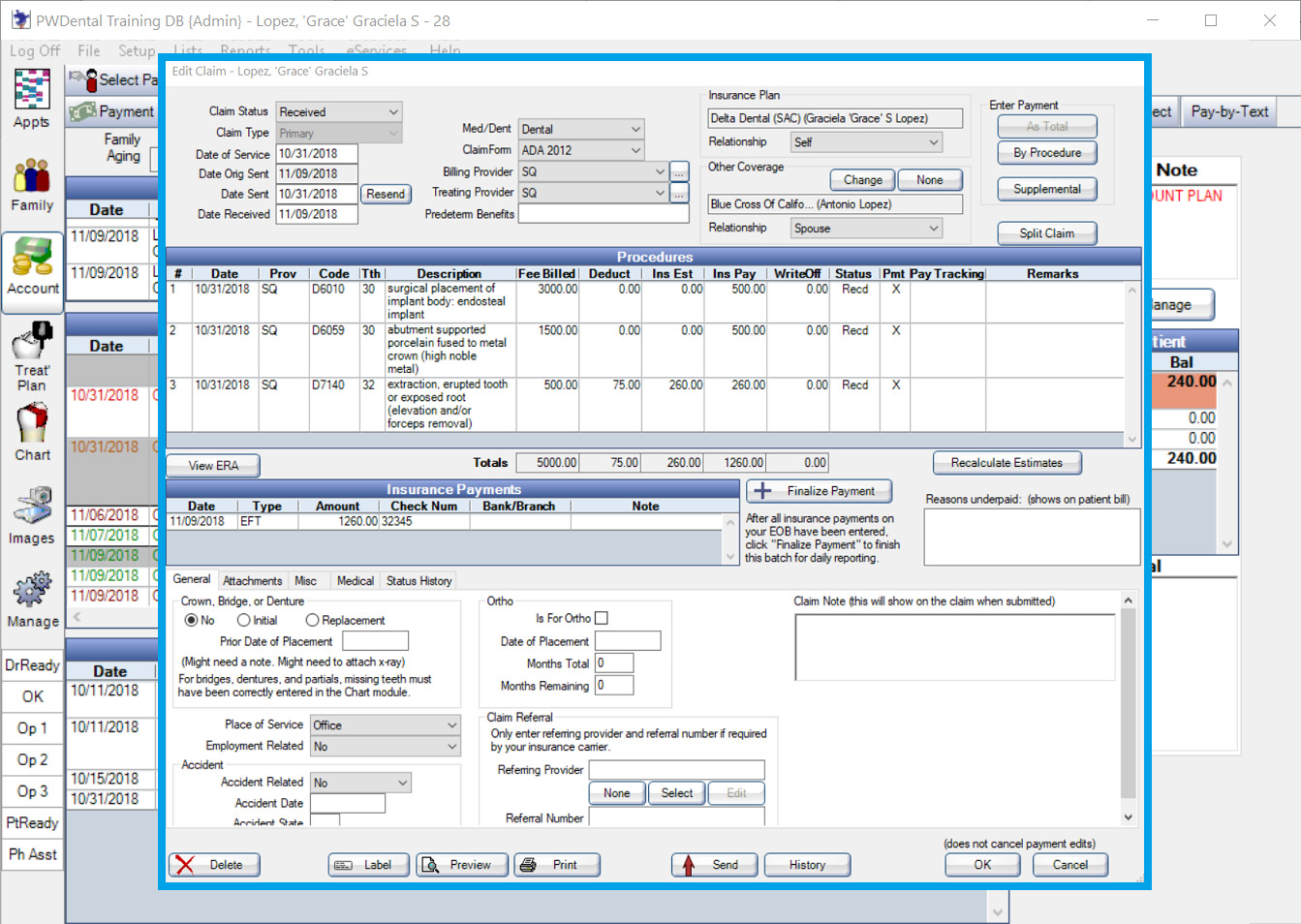

When your business suffers from theft flood or fire you lose money. Receive as debit to cash credit to the same insurance expense account to which payment is normally made. When the claim is agreed set up an accounts receivable due from the insurance company.

It should be an offset to insurance expense. Bank for payments to an insurance company for business insurance. See more details in this article.

Insurance Proceed on damaged property. Accounting for insurance proceeds December 17 2020 When a business suffers a loss that is covered by an insurance policy it recognizes a gain in the amount of the insurance proceeds received. As the prepaid amount expires the balance in Prepaid Insurance is reduced by a credit to Prepaid Insurance and a debit to Insurance Expense.

When the insurance company pays out for your claim you get the moneyor at least some of itback. Debit Loss on Insurance Settlement. This usually happens when net book value of the property book value minus accumulated depreciation is more than the amount reimbursed.

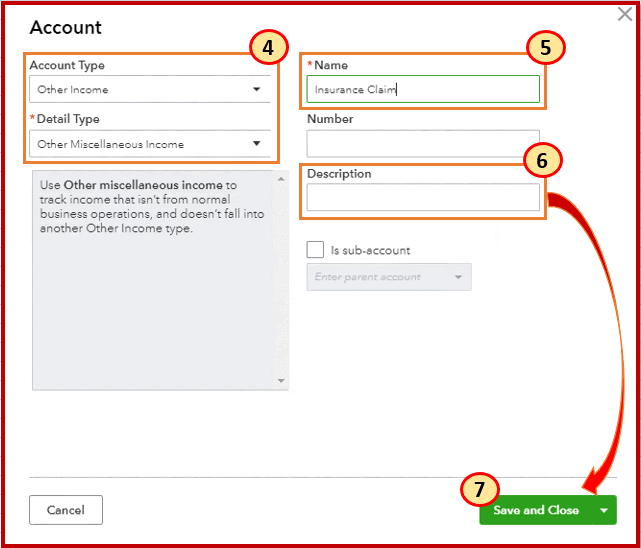

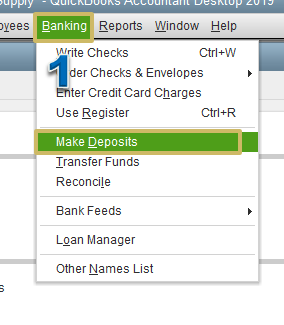

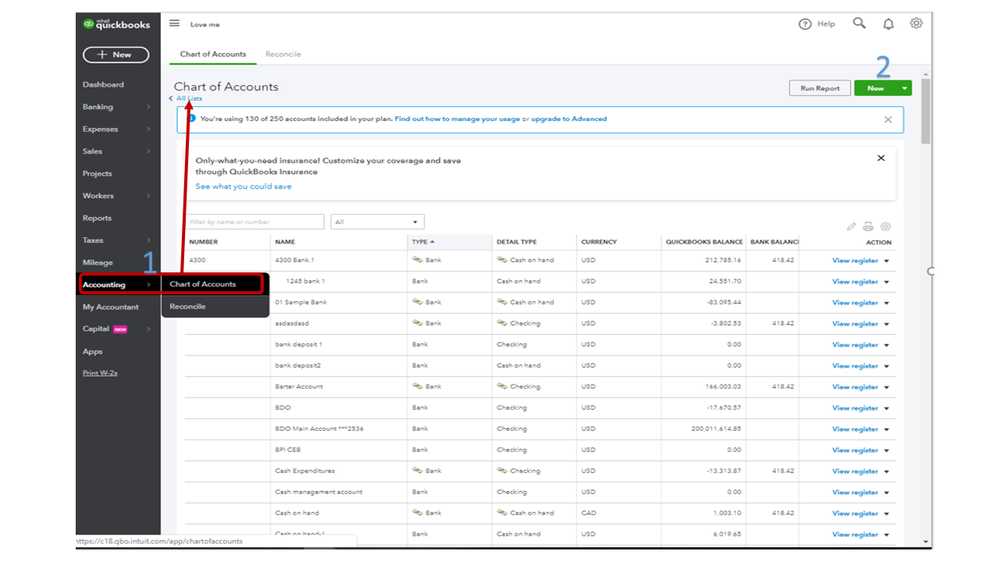

Usually you report it as a gain in the same category you reported the original loss. Couple of ways to do this step depending on version and level of detail needed or required. Then add it to their invoices so they can pay you back.

A basic insurance journal entry is Debit. The process is split into three stages as follows. Write off the damaged inventory to the impairment of inventory account.

Dr Insurance receivable debtor 4500 5000-500 Cr Insurance income 4500 So you have insurance income of 4500 credit versus the repair cost expense of 5000 which means your business lost 500 on this whole thing. In accounting insurance recovery money is a separate entry from other income. Reimbursement of business expenses.

Accounting for property damage and related insurance recoveries INSIGHT ARTICLE May 07 2020 When faced with property damage and other losses that an entity has insured itself against questions often arise with respect to the accounting for that property damage and any related insurance recoveries. This may instead be set off against the loss on asset theft. An alternative would be to credit a liability eg Employee Withholdings for Insurance for the 75 withheld from the employee.

As a business owner who is concerned about the risk of loss insurance is designed to secure your business against future occurrences that might lead to loss of asset or properties due to an unforeseen event. And then for the insurance reimbursement record this separately. Some insurance payments can go on to the Profit and Loss Report and some must go on the Balance Sheet.

One objective of the adjusting entry is to match the proper amount of insurance expense to the period indicated on the income statement. Create a non-taxable reimbursement payroll item. This is done with an adjusting entry at the end of each accounting period eg.

Not all insurance payments premiums are deductible business expenses. Record a loss on the insurance settlement. When the company pays the insurance bill of 300 it will debit the liability account for 75.

Accounting Treatment For Insurance Premium Learn The Journal Entries For Insurance Premium Income Paid In Advance Payment Claim Settlement Brokerage Fees or Commission. This will result in 225 being reported as the companys health insurance expense for that pay period. Now my GainLoss account shows a debit of 14000 for the fixed asset a credit of 2346517 for the insurance payout and a credit of 1321392 that they paid off the loan with.

The accounting entries may therefore be summarized as follows. I made another journal entry for this payoff and debited the Note payable and credited the Gainloss account. If this is a refund or reimbursement it is NOT other income.

Payroll Journal Entries For Wages Accountingcoach

Payroll Journal Entries For Wages Accountingcoach

Insurance Journal Entry Example

Insurance Journal Entry Example

Use Case Enter Dates In A Check Register Checkbook Register Excel Check Register

Use Case Enter Dates In A Check Register Checkbook Register Excel Check Register

Reimbursed Employee Expenses Journal Double Entry Bookkeeping

Reimbursed Employee Expenses Journal Double Entry Bookkeeping

Ar Follow Up Services Patient Demographics Entry Services Medical Billing Service Medical Billing And Coding Medical Billing Company

Ar Follow Up Services Patient Demographics Entry Services Medical Billing Service Medical Billing And Coding Medical Billing Company

Cash Flow Statement Template Excel Cash Budget Template Cash Budget Template Will Be Related To Maintain Cash Flow Statement Cash Budget Statement Template

Cash Flow Statement Template Excel Cash Budget Template Cash Budget Template Will Be Related To Maintain Cash Flow Statement Cash Budget Statement Template

Insurance Journal Entry For Different Types Of Insurance

Insurance Journal Entry For Different Types Of Insurance

2019 Marriage Visa Income Requirements For The Sponsoring Spouse Boundless Immigration Income Statement Profit And Loss Statement Statement Template

2019 Marriage Visa Income Requirements For The Sponsoring Spouse Boundless Immigration Income Statement Profit And Loss Statement Statement Template

This Is A Business Forms Form That Can Be Used For Accounting Download This Form For Free Now Businessforms Accounting La Accounting Accounts Payable Form

This Is A Business Forms Form That Can Be Used For Accounting Download This Form For Free Now Businessforms Accounting La Accounting Accounts Payable Form

How To Account For Stolen Inventory 8 Steps With Pictures

How To Account For Stolen Inventory 8 Steps With Pictures

Prepaid Expenses Definition Example Journal Entries Play Accounting

Prepaid Expenses Definition Example Journal Entries Play Accounting

Employee Termination Checklist Form How To Create An Employee Termination Checklist Form Download This Employee Good Essay Sample Resume Cover Letter Sample

Employee Termination Checklist Form How To Create An Employee Termination Checklist Form Download This Employee Good Essay Sample Resume Cover Letter Sample

10 Free Remittance Advice Templates Word Excel Pdf Templates Word Template Templates Invoice Template

10 Free Remittance Advice Templates Word Excel Pdf Templates Word Template Templates Invoice Template

Printable Ledger Medical Office Work Organization Office Organization At Work

Printable Ledger Medical Office Work Organization Office Organization At Work

Ar Follow Up Services Patient Demographics Entry Services Medical Billing Service Medical Billing Company Medical Practice Management

Ar Follow Up Services Patient Demographics Entry Services Medical Billing Service Medical Billing Company Medical Practice Management

Free Accounting And Bookkeeping Excel Spreadsheet Template Spreadsheet Template Business Excel Spreadsheets Templates Spreadsheet Template

Free Accounting And Bookkeeping Excel Spreadsheet Template Spreadsheet Template Business Excel Spreadsheets Templates Spreadsheet Template

Post a Comment for "Insurance Reimbursement Accounting Entry"