What Is Considered A Good P/e Ratio

- Good customer. However the long answer is more nuanced than that.

:max_bytes(150000):strip_icc()/dotdash_Final_Calculating_the_Equity_Risk_Premium_Dec_2020-06-acd73a07b27f4ea38d124481e271fe49.jpg) Calculating The Equity Risk Premium

Calculating The Equity Risk Premium

You shouldnt compare PE ratios of different kinds of companies like a tech company and a consumer staple company.

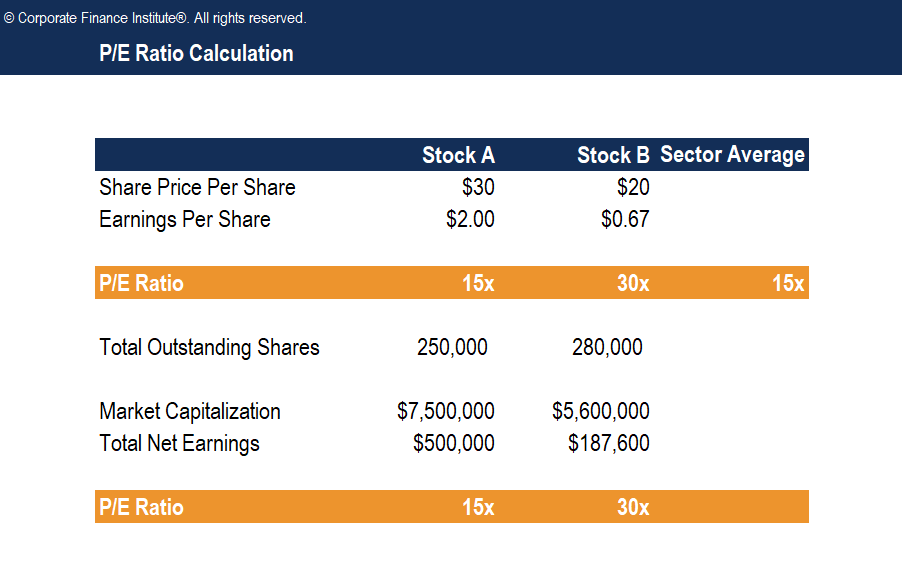

What is considered a good p/e ratio. The priceearnings to growth ratio or PEG ratio is a stock valuation measure that investors and analysts can use to get a broad assessment of a companys performance and evaluate investment risk. The PE ratio is calculated simply by dividing the current price-per-share by the current earnings-per-share. One way to gauge whether a PE ratio is good is to compare it to the market average.

Its also ok if the stock is like PE 27. Amazons PS ratio for example has ranged between 2 and 6 for the last five years. The PE ratio of the SP 500 has fluctuated from a low of around 6x in 1949 to over 120x in 2009.

Traditionally a PEG ratio near 1 is considered fairly valued while greater 1 one is over-valued and less than 1 is under-valued. PE ratio share priceearnings per share. A higher-margin company could have a much higher PS ratio and still be considered a bargain.

With PE ratios there is no absolute judgment over good or bad but stocks with lower PE ratios are considered cheap stocks regardless of what the stock price indicates. The share price has risen faster than earnings on expectations of an improvement in performance. During financial analysis an investor is trying to determine whether a stock is a good buy or not.

EPS PE Ratio. A good PE ratio isnt necessarily a high ratio or a low ratio on its own. Id prefer it to be under 15 but its ok if not.

So say if a companys share price is 100 and the company makes 10 of earnings per share it would have a price-to. A high PE ratio suggests that investors expect a high level of earnings in the future and that growth will be strong. As an example I want a stock to have a PE under 25.

The market average PE ratio currently ranges from 20-25 so a higher PE above that could be considered bad while a lower PE ratio could be considered better. Examples of a Good PE Ratio. The PE calculation would show that the stock is trading in line with both its industry peers and the SP 500 and represents a fair value.

That stocks PEG ratio would be 127 40 160 30 127. For instance if a companys stock is trading at 100 times of its earnings with PE ratio of 100 its considered as overvalued to another company in the same industry which is trading at 10 times of its earnings with PE ratio of 10. The PE ratio can be used to compare two or more companies.

The long-term average PE for the SP 500 is around 15x meaning that the stocks that make up. EPS does not help in making this decision. Hence why the full name for the PE ratio is the price-to-earnings ratio.

Therefore if a companys EPS is 20 and its share price is valued at 140 then it has a PE ratio of seven. Thats not much different than PE 24 if you think about it. PE ratio attaches a companys EPS with its market share.

PE or price to earnings ratio is calculated by dividing the companys current market price per share by the earnings per share or EPS. The PE ratio or price-to-earnings ratio is a quick way to see if a stock is undervalued or overvalued and generally speaking the lower the PE ratio is the better it is for the business and for potential investors. The average PE ratio for the SP 500 which is a market index that represents trading in the broader stock.

Price-to-earnings PE 25000 1000 25. The metric is the stock price of a company divided by its earnings per share. Investing Decisions An investor can make good use of PE multiples when considering his own individual investment style.

So while theres no hard-and-fast rule that answers the question what is a good PE Ratio in general many value investors consider that lower is better. Comparing a company to other similarly sized companies in the same type of business is the best way to judge what a good price-to-earnings ratio is. What does a PE ratio tell us.

Say that a stock has great metrics all across the board but the PE is just barely higher than 25. If an ownership stake was thought about in this stock then a multiple of 25 would be applied. The PE ratio is a key tool to help you compare the valuations of indivi.

This is because EPS doesnt tell an investor if a stock is worth his money. If a stock has a lower PE ratio than its peers thats generally a good sign. This is where PE ratio comes into the picture.

The overall market also has a PE ratio which reached 205 among the Standard Poors 500 according to a screen in early 2015 on GuruFocus. Would be considered a value company.

10 Stocks Which Are Fixed Deposit Shares To Buy For Long Term Investment Future Multibagger 2020 Youtube Investing Portfolio Management Stock Analysis

10 Stocks Which Are Fixed Deposit Shares To Buy For Long Term Investment Future Multibagger 2020 Youtube Investing Portfolio Management Stock Analysis

Getting Started With Stock Screeners

Price Earnings Ratio Formula Examples And Guide To P E Ratio

Price Earnings Ratio Formula Examples And Guide To P E Ratio

:max_bytes(150000):strip_icc()/using-price-to-earnings-356427-FINAL2-b2131aeaca004b6aa094e5fd986becab.png) Peter Lynch S Formulas For Valuing A Stock S Growth

Peter Lynch S Formulas For Valuing A Stock S Growth

What Is A Pe Ratio Understand This Key Stock Market And Fund Analysis Tool It S Like A Price Tag For Your Investments Stockmarkettradinginvesting

What Is A Pe Ratio Understand This Key Stock Market And Fund Analysis Tool It S Like A Price Tag For Your Investments Stockmarkettradinginvesting

:max_bytes(150000):strip_icc()/GettyImages-758612069-7812ee27cffd466cb87ea31e292bfb28.jpg) Price To Earnings Ratio P E Ratio Definition Formula And Examples

Price To Earnings Ratio P E Ratio Definition Formula And Examples

/stocks-lrg-5bfc2b1d4cedfd0026c103ab.jpg) Using The Price To Earnings Ratio And Peg To Assess A Stock

Using The Price To Earnings Ratio And Peg To Assess A Stock

How To Invest In Stocks The Pe Ratio Youtube In 2021 Investing In Stocks Investing Investment Advisor

How To Invest In Stocks The Pe Ratio Youtube In 2021 Investing In Stocks Investing Investment Advisor

Price To Earnings Ratio Pe Ratio Definition

Price To Earnings Ratio Pe Ratio Definition

:max_bytes(150000):strip_icc()/GettyImages-1128046391-2bc7aee959e24c419318589956dc3995.jpg) 5 Must Have Metrics For Value Investors

5 Must Have Metrics For Value Investors

/DEBTEQUITYFINALJPEG-098e44fb157a41cf827e1637b4866845.jpg) Debt To Equity Ratio D E Definition

Debt To Equity Ratio D E Definition

Price Earnings Ratio Formula Examples And Guide To P E Ratio

Price Earnings Ratio Formula Examples And Guide To P E Ratio

What P E Can Tell You About A Stock And What It Can T Moneysense

What P E Can Tell You About A Stock And What It Can T Moneysense

What Is A Good P E Ratio Ig Uk

What Is A Good P E Ratio Ig Uk

What Does Price Earnings Ratio Mean Stock Market Investing Investing Stock Market

What Does Price Earnings Ratio Mean Stock Market Investing Investing Stock Market

Pe Ratio Price Earnings Ratio Basics Calculation And More

Pe Ratio Price Earnings Ratio Basics Calculation And More

Peg Ratio Peg Ratio Finance Peg

Peg Ratio Peg Ratio Finance Peg

Post a Comment for "What Is Considered A Good P/e Ratio"