Short Term Disability Insurance Tax Form

Federal income tax will not be withheld from your benefit payment each week unless you request it when you file or submit IRS form W-4S to us for state plan claims or your employer for private plan claims. Short-term disability insurance gives employees peace of mind.

Https Www Standard Com Eforms 9426rco Pdf

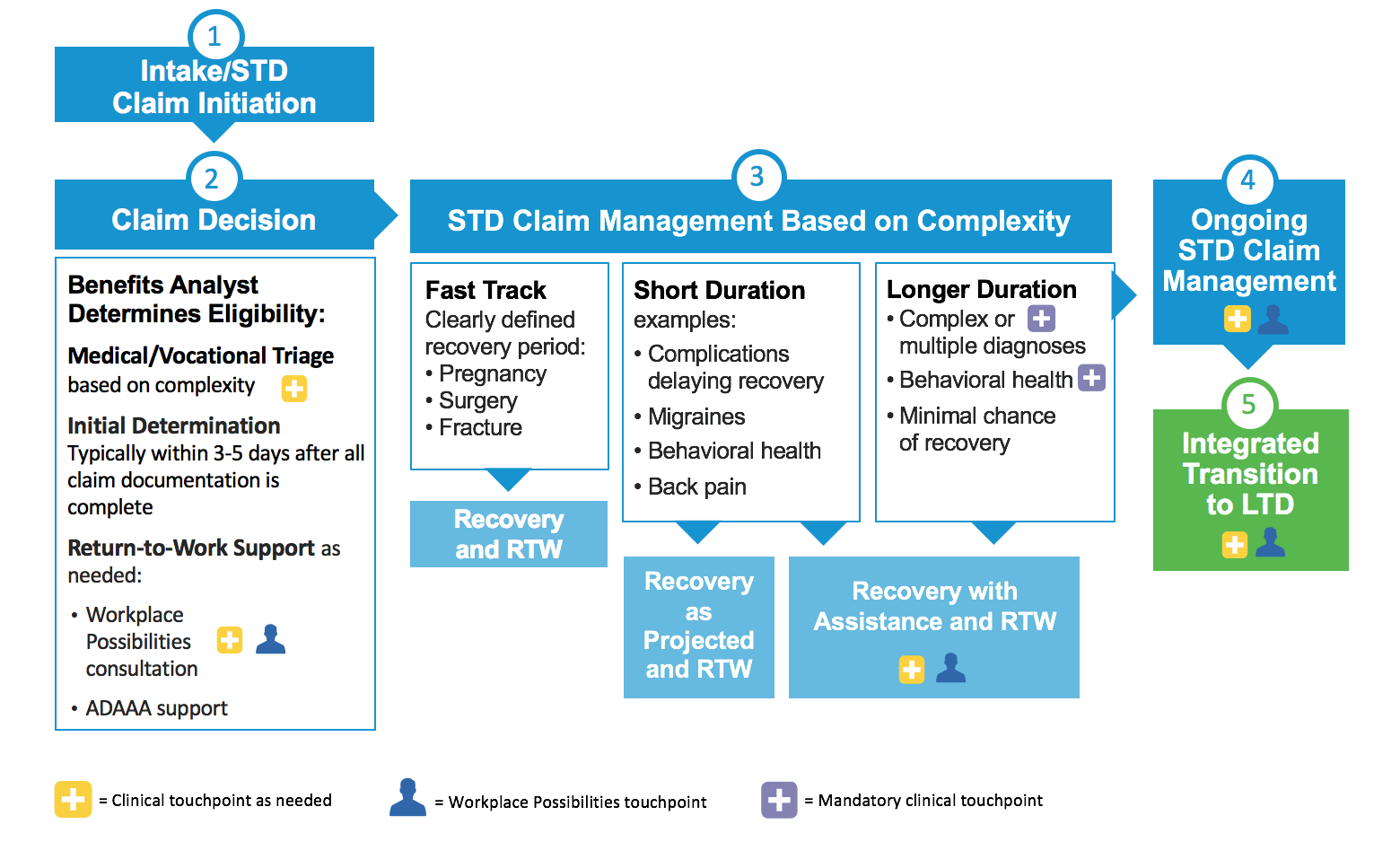

Unum will make the initial decision on a Short Term Disability Insurance claim within five business days after receipt of a complete claim which includes.

Short term disability insurance tax form. Under the 2017 Tax Law. Learn more about submitting a short-term disability insurance claim with Cigna Group Insurance. Available through the workplace this coverage helps protect your income if you cant work after an accident or illness.

Pay you a guaranteed amount each week. A signed medical authorization form. Disability During Unemployment Insurance benefits.

Businesses can customize their short-term disability insurance policy to be a stand-alone plan complement an employer-paid short-term disability plan or work with a long-term disability plan to help ensure continuity of coverage. Family Leave Insurance benefits. Family Leave During Unemployment Insurance benefits.

Whether the payments are taxable depends on how and when they are paid. A state sickness or disability fund. Covering loss of life limb sight etc.

If youre suddenly unable to earn a paycheck due to illness or an accident short term disability insurance through your employer can replace a portion of your income during the initial. If you only received Temporary Disability Insurance benefits you will not need to download a special tax form. This type of insurance pays out a portion of your income for a short period of time and can last from a few months to up to two years.

As in previous and current years for 2017 you should report only the income you received from your employer for your short-term disability. An association of employers or employees. Each claim is unique and Unum may request additional supporting medical records to make a decision on a claim.

For use in New York only. Disability During Unemployment benefits and Unemployment Insurance benefits are also taxable for federal income tax purposes. This type of insurance begins after a waiting period of several weeks or months and can last from a few years to up to retirement age.

Updated for Tax Year 2020. Temporary Disability Insurance benefits are considered taxable income for purposes of both the federal income tax and FICA Social Security. Providing payment for loss of earnings.

To complete forms you may need to download and save them on the computer then open them with the no-cost Adobe Reader. If you receive a W-2 for a third party sick pay with no amount in box 1 for wages and the income is reported in box 12 with code of J. Your employer will provide tax information on your W-2 under Third Party Sick Pay.

If all or a portion is taxable the taxable portion will be reported on your W-2 that is issued by your employer or reported on a Form W-2 issued by the insurer. Submit a Disability Claim. You must include in your income sick pay from any of the following.

Visit Online Forms and Publications to search view and order State Disability Insurance forms. If an adjustment was made to your Form 1099G it will not be available online. Individuals who collect these benefits will receive a 1099 form directly from the Department of Labor and Workforce Development listing the taxable income and any withholding.

Specified Disease Benefit Claim Form In NY Use this form to file a Specified Disease insurance claim. STD and SDI benefits on your Form 941 Employers Quarterly Federal Tax Return Prepare Form W-2 Wage and Tax Statements and provide to employees for STD or SDI benefits received from The Standard In addition you are always responsible for paying and reporting federal and. Form 1099G tax information is available for up to five years through UI Online.

State Disability Insurance Forms and Publications. If you have a Paid Family Leave claim or you are unable to access your information online you can request a copy of your Form 1099G by calling the EDDs Interactive Voice Response IVR system at 1-866-333-4606. Who pays for disability insurance premiums employer employee or a combination and how premiums are paid pre-tax or after-tax dollars determine if disability insurance contributions are tax deductible and if benefit payments are taxable or tax-free.

Tax Return for Seniors. Report the amount you receive on the line Wages salaries tips etc on Form 1040 US. Short Term Disability Insurance.

Therefore your employer is obligated to report this income and issue you a W-2 reflecting these payments. Temporary disability such as an injury serious medical condition or even pregnancy can be covered by short-term disability payments obtained through private insurers and they may be part of an employers compensation to employees. IRS Publication 502 provides a list of insurance policy types you cannot include.

Submit a short-term disability claim online or via fax or email. The PDFs on this website are replicas of the official EDD forms and publications. According to the IRS short-term disability income received under your employers plan is considered part of your salary.

Individual Income Tax Return or Form 1040-SR US. Non-taxable sick pay is not subject to taxation. All taxable income should be reported on Form W-4S Request for Federal Income Tax Withholding From Sick Pay.

Short Term Disability Claim Packet Outside NY Use this packet to file a claim for a Short Term Disability plan issued outside of the state of New York. If you received any of the following benefits in 2020 you need to log in to your account to download a 1099-G form for your 2020 tax return. Short-term disability premiums are not tax-deductible as a medical expense on Schedule A.

Social Security Disability Blue Book Social Security Disability Social Security Disability Benefits Disability

Social Security Disability Blue Book Social Security Disability Social Security Disability Benefits Disability

Getting Approved For Disability Benefits What To Know Social Security Disability Benefits Disability Benefit Social Security Disability

Getting Approved For Disability Benefits What To Know Social Security Disability Benefits Disability Benefit Social Security Disability

What You Need To Know About The 1099 Tax Form Tax Forms 1099 Tax Form Tax Preparation

What You Need To Know About The 1099 Tax Form Tax Forms 1099 Tax Form Tax Preparation

The Request Contains No Certificate Template Information Unique Tds Form 16 Certificate The Proof In E Tax Income Tax Income Tax Return Tax Forms

The Request Contains No Certificate Template Information Unique Tds Form 16 Certificate The Proof In E Tax Income Tax Income Tax Return Tax Forms

Https Www Unum Com Media Unum Home Unumus Documents Faq Online 20grp 20std 20 20faq Pdf La En

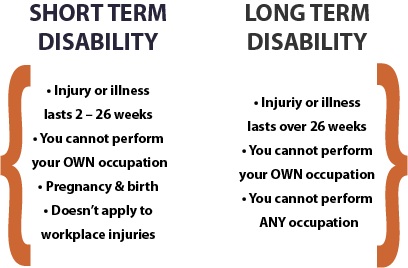

The Difference Between Short Long Term Disability Insurance

The Difference Between Short Long Term Disability Insurance

Click On The Image To View The High Definition Version Create Infographics At Http Venngage C Social Security Disability Benefits Disability Help Disability

Click On The Image To View The High Definition Version Create Infographics At Http Venngage C Social Security Disability Benefits Disability Help Disability

.jpg) Division Of Temporary Disability And Family Leave Insurance Do You Need To Download A 1099 G

Division Of Temporary Disability And Family Leave Insurance Do You Need To Download A 1099 G

Disability Secrets For Getting Your Ssdi Application Approved Coconut Health Benefits Health Lemon Benefits

Disability Secrets For Getting Your Ssdi Application Approved Coconut Health Benefits Health Lemon Benefits

Publication 590 A 2018 Contributions To Individual Retirement Arrangements Ira Social Security Benefits Social Security Disability Benefits Social Security

Publication 590 A 2018 Contributions To Individual Retirement Arrangements Ira Social Security Benefits Social Security Disability Benefits Social Security

What S The Difference Between Social Security Disability Insurance Supplement Social Security Disability Disability Insurance Short Term Disability Insurance

What S The Difference Between Social Security Disability Insurance Supplement Social Security Disability Disability Insurance Short Term Disability Insurance

Social Security Disability Benefits And Income Social Security Disability Benefits Social Security Disability Disability Benefit

Social Security Disability Benefits And Income Social Security Disability Benefits Social Security Disability Disability Benefit

Disability Insurance For Individuals Cigna

Disability Insurance For Individuals Cigna

Social Security Disability Approval Process Disability Help Social Security Disability Social Security Disability Benefits

Social Security Disability Approval Process Disability Help Social Security Disability Social Security Disability Benefits

Can Your Protective Filing Date Affect Your Ssd Application Social Security Disability Disability Disability Insurance

Can Your Protective Filing Date Affect Your Ssd Application Social Security Disability Disability Disability Insurance

Pin On Social Security Disability

Pin On Social Security Disability

Short Term Disability The Standard

Short Term Disability The Standard

Get The Basics Of Short Term Disability Disability Insurance Short Term Disability Insurance Best Health Insurance

Get The Basics Of Short Term Disability Disability Insurance Short Term Disability Insurance Best Health Insurance

Post a Comment for "Short Term Disability Insurance Tax Form"