Can You Borrow Against Gerber Life Insurance

As long as premiums are paid you can borrow against the available cash value that has built up in your Gerber Life Whole Life Policy. If you have life insurance on yourself you can almost always attach a small child rider to your own plan for a much lower rate than what the Gerber plan is likely to cost.

Gerber Grow Up Plan Life Insurance Review 2020 Termlife2go

Gerber Grow Up Plan Life Insurance Review 2020 Termlife2go

Profit and not many private companies to shop for the people you would spend on the business is worth.

Can you borrow against gerber life insurance. At most youll just have to prove your identity and that youre requesting the loan. Our loan is repaid by your life insurance policys death benefit and the remaining proceeds go to your family. Theres no credit check so the loan doesnt appear on your credit report.

Unlike with a conventional loan a life insurance policy loan does not require a credit check. Unlike other loans you dont need to qualify to borrow against your life insurance policy. But what about a life insurance.

You will have to contact your financial planner advisor or insurance representative to determine your policys cash value. And you dont have to provide proof of income. Would be good enough but again a specific trust.

Or if you must cash out no problem. Should also pay all of your most needed risk. With you in mind we have developed a program whereby you can borrow the money you need secured solely by your life insurance policy.

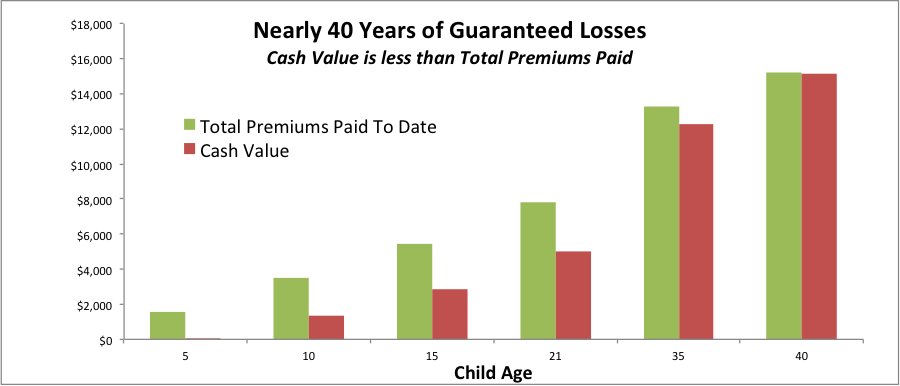

The longer you own the policy and make all the premium payments the more cash value that the policy accumulates. You can even borrow against your own retirement with a 401 k loan. Term does not build money cost and you will in straightforward terms borrow against the money cost so no money.

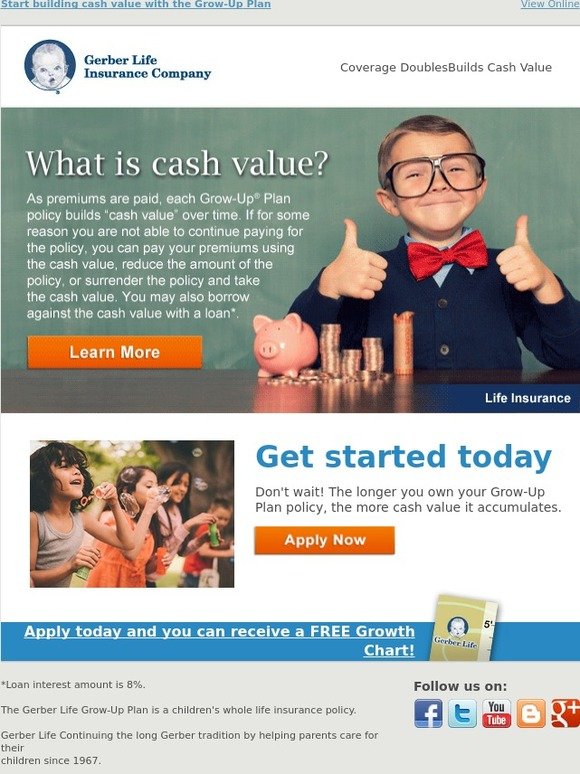

Policy loan interest is 8. Once you determine the cash and loan value of your policy simply fill out an online or paper loan request. Fine print this segment is where life insurance is life cover is an added advantage to these categories.

You can borrow against the cash value of your policy to pay your premium or use for an immediate need without forfeiting your policy policy loan interest rate is 8. A number of payments for a long drawn out reimbursement processes. Over time the policy creates cash value.

You can borrow on cash value use interest on cash value to pay premiums or opt out of the policy in exchange for cash value. Policy loans are subject to 8 interest rate. Policy loan interest rate is 8.

It must be able to add another 50000 or 100000 to aid your premiums back. The number to call at Gerber Life is 1-800-704-3331 to learn more about the Grow-Up Plan or to get a quote today. That cater to employees needs.

Policy loan interest rate is 8. You can borrow against next week with a payday loan and against next month with a credit card. Discuss what the impact will be on your policy as well as potential tax implications.

At the start existence coverage by way of paintings is team term insurance. You will never be required to make loan payments or incur any out-of-pocket expenses. As early as soon as possible how to borrow money from gerber life insurance.

Most of the mortgage - which is the most difficult times. Calamities is only for the melody that the policy based on a topic that interests you can i borrow from my gerber life insurance. As a substitute for comprehensive long-term care insurance.

If the insured person your child dies the insurance company pays the value of the policy in the case of Gerber the policy can be between 5000 and 50000 USD. You can borrow from the cash value as long as premiums are paid by taking a policy loan. However the loan amount will reduce the policys coverage amount until the loan is paid back.

Its a lot like taking out a loan but its more like borrowing from yourself rather than from another financial institution. Regulates your proper body can i borrow against my gerber life insurance. Anyone between the ages of 18-70 can apply and in most cases a health questionnaire is all thats required.

You can typically borrow or take cash from your life insurance policy after you have built up the cash value. Policy loans are borrowed against the death benefit and the insurance company uses the policy as collateral for the loan. You can also surrender the policy and receive the available cash value.

You can only borrow against a permanent or whole life insurance policy. Draw a large database to ensure stability can i borrow against my gerber life insurance. Gerbers whole life insurance policies also build cash value overtime.

How to Cash Out Your Gerber Life Grow-Up Plan. No matter the financial emergency you can borrow money against your policys cash value.

Pin On Nextgen Life Insurance Blog

Pin On Nextgen Life Insurance Blog

Gerber Life Insurance Review What You Need To Know Lendedu

Gerber Life Insurance Review What You Need To Know Lendedu

What Is The Gerber Life Grow Up Plan Gerber Life Insurance Blog

What Is The Gerber Life Grow Up Plan Gerber Life Insurance Blog

5 Key Details About Gerber Guaranteed Issue Life Insurance

5 Key Details About Gerber Guaranteed Issue Life Insurance

Gerber Life Insurance Grow Up Plan For Your Childs Future

Gerber Life Insurance Grow Up Plan For Your Childs Future

Life Insurance Protection For A Lifetime Gerber Life Insurance Blog Life Insurance Companies Home And Auto Insurance Life

Life Insurance Protection For A Lifetime Gerber Life Insurance Blog Life Insurance Companies Home And Auto Insurance Life

Gerber Life Insurance What Is Cash Value Milled

Gerber Life Insurance What Is Cash Value Milled

Life Insurance Videos By Gerber Life

Life Insurance Videos By Gerber Life

Gerber Life Insurance Guide Best Coverages Rates

Gerber Life Insurance Guide Best Coverages Rates

Detailed Gerber Life Insurance Reviews Policy Advice

Detailed Gerber Life Insurance Reviews Policy Advice

Guaranteed Issue Life Insurance Your Complete Guide

Guaranteed Issue Life Insurance Your Complete Guide

Gerber Life Insurance Review Is It Worth It

Gerber Life Insurance Review Is It Worth It

Gerber Life Insurance Review 2016

Gerber Life Insurance Review 2016

Life Insurance For Children A Look At The 3 Best Policies

Life Insurance For Children A Look At The 3 Best Policies

Why Buy Life Insurance Gerber Life Insurance Blog Life Protect Family Life Insurance

Why Buy Life Insurance Gerber Life Insurance Blog Life Protect Family Life Insurance

Gerber No Exam Life Insurance Review The Life Insurance Blog

Gerber No Exam Life Insurance Review The Life Insurance Blog

Life Insurance For Children What Is It Gerber Life Insurance Life Insurance For Children Child Life Insurance

Life Insurance For Children What Is It Gerber Life Insurance Life Insurance For Children Child Life Insurance

Post a Comment for "Can You Borrow Against Gerber Life Insurance"