Why Is The Property Insurance Market Hardening

Premiums are high and insurers are disinclined to negotiate terms. It can be difficult to find options for insurance and as a result rates go up.

The Property Insurance Market Will Continue To Harden In 2020 According To Recent Projections Amsuisse

The Property Insurance Market Will Continue To Harden In 2020 According To Recent Projections Amsuisse

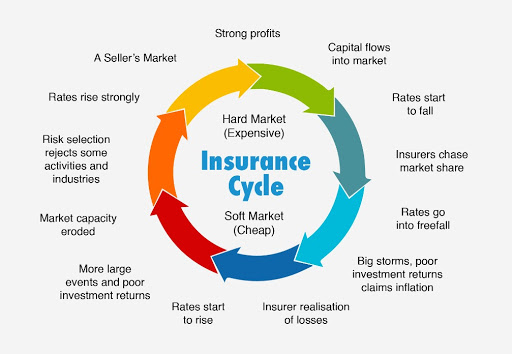

A soft insurance market is the opposite of a hard one.

Why is the property insurance market hardening. The role of brokers in all of this is to help you navigate the insurance market whether its hard or soft. Like the Property and Casualty insurance market in general the market for Cyber Liability Insurance was already hardening when 2020 began. It put the 15 rise down to a market-wide deterioration in claims developments and few new market entrants.

Simply stated a hard insurance market is defined by continued high demand for insurance coverage with limited or reduced supply. Pandemic Losses Burden 20201H21 Results Fitch expects that commercial insurers will be hit hard by pandemic-related losses that affect event cancellation as well as credit and surety policies in 2020 and 1H21. During the hard market the market is less competitive and underwriters adhere to stricter standards.

Offices emptied their former occupants shifting to work-at-home arrangements including remote access to company networks. Increased global footfall back to the London market as well as a hardening reinsurance market are amplifying the impact as similar conditions are evident globally. To see how lawsuits are changing just look at the Securities Class Action SCA numbers.

This reduces carriers ability to continue going after new business and causes the market to start hardening. Market hardening isnt typically caused by just one event but rather a combination of factors that all place increased pressure on the insurance industry. Thanks to premium increases a byproduct of a hardening insurance cycle insurance professionals are facing an uphill battle in the eye of public opinion.

The market may also be hardening for general liability EO DO and EPL insurance where an increase in litigation is leading to large losses. Thats why Justin Thouin co-founder. Our role as your broker in a hard market.

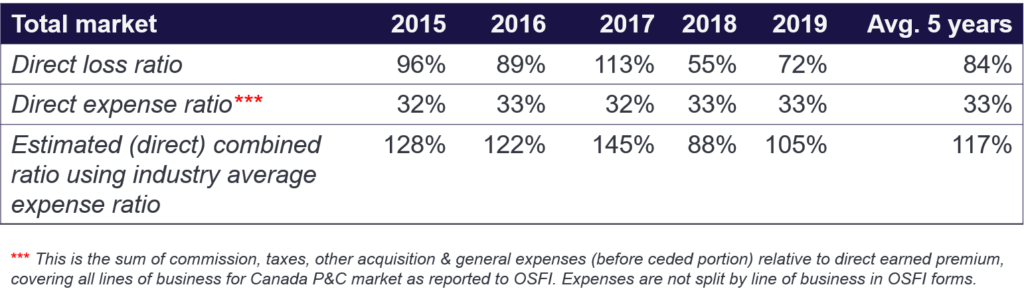

Insurers impose strict underwriting standards and issue a limited number of policies. 2020 was one heck of a year. There are many factors contributing to the hardening insurance market we are currently experiencing including an increase in natural disasters and increased claims costs.

With the catastrophic claims. Insurers willing to take on less risk. Then the COVID-19 pandemic hit.

A hard insurance market is characterized by a high demand for insurance coverage and a reduced supply. While rates start hardening the impact and severity vary on the basis of occupancy history risk quality and profile. This is not an exhaustive list of what a hardened market means for customers.

Because of the tightening or hardening of the property market they are looking to do more of that particularly with flood and earthquake and windstormIts already been forced on them as far as. There is however often a catalyst which speeds up the process for example the 911 attacks in the early 2000s and the coronavirus pandemic today. Pandemic losses hurt the property-casualty bottom line The pandemic and other catastrophe losses hit many insurers hard in first-half 2020 especially those writing events cancellation and workers compensation.

Premium rates will be less competitive among insurers. The insurance industry has experienced more claims this year than in the history of insurance with over a billion dollars in intentional property destruction alone. Stricter underwriting criteria on your policy.

The causes for the limited or reduced supply are manifold but the net result is an upset from the status quo with insurance carriers focused on increasing rates restricting coverage terms and conditions and possibly raising deductibles and retentions for the insured. In 2015 there were 208. By NCIAs Risk Management Insurance Committee How a Hardening Market is Limiting Coverage and How to Be Prepared.

To see how lawsuits are changing consider the Securities Class Action SCA numbers. The trend toward dominance in online commerce accelerated as stores and restaurants limited. The market may also be hardening for general liability errors and omissions directors and officers and employment practices liability insurance where an increase in litigation is leading to large losses.

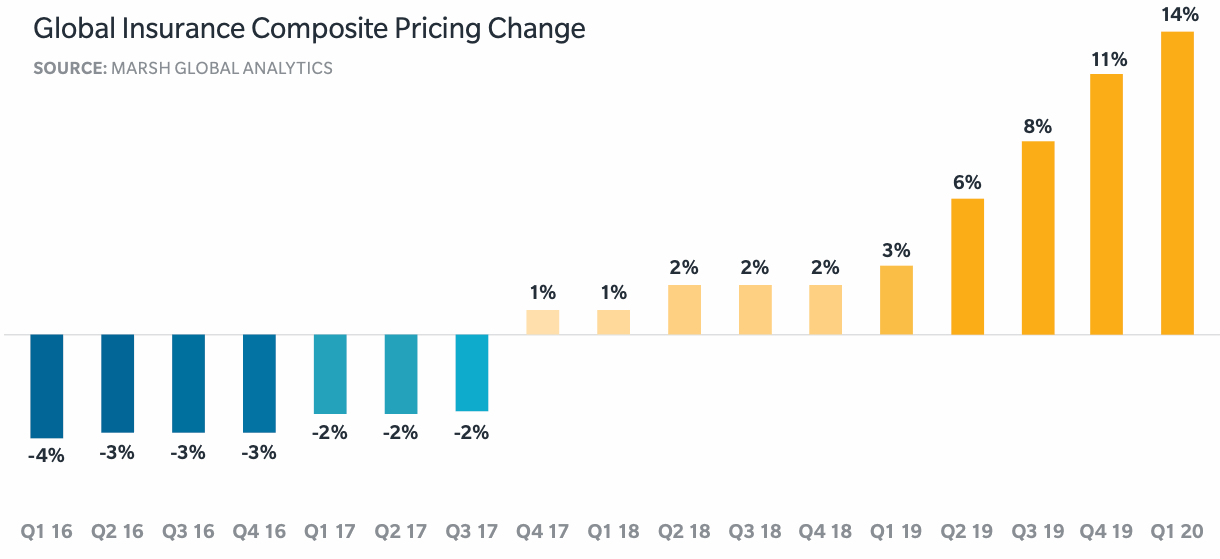

Across commercial property extreme catastrophic weather and wildfires since 2017 have had a direct impact on pricing prompting conditions to harden with sustained escalation in rates. The hardened market will usually mean the following for customers. Personal Experts say the insurance sector has been traumatised by the prospect of unintended coverage for business interruption related to coronavirus.

According to Risk Insurance SCA claims have skyrocketed. In UK property Marsh reported price increases of 35 as it said some insurers are now more willing to walk away from major renewals reducing competition. The Covid-19 outbreak has accelerated the hardening of the UK insurance market with rates being pushed up as insurers scramble to respond to the crisis.

In UK casualty it reported premium prices dropping by 10.

Recovering From A Flood Can Take Months To Realize And Costs A Whole Lot Of Money The Losses Can Be Extraordinary And Difficu Flood Insurance Flood Flood Zone

Recovering From A Flood Can Take Months To Realize And Costs A Whole Lot Of Money The Losses Can Be Extraordinary And Difficu Flood Insurance Flood Flood Zone

The Impact Of Covid 19 On The Insurance Market Wedgwood Insurance

The Impact Of Covid 19 On The Insurance Market Wedgwood Insurance

June Friedman Report Flood Insurance Facts About Floods Insurance Quotes

June Friedman Report Flood Insurance Facts About Floods Insurance Quotes

Why Is The Uk Insurance Market Hardening So Much Hamilton Leigh

Why Is The Uk Insurance Market Hardening So Much Hamilton Leigh

U S Commercial Property Insurance Rates Rise 21 In Q1 2020 Artemis Bm

U S Commercial Property Insurance Rates Rise 21 In Q1 2020 Artemis Bm

Cyber Loss Outsourcing Data To The Cloud Doesn T Diminish Risk Outsourcing Data Clouds

Cyber Loss Outsourcing Data To The Cloud Doesn T Diminish Risk Outsourcing Data Clouds

Affordability Of National Flood Insurance Program Premiums Report 2 Flood Insurance Flood Flood Information

Affordability Of National Flood Insurance Program Premiums Report 2 Flood Insurance Flood Flood Information

Reinsurance Insurance Earthquakes Catastrophemodeling Hazard Analysis Earthquake Spatial

Reinsurance Insurance Earthquakes Catastrophemodeling Hazard Analysis Earthquake Spatial

The Quest For Telematics In Automotive By E Y

The Quest For Telematics In Automotive By E Y

This Is Where The Catastrophe Bond Money Went In The Insurance And Reinsurance Industry Last Year Insurance Bond Composition

This Is Where The Catastrophe Bond Money Went In The Insurance And Reinsurance Industry Last Year Insurance Bond Composition

The State Of The Property Insurance Market

The State Of The Property Insurance Market

Why Covid 19 Accelerated The Hardening Financial And Professional Liability Market

Why Covid 19 Accelerated The Hardening Financial And Professional Liability Market

Agribusiness Hardening Property Markets Affect Tight Margins M3 Insurance

Agribusiness Hardening Property Markets Affect Tight Margins M3 Insurance

2021 Insurance Trends What To Expect In A Hard Insurance Market

2021 Insurance Trends What To Expect In A Hard Insurance Market

How To Manage Risk In A Hardening Market

How To Manage Risk In A Hardening Market

June Friedman Report Flood Insurance Facts About Floods Insurance Quotes

June Friedman Report Flood Insurance Facts About Floods Insurance Quotes

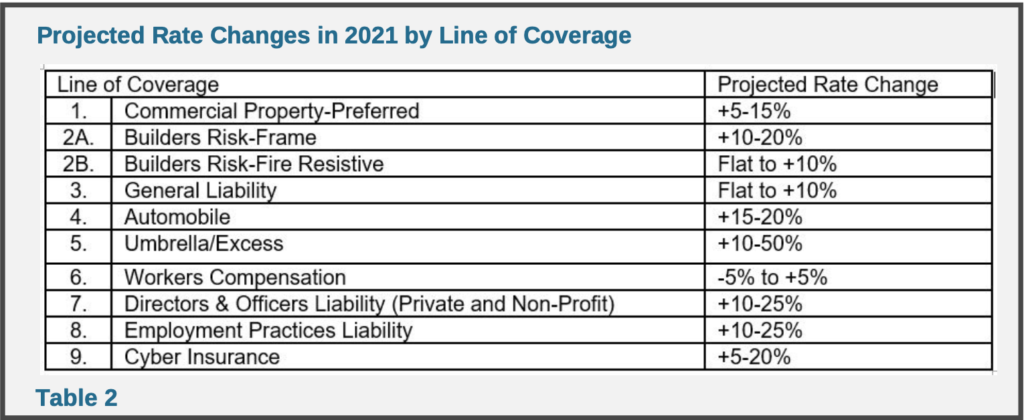

The State Of The Insurance Market 2021 Cavignac

The State Of The Insurance Market 2021 Cavignac

Market Conditions Cycles And Costs Iii

Market Conditions Cycles And Costs Iii

Post a Comment for "Why Is The Property Insurance Market Hardening"