Esg Integration Insurance Companies

Ensuring regulatory compliance with regard to sustainability requirements Impact of the EU Disclosure and Taxonomy Regulation as well as ESG aspects of the IDD and EU Benchmark Regulation on insurers business models. ESG Investor Insights series - A Teach-in with investors.

Sustainable Investing J P Morgan Asset Management

Sustainable Investing J P Morgan Asset Management

Compared with other types of perils such as financial risks the understanding of the relevance of ESG issues and their practical application for insurance is still in its infancy.

Esg integration insurance companies. Decision-making about ESG risks. According to a 2018 study of 159 insurers by international ESG research firm Vigeo Eiris the insurance industry ranked 23rd out of 39 industries surveyed for reporting and integration. 50 Best ESG Companies.

Aviva issues an ESG call to action as it unveils bold net zero strategy. While insurers such as Allianzand Zurichactively point to the role ESG integration plays in their operations and investments others are lagging behind. ESG Referral Process and Sensitive Business Guidelines.

There is growing interest in the insurance industry and the wider financial sector in under- standing the correlation between ESG factors and strong performance of companies across industries. During 2019 we reviewed 477 transactions for potential ESG risks part. Check out how we integrate environmental social and governance factors across our business to make sure we manage our activities effectively ethically and sustainably.

A majority of respondents declared that they integrate some ESG considerations into their investment decision process. Asset owners including pension funds insurance companies and sovereign wealth funds which have long-term liabilities and a fiduciary duty to their members are leading the way by integrating ESG criteria across their entire. With ESG expectations and put ESG issues at the forefront of their decision-making.

This experience refers to Enterprise Risk Management ERM an essential part of an insurance companys ongoing operations. As discussed above not doing so may damage reinsurers reputations and growth from both an underwriting and investment perspective. ESG Integration MIM seeks to deliver client solutions that manage risk and create sustainable investment returns.

We believe that proactively integrating environmental social and governance ESG factors in our investing will help us to do our job well on a long-term basis. Events to decades as an insurance company. The increasing number of ESG risks to investors alongside legislative impetus for ESG integration into investment and the development of themed sustainability strategies and products means investors now regularly require companies to comprehensively report their ESG risks.

To bridge this gap Allianz Global Corporate Specialty AGCS together with The Value Group a Munich-based research and investment consultancy initiated a research project to assess the relevance of ESG for industrial insurance. ESG integration in insurance is carried out by all Allianz operating entities and global lines through group-wide ESG guidelines and processes. This first insurance industry guide on ESG issues will raise awareness of the potential benefits of ESG integration in the insurance business model.

At Sage we view the incorporation of ESG principles as a logical and effective means of risk mitigation for insurance company portfolios one that is a natural extension of the insurance experience. ESG integration across asset classes and alongside traditional financial metrics and state-of-the-art risk management practices helps us to achieve superior risk-adjusted long-term financial returns. Part 1 - Investor Engagement What do companies need to know.

There is growing interest in the insurance industry and the wider financial sector in under-standing the correlation between ESG factors and strong performance of companies across industries. However while solutions are being developed to help the insurance industry make efficient ESG decisions smaller insurance actors remain at a disadvantage. ESG integration refers to the idea that all types of investors should examine companies.

We believe material ESG factors have an impact on investment performance and are important considerations to effectively manage risk and achieve our clients investment objectives. This first insurance industry guide on ESG issues will raise awareness of the potential benefits of ESG integration in the insurance business model. Allianz integrates ESG factors into the investment of proprietary assets and the management of third-party assets.

For further details see the Allianz ESG Integration Framework and the Group Sustainability Report. Reducing reputational risk was the most-cited reason behind reinsurers integration of ESG factors in investing mandates. SP DJI caters to a diverse spectrum of ESG investing needs from best-in-class approaches like the world-renowned Dow Jones Sustainability Index to broad-market ESG alternatives to mainstream indices like the SP 500 ESG Index.

UK insurer Aviva has cast itself as an industry ESG leader with a bold series of targets which includes developing a methodology for net zero underwriting that it claims will represent an important and significant move for the global insurance. Detection and analysis of risks. Insurance transactions and unlisted investments in 13 sensitive business areas are screened and assessed for ESG risks.

Integration of ESG risks into existing risk management processes. 20 pension funds out of 25 respondents and 30 insurance companies out of 51 considered at least some environmental social or governance factors on new investments. Integration of ESG issues.

Risk Management Lifetime Wealth Strategies

Http Www Unepfi Org Psi Wp Content Uploads 2019 05 Allianz Group Psi Report 2018 Pdf

Https Www Insurercio Com Images Ignoring 20esg 20factors 20poses 20reputational 20risk Pdf

Aegon Asset Management Brighttalk

Aegon Asset Management Brighttalk

Sustainability Risks Opportunities In The Insurance Industry Springerlink

Sustainability Risks Opportunities In The Insurance Industry Springerlink

Insurance Industry Drawn To Esg Risk Management

Insurance Industry Drawn To Esg Risk Management

Developing Appropriate Environmental Social Governance Esg Fixed Income Strategies Insurance Aum Journal

Developing Appropriate Environmental Social Governance Esg Fixed Income Strategies Insurance Aum Journal

Best S Special Report Insurers And Reinsurers Ignoring Esg Factors Poses Reputational Risk Business Wire

Best S Special Report Insurers And Reinsurers Ignoring Esg Factors Poses Reputational Risk Business Wire

Esg Integration J P Morgan Asset Management

Esg Integration J P Morgan Asset Management

Ms Ad Insurance Group And Sustainability Sustainability Ms Ad Insurance Group Holdings Inc

Ms Ad Insurance Group And Sustainability Sustainability Ms Ad Insurance Group Holdings Inc

Msci Offers Esg Integration Framework

Msci Offers Esg Integration Framework

Esg Integration Responsible Investing Great Lakes Advisors

Esg Integration Responsible Investing Great Lakes Advisors

Public Consultation First Global Guide To Esg Risks In Non Life Insurance Unep Fi Principles For Sustainable Insurance

Esg Integration Institutional Blackrock

Esg Integration Institutional Blackrock

The Role Of Responsible Investing In Active Equity Management Epoch Investment Partners Inc

The Growing Recognition Of Esg Factors Amongst Us Insurers Blogs Pri

The Growing Recognition Of Esg Factors Amongst Us Insurers Blogs Pri

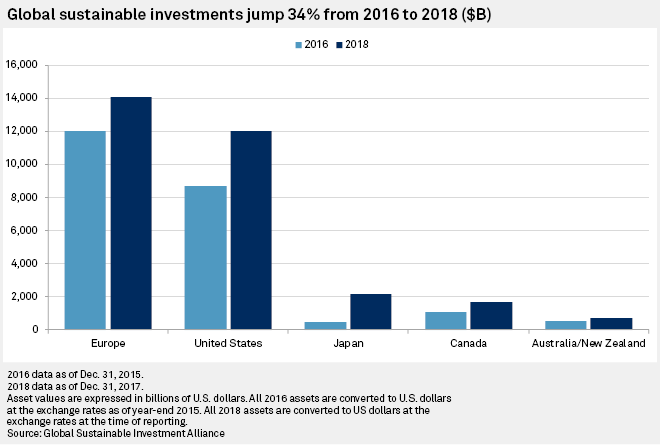

Esg Becoming Mature Market Assets Hit 30 7 T In 2018 S P Global

Esg Becoming Mature Market Assets Hit 30 7 T In 2018 S P Global

Post a Comment for "Esg Integration Insurance Companies"