Home Insurance Premium Definition

There are a number of factors that impact your premium namely your level of coverage deductible amount home characteristics and credit score. In the most simple terms the insurance premium is defined as the amount of money the insurance company is going to charge you for the insurance policy you are purchasing.

Location is one of the biggest factors in your home insurance rates.

Home insurance premium definition. Therefore when you hear insurance premium. Ordinance or law coverage is included in some package policies often as a percentage of the dwelling coverage 10 25 50 etc. Most people pay their premium on a monthly basis but others choose to pay the.

Here are the basics to help you understand what an insurance premium is and how it works. What Is the Insurance Premium. Get coverage built to protect your home.

Homeowners policy is a multiple-line insurance policy meaning that it includes both property insurance and liability coverage with an indivisible premium meaning that a single premium is paid for all risks. Health insurance life insurance auto insurance disability insurance homeowners. If you get a Federal Housing Administration FHA loan your mortgage insurance premiums are paid to the Federal Housing Administration FHA.

A reinsurance premium is an amount of money that an insurance company pays to a reinsurance company to receive a specific amount of reinsurance coverage over a specified period of time. You can claim the deduction on line 8d of Schedule A Form 1040 for amounts that were paid or accrued in 2020. Your homeowners insurance premium is the amount of money you pay every year to keep your insurance policy active.

Monthly mortgage insurance fees or premiums are based on the loan amount. An insurance premium is the amount of money an individual or business must pay for an insurance policy. Your homeowners insurance premium is the amount you pay to keep your home insurance policy active.

The deductible affects your insurance policys cost. Insurance companies purchase reinsurance to hedge their risks. For example if a home is damaged or destroyed changes in building codes could result in additional uncovered expense when the home is repaired or rebuilt.

Typically the higher your homeowners insurance deductible the lower your premium. Third Party Loss A situation involving a person other than the insurer and insured ie a person making a liability claim against the insured. Allstate home insurance is more than quality coverage for your space.

Depending on the insurer and the amount of risk involved in the loan the average monthly fee is based on an annual rate. An extra charge added to your premium by an insurance company. Home equity loan interest.

Simply put premiums are what you pay insurance companies in exchange for coverage. The result is your home insurance premium. An insurance premium is a monthly or annual payment made to an insurance company that keeps your policy active.

A type of insurance that can be added to a renters or homeowners insurance policy to temporarily cover the value of the gifts a couple receives when they get married. FHA mortgage insurance is required for all FHA loans. It costs the same no matter your credit score with only a slight increase in price for down payments less than five percent.

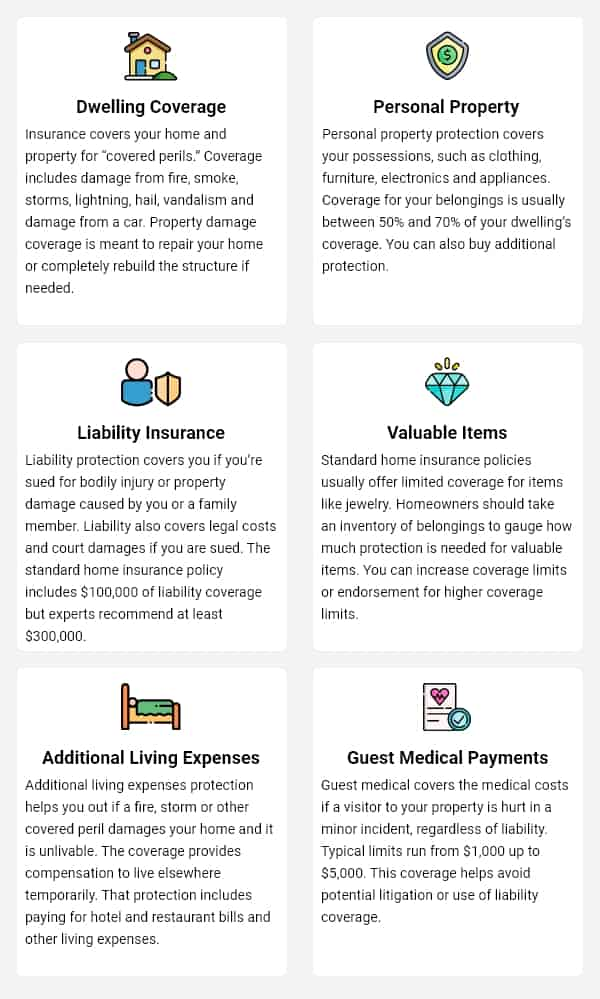

This means that it covers both damage to ones property and liability for any injuries and property damage caused by the owner or members of hisher family to other people. Homeowners insurance deductibles are an important part of figuring out how to choose homeowners insurance. Some allowed up to one without any increases on insurance premiums while other allowed up to two roommates without any increases.

Insurers consider many factors when judging location. The insurance premium is the cost of your insurance. With access to innovative tools money-saving discounts and a local agent its easy to make sure youre covering all your basesRead on to see all that Allstate has to offer.

A homeowners insurance deductible decides how much you pay when you file a claim. The itemized deduction for mortgage insurance premiums has been extended through 2020. All insurance companies stated along the line that anymore than two roommates would increase your insurance premiums a situation that I will never be in because my townhouse only has two bedrooms.

For home insurance a surcharge is usually added if you have a claims history. Location plays an important role in the cost of home insurance. Insurance premiums are paid for policies that cover healthcare auto home and life.

Weather areas that experience more natural disasters will likely have higher premiums. An insurance premium is the amount you pay for an insurance policy.

What Is Health Insurance Definition What Is Health Health Insurance Health

What Is Health Insurance Definition What Is Health Health Insurance Health

Personal Property Insurance What You Should Know Insuropedia By Lemonade

Personal Property Insurance What You Should Know Insuropedia By Lemonade

Understanding Your Home Insurance Declarations Page Policygenius

Understanding Your Home Insurance Declarations Page Policygenius

Allstate Accident Graphic Umbrella Insurance Insurance Marketing Life Insurance Marketing

Allstate Accident Graphic Umbrella Insurance Insurance Marketing Life Insurance Marketing

Limit Of Liability What You Should Know Insurance Dictionary By Lemonade

Limit Of Liability What You Should Know Insurance Dictionary By Lemonade

What Is Mip Mortgage Insurance Premium

What Is Mip Mortgage Insurance Premium

What Does Renters Insurance Cover 7 Surprising Things Real Estate 101 Trulia Blog In 2020 Renters Insurance Tenant Insurance Homeowners Insurance

What Does Renters Insurance Cover 7 Surprising Things Real Estate 101 Trulia Blog In 2020 Renters Insurance Tenant Insurance Homeowners Insurance

Homeowners Insurance Cover Compare Home Insurance Options And Deals Homeowners Insurance Coverage Home Insurance Quotes Home Insurance

Homeowners Insurance Cover Compare Home Insurance Options And Deals Homeowners Insurance Coverage Home Insurance Quotes Home Insurance

Life Insurance Facts Lifeinsurancetips Life Insurance Facts Homeowners Insurance Life Insurance Policy

Life Insurance Facts Lifeinsurancetips Life Insurance Facts Homeowners Insurance Life Insurance Policy

What You Should Know About Your Ho5 Insurance Policy Dictionary By Lemonade

What You Should Know About Your Ho5 Insurance Policy Dictionary By Lemonade

Homeowners Insurance California Insurance Com

Homeowners Insurance California Insurance Com

What Is A Homeowners Insurance Deductible Valuepenguin

What Is A Personal Umbrella Policy And When Do You Need It Allstate Umbrella Insurance Insurance Marketing Allstate Insurance

What Is A Personal Umbrella Policy And When Do You Need It Allstate Umbrella Insurance Insurance Marketing Allstate Insurance

How Much Is Renters Insurance Compared To What The Average American Spends On Shoes Soda Phones Home Insurance Quotes Renters Insurance Homeowners Insurance

How Much Is Renters Insurance Compared To What The Average American Spends On Shoes Soda Phones Home Insurance Quotes Renters Insurance Homeowners Insurance

While Most Homeowners Purchase Ho 3 Coverage We Ll Explain The Options So You Know Which Plan Provides The Most Cov Homeowners Guide Home Insurance Homeowner

While Most Homeowners Purchase Ho 3 Coverage We Ll Explain The Options So You Know Which Plan Provides The Most Cov Homeowners Guide Home Insurance Homeowner

10 Things You Should Know Before Embarking On E Renters Home Insurance E Renters Home Insu Renters Insurance Renters Insurance Quotes Home And Auto Insurance

10 Things You Should Know Before Embarking On E Renters Home Insurance E Renters Home Insu Renters Insurance Renters Insurance Quotes Home And Auto Insurance

Promoting Life Insurance To Millennials Life Insurance Quotes Life Insurance Facts Life Insurance Marketing

Promoting Life Insurance To Millennials Life Insurance Quotes Life Insurance Facts Life Insurance Marketing

Home Insurance Buy Property Home Insurance Policy Online

Home Insurance Buy Property Home Insurance Policy Online

:max_bytes(150000):strip_icc()/life_insurance_151909996-5bfc3710c9e77c00519d7859.jpg)

Post a Comment for "Home Insurance Premium Definition"