Dcf Valuation Insurance Companies

DCF essentially attempts to estimate the current value of a company and its shares by projecting its future free cash flows FCF and discounting them to the present with an appropriate rate. Find out how you can define the valuation of a startup by applying the discounted cash flow in six easy steps.

:max_bytes(150000):strip_icc()/GettyImages-1201625789-e6613ebdb23a4b1a8605019c2d195755.jpg) How To Value An Insurance Company

How To Value An Insurance Company

The Discount Rate also represents your opportunity cost as an investor.

:max_bytes(150000):strip_icc()/DiscountedCashFlowsvs.Comparables2-fea4624dffab4bd8bec311cb6d134a2f.png)

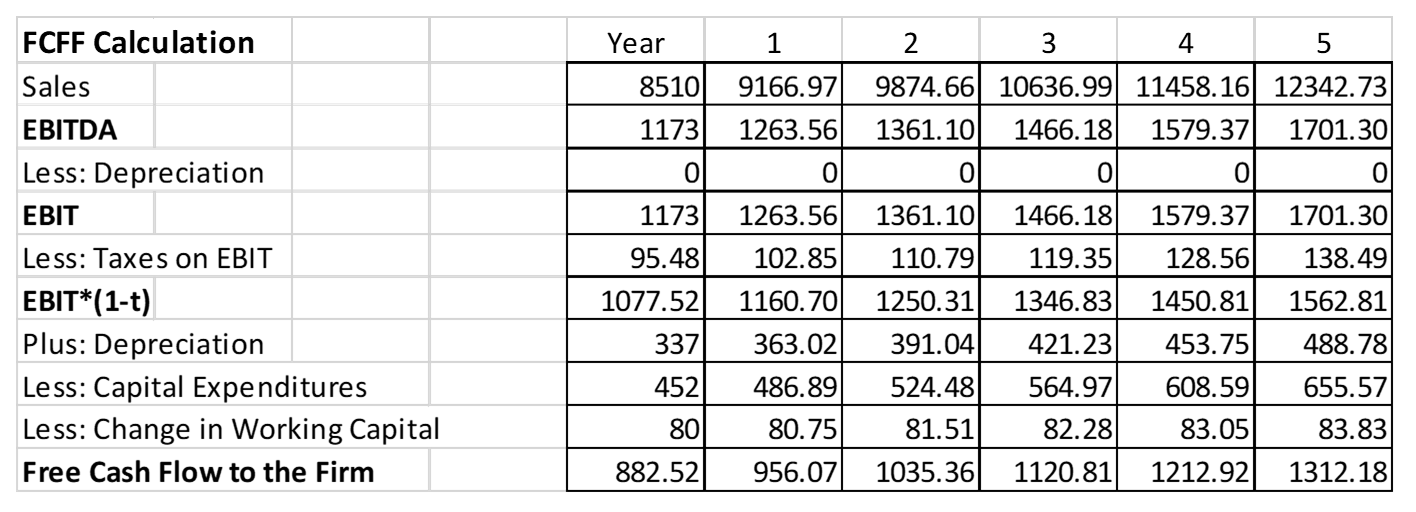

Dcf valuation insurance companies. DCF analysis attempts to figure out the value of an investment. The DNI method involves projecting an insurance companys net income and discounting the projected earnings to a present value amount using the required rate of return on the insurance companys equity. The DCF valuation method focuses on cash and not on accounting profits therefore it includes any effects which impact the cash position of a company before considering the type of financing debt or equity.

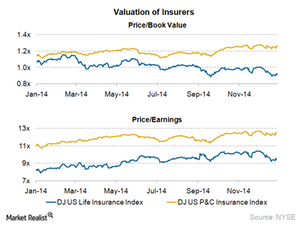

Discounted cash flow DCF is a valuation method used to estimate the value of an investment based on its expected future cash flows. The problems with valuing financial service firm stem from two key characteristics. The section starts by discussing the primary drivers of insurers intrinsic value including profitability growth prospects and cost of equity capital as well as accounting quality indicators that inform on the reliability of the measured.

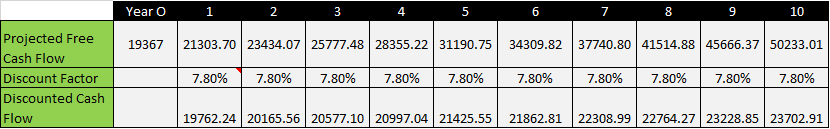

NWLI is trading with a price-earnings ratio of 739. A DCF valuation is a forward-looking valuation method based on an expected cash flow stream going forward. The Discount Rate represents risk and potential returns so a higher rate means more risk but also higher potential returns.

These articles will teach you business valuation best practices and how to value a company using comparable company analysis discounted cash flow DCF modeling and precedent transactions as used in investment banking equity research in each period divided by one plus the discount rate WACC WACC WACC is a firms Weighted Average Cost of Capital and represents its blended cost of capital including equity and debt. Find out how you can define the valuation of a startup by applying the discounted cash flow in six easy steps. Discount Rate Meaning and Explanation.

DCF analysis comparable companies and precedent is the set of procedures used to appraise a companys current net worth. NYSESFG disability National Western Life Insurance Company NASDAQNWLI Life insurance and annuities sold to. These companies include MetLife Prudential Financial and AFLAC.

If you were to invest in a company like Michael Hill. Addresses the valuation of insurance companies. What is Discounted Cash Flow Valuation.

With a market cap of 720 million National Western Life Group Inc. Reinsurance Group of America Inc NYSERGA life reinsurance ENH PC insurance reinsurance Assurant Inc. The value of the discounted earnings stream reflects an estimate of the equity value of the insurance company.

Valuing banks insurance companies and investment banks has always been difficult but the market crisis of 2008 has elevated the concern to the top of the list of valuation issues. Notes Mostly on Financials. 1 DCF analysis 2 comparable company analysis and 3 precedent transactions.

National Western Life Group. Discounted cash flow analysis is method of analyzing the present value of company or investment or cash flow by adjusting future cash flows to the time value of money where this analysis assesses the present fair value of assets or projectscompany by taking into effect many factors like inflation risk and cost of capital and analyze the companys. So according to the DCF valuation Novartis is overvalued as it trades at 7521 and the DCF shows that the value per share should be 5949 based on the companys FCFF.

A couple of key metrics can be used to value insurance companies and these metrics happen to be common to financial firms in general. If you are interested in an official company valuation contact a certified Register Valuator. DCF is a valuation method that can be used for privately-held companies.

It projects a series of future cash flows EBITDA or earnings and then discounts for the time value of money. The Discount Rate goes back to that big idea about valuation and the most important finance formula. Market Approach Key.

The assumption is that the company or asset is expected to generate cash flows Cash Flow Cash Flow CF is the increase or decrease in the amount of money a business institution or individual has. When valuing a company as a going concern there are three main valuation methods used by industry practitioners. Insurance Valuation Insight.

According to the DCF calculator the stock has a fair value of 373 while trading at 19829. The WACC formula is EV x Re DV x Rd x 1-T. These are the most common methods of valuation used in investment banking.

Valuing PC insurers or reinsurers by cash flow methodologies is relatively less complex especially in the case of short. Private company valuation Valuation Methods When valuing a company as a going concern there are three main valuation methods used. NYSEAIZ Life PC Warranties Pensions Individual Health StanCorp Financial Group Inc.

Some limitations of the DCF valuation. 1 If you want to experiment with this here are five very different insurers that are my current favorites. Discounted cash flow DCF analysis determines the present value of a company or asset based on the value of money it can make in the future.

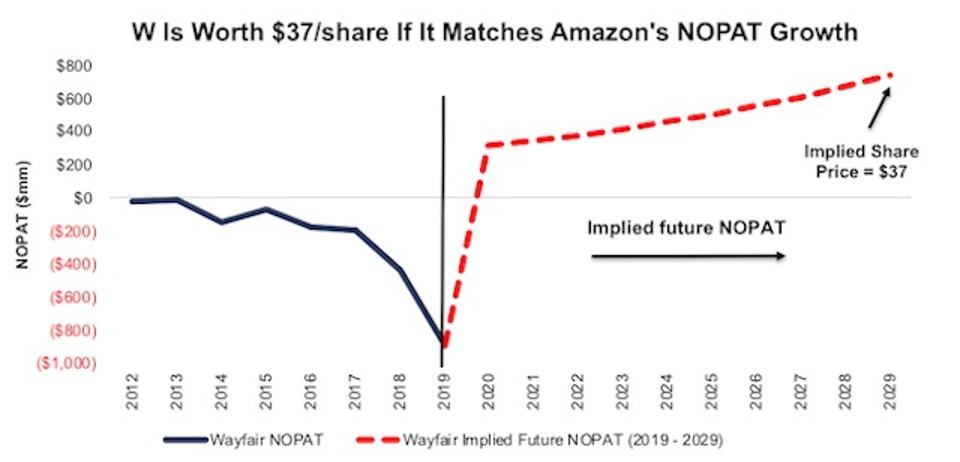

Wayfair Is Furnishing Investors With Risk

Wayfair Is Furnishing Investors With Risk

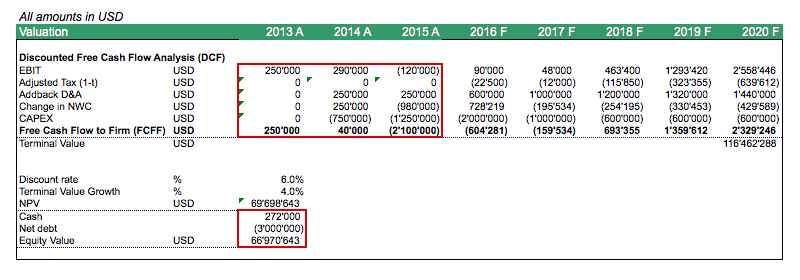

Dcf Model Tutorial With Free Excel Business Valuation Net

Dcf Model Tutorial With Free Excel Business Valuation Net

Give Your Portfolio Some Insurance With Allstate Corp

Give Your Portfolio Some Insurance With Allstate Corp

Https Www Casact Org Library Studynotes Goldfarb2010 Pdf

Dcf Mistakes Valuation Date Efinancialmodels

Dcf Mistakes Valuation Date Efinancialmodels

Discounted Cash Flow Valuation Cash Flow Cash Flow Statement Financial Documents

Discounted Cash Flow Valuation Cash Flow Cash Flow Statement Financial Documents

:max_bytes(150000):strip_icc()/DiscountedCashFlowsvs.Comparables2-fea4624dffab4bd8bec311cb6d134a2f.png) Discounted Cash Flows Vs Comparables

Discounted Cash Flows Vs Comparables

Three Of The Most Dangerous Stocks For 2021

Three Of The Most Dangerous Stocks For 2021

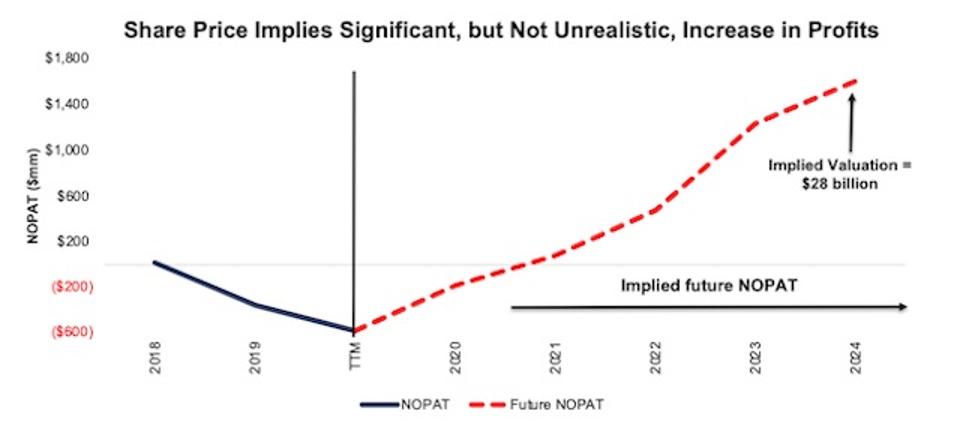

Investors Can Rest Well With Airbnb S Ipo

Investors Can Rest Well With Airbnb S Ipo

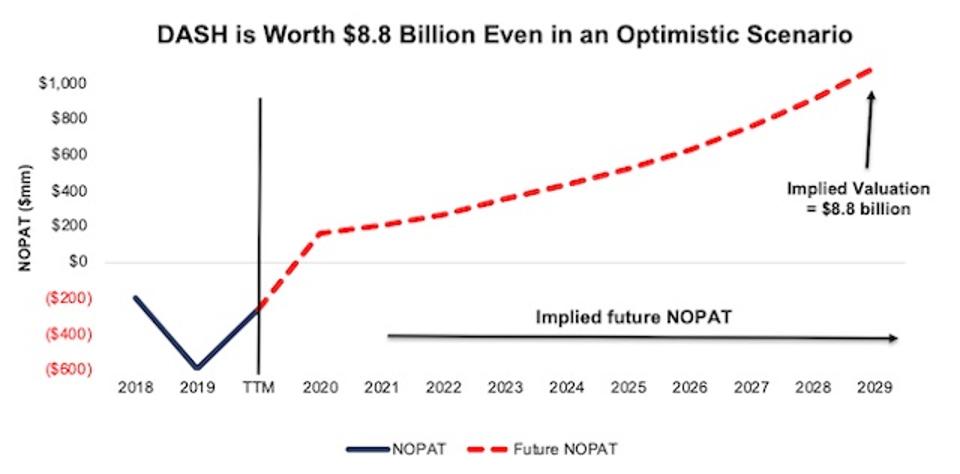

Doordash S New Valuation Is Even More Ridiculous

Doordash S New Valuation Is Even More Ridiculous

How Valuation Of Insurance Companies Works

How Valuation Of Insurance Companies Works

Top 10 Mistakes In Dcf Valuation Models Financial Modeling Cash Flow Finance

Top 10 Mistakes In Dcf Valuation Models Financial Modeling Cash Flow Finance

How To Value Berkshire Hathaway Morningstar

How To Value Berkshire Hathaway Morningstar

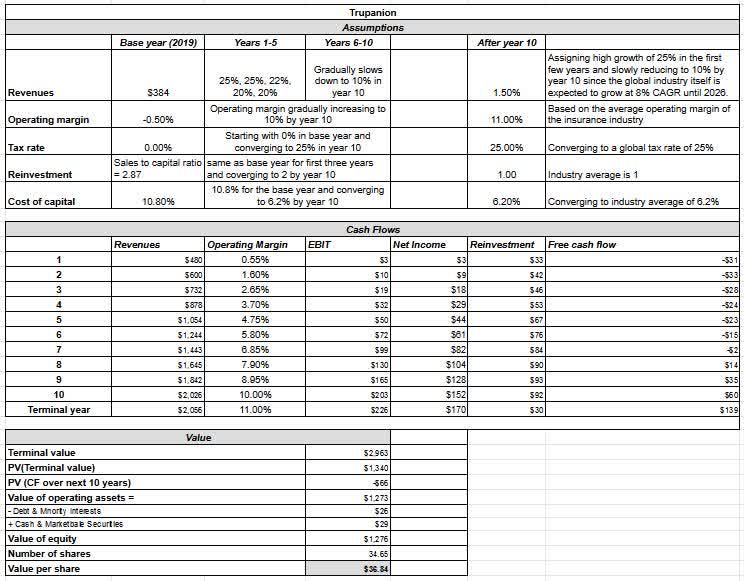

Trupanion Love The Company But Not The Valuation Nasdaq Trup Seeking Alpha

Trupanion Love The Company But Not The Valuation Nasdaq Trup Seeking Alpha

Explaining The Dcf Valuation Model With A Simple Example

Explaining The Dcf Valuation Model With A Simple Example

Https Www Casact Org Research Valpap1 Pdf

Guide To Terminal Value Using The Gordon Growth Model

Guide To Terminal Value Using The Gordon Growth Model

Https Www Casact Org Pubs Proceed Proceed05 05267 Pdf

Post a Comment for "Dcf Valuation Insurance Companies"