Insurance Hard Market Graph

The extent that your renewal will be affected by a hard market will vary depending on your risk profile claims record strategies for risk management and the capabilities of your insurance broker but in this current climate the vast majority of organisations are likely to see sizeable raises in premium rate. Normally hard markets occur every six to eight years but this has been far longer and deeper than ever before.

This Graph Shows Everything That S Wrong With Health Insurance Premiums Business Insider Health Insurance Cost Medical Insurance Health Insurance Coverage

This Graph Shows Everything That S Wrong With Health Insurance Premiums Business Insider Health Insurance Cost Medical Insurance Health Insurance Coverage

These measures which well touch on shortly make it harder for the average person to find affordable insurance coverage they lead to a hard market To put it simply a hard market is a period of time when there is a high demand for insurance but a lower supply of coverage available.

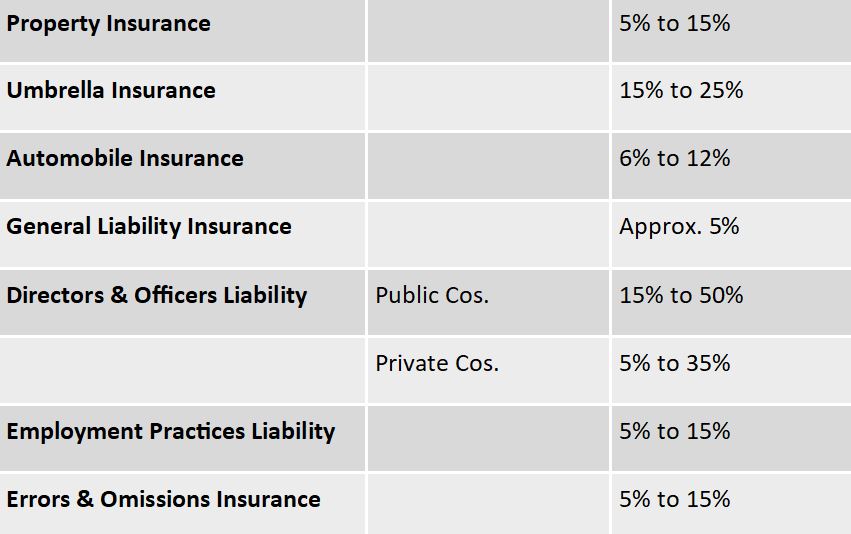

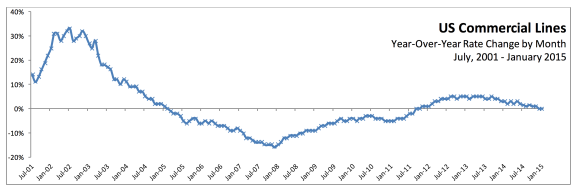

Insurance hard market graph. The graph below shows the effect that these two events had on insurance premiums. In yet another sign of a hardening market US. According to The ouncil of Insurance Agents rokers the Q2 2017 ommercial Property and asualty Sur-vey results showed that commercial rates decreased across all account sizes with an overall average decrease of 28 in second quarter the eleventh consecutive quarter of declining rates.

Similarly the period of the late 1970s and early 1980s is likewise regarded. The chart below shows both nominal and inflation-adjusted growth of PC net premiums written over four decades and three hard markets. Therefore premiums rise rapidly.

As a result insurance companies are less inclined to take on new business. Team managers will likely need to become microleaders instituting organizational and cultural shifts at the small group level. And prices rose in nearly all commercial lines with the notable exception of workers compensation according to the report which also notes a minimum of a 20 rate increase on energy coverages and higher marine rates.

The Insurance Industrys Cycle and Why Were Currently in a Hard Market. Typically when an insurance company has excess profit they will try and buy growth by lowering rates or relaxing underwriting guidelines. Soft Market Insurance pricing cycles have two distinct periods known as the hard and soft markets.

Call it what you will. Commercial insurance prices grew at an accelerated rate compared to a year ago according to Willis Towers Watsons latest Commercial Lines. A firming market a challenging market a sellers market a disciplined market an unconventional hard market North American businesses are paying more for insurance.

In the first quarter of 2019 rates rose 2 on average according to our latest Insurance Marketplace Realities report. Both soft markets have been succeeded by a very hard market. Our graph shows a general summary of how the underwriting cycle works.

Identifying the characteristics of these market conditions might include. Market shares for the individual accident and health lines of business are not included in this report. This chart uses net premiums written which reflect premium amounts after deductions for reinsurance transactions.

Over and above the companys baseline property rate pricing predictions a micro-hard market can be expected to produce increases of 50 to 100 and even up to 400 for challenged occupancies. Premiums can be accounted for in several ways. In addition to this large claims have left even larger companies with less capital.

The commercial lines with the greatest de-. But the truth is that the insurance market is cyclical in nature fluctuating between soft and hard markets. Although no two cycles are exactly the same insurance industry cycles typically last.

If you require any further assistance or advice on the hard market and how it may impact upon your business or would like us to conduct a review of your existing insurance please contact us directly on 0161 300 2930 or complete the contact request form this page. All industries experience cycles of expansion and contraction and this is particularly true of the insurance industry. A separate publication Market Share Reports for the Top 125 Accident and Health Insurance Companies and Groups by State and Countrywide combines data from all four statements to provide complete market share information for that line.

After years of mostly falling or flat insurance rates we are now seeing signs of a hardening insurance market. After a major claims burst less stable companies are driven out of the market which decreases competition. Even before 2020 began we were starting to experience a hard insurance market.

In the case of our current hardening swing what has precipitated this has been the first two points mentioned. The extent will vary as always depending on the business its risk profile and its strategy for risk management but the story that emerges in the. The vision for each postpandemic organization will be set at the top so insurance executives will likely face hard decisions about which archetype best suits their company.

Payouts may have increased and profits may have declined. A hard market is characterized by a high demand for insurance coverage and therefore a reduced supply. The period of the 1990s is regarded as a soft market for property and casualty insurance.

Catastrophic losses increased frequency and severity of bodily injury claims and additional defense costs impacted. Federal Open Market Committee. Twelve years of soft market pricing for the aviation insurance industry worldwide was unprecedented.

In a soft market insurance companies have a broader appetite for risk and compete with one another by lowering premiums to attract more customers.

Chart Historical Capital Levels Of Guy Carpenter Global Reinsurance Composite Historical Composition Chart

Chart Historical Capital Levels Of Guy Carpenter Global Reinsurance Composite Historical Composition Chart

Motor Insurance Gross Written Premiums Statista

Motor Insurance Gross Written Premiums Statista

Https Opencommons Uconn Edu Cgi Viewcontent Cgi Article 1563 Context Srhonors Theses

Industry Giants 2019 S Top 100 Insurance Companies Propertycasualty360

Industry Giants 2019 S Top 100 Insurance Companies Propertycasualty360

Market Conditions Cycles And Costs Iii

Market Conditions Cycles And Costs Iii

Hard Market Vs Soft Market The Insurance Industry S Cycle And Why We Re Currently In A Hard Market

Hard Market Vs Soft Market The Insurance Industry S Cycle And Why We Re Currently In A Hard Market

Understanding The Current Insurance Cycle Lockton Uk

Understanding The Current Insurance Cycle Lockton Uk

Https Scholar Harvard Edu Files Hendren Files Topic 7 Adverse Selection And Insurance Market Failures Pdf

Zero To 100 Million In 3 Years A Lemonade Transparency Chronicle

Zero To 100 Million In 3 Years A Lemonade Transparency Chronicle

Real Estate Market Update Fontana Graph Days To Sell Vs List Price Things To Sell Fontana Graphing

Real Estate Market Update Fontana Graph Days To Sell Vs List Price Things To Sell Fontana Graphing

Insurance Stocks Dump After Hurricane Harvey Stock Market Harvey Investing

Insurance Stocks Dump After Hurricane Harvey Stock Market Harvey Investing

Triple I Blog Triple I Ceo To Speak Br At Raa Catastrophe Risk Management Conference

Triple I Blog Triple I Ceo To Speak Br At Raa Catastrophe Risk Management Conference

United States Health Care Statistics Memes Google Search Health Care Insurance Personal Health Charts And Graphs

United States Health Care Statistics Memes Google Search Health Care Insurance Personal Health Charts And Graphs

Graph Database Use Case Insurance Fraud Detection Keep On Reading Graph Database Use Ca Machine Learning Machine Learning Models Learning Techniques

Graph Database Use Case Insurance Fraud Detection Keep On Reading Graph Database Use Ca Machine Learning Machine Learning Models Learning Techniques

Post a Comment for "Insurance Hard Market Graph"