Zurich Insurance Expense Ratio

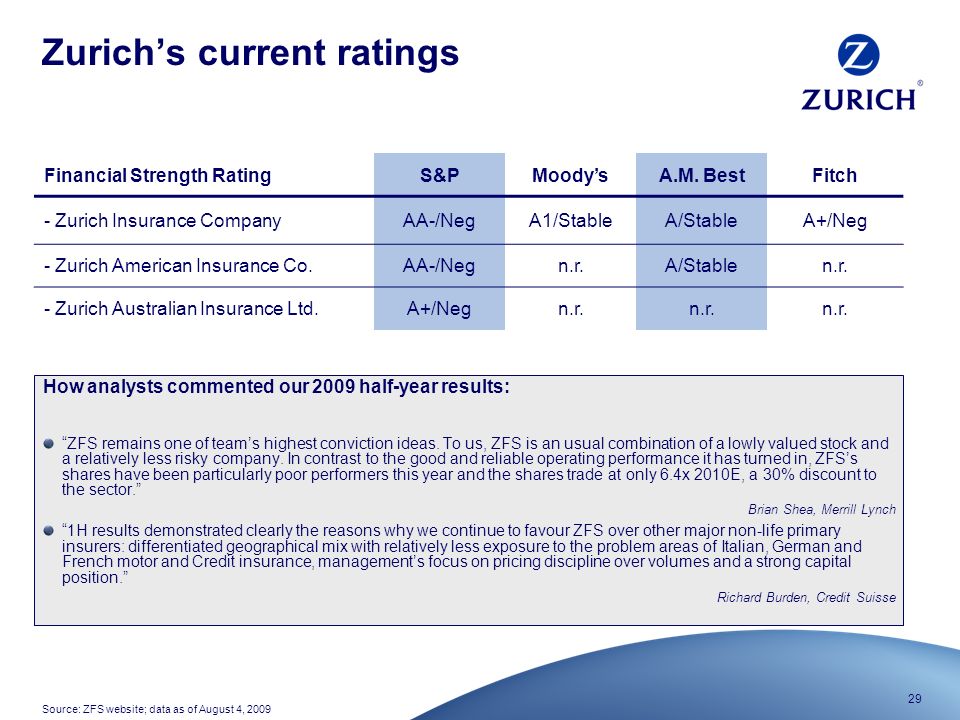

As of January 1 2020 Zurichs Swiss Solvency Test ratio stood at 198 7 compared with 221 one year earlier. Zurich Insurance Group research and development expenses for the twelve months ending June 30 2020 were 0M a NAN increase year-over-year.

Htf Mi Analyst Have Added A New Research Study On Title Global Digital Innovation In Insurance Market Size Innovation Management Swot Analysis Future Trends

Htf Mi Analyst Have Added A New Research Study On Title Global Digital Innovation In Insurance Market Size Innovation Management Swot Analysis Future Trends

Zurich Insurance Group AGs dividend payout ratio for the months ended in Jun.

Zurich insurance expense ratio. Zurich strengthened customer and employee satisfaction following its rapid and extensive response to the pandemic. During the past 12 months the average EBITDA Growth Rate of Zurich Insurance Group AG was -1820 per year. The policyholder dividend ratio is a measurement of the profitability of an insurance company or the.

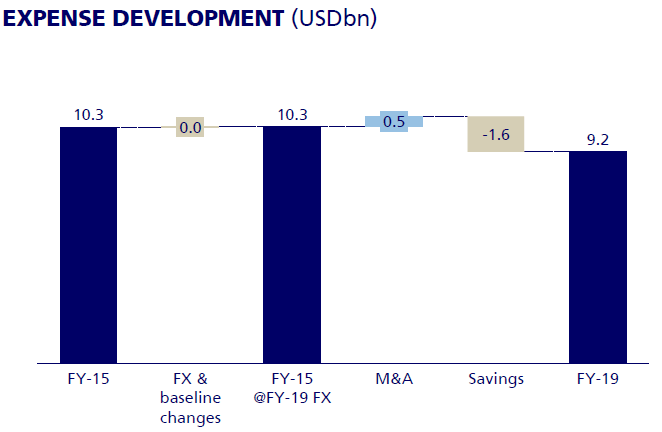

Now the company has spread throughout the world and has thousands of people working in the United States for Zurich North America. Our expense ratio in simple terms is the cost of running our business as a percentage of our premium income. Zurich groups balance sheet strength is underpinned by risk-adjusted capitalisation as measured by Bests Capital Adequacy Ratio BCAR being at the strongest level.

Zurich Insurance Group AGs EPS without NRI for the trailing twelve months TTM ended in Dec. If a company dividend payout ratio is too high its dividend may not be sustainable. Therefore Zurich Insurance Group AGs PE Ratio without NRI for today is 1616.

During the past 3 years the average EBITDA Growth Rate was -220 per year. EuropeMiddle EastAfrica accounts for about 43 of premiums and North. For every dollar Zurich took in in premiums it paid 978 in expenses and costs.

2January 1 2018 SST results refer to those filed with FINMA at the end of April 2018 before model change. The ratio of dividends to policyholders to net premiums earned. PC combined ratio was 978 last year.

The lowest was 727. Insurance risk is the inherent uncertainty regarding the occurrence amount or timing of insurance liabilities. The profitability of insurance business is also susceptible to business risk in the form of unexpected changes in expenses policyholders behavior and fluctuations in new business volumes.

12 2021 504 PM ET Zurich Insurance Group AG ZURVY ZFSVF. This facility is the central intake point for all new claims reported to Zurich and handles more than 750000 transactions annually. Overall rates rose by around 2 percent in 2016.

There are two components to the combined ratio - the loss ratio and the expense ratio - and Zurich has had challenges with both. Included are employee salaries and benefits the cost of running our offices commissions to brokers and travel costs. Zurich Insurance started inyou guessed it Zurich Switzerland back in 1872.

Zurich Insurance Group annual research and development expenses for 2019 were 0B a NAN decline from 2018. 2020 was CHF6473 Mil. On the expense side the companys expense ratio has remained.

2020 was CHF4242 MilIts EBITDA for the trailing twelve months TTM ended in Dec. Zurichs award-winning Customer Care Center is staffed by a team of specialists trained to set up your claim. SST ratio based on risk margin included in liabilities4430 279 151 1January 1 2019 SST results refer to those that will be filed with FINMA at the end of April 2019 after model change.

Zurich Insurance Group Zurich reported a solid half-year performance amid the widespread social economic and financial impacts of COVID-19 with strong growth in the Groups commercial business. And the median was 1198. Zurich Insurance Group today reported a 16 increase in 2019 business operating profit and proposed raising the dividend to CHF 20 per share as the company benefits from an improved business mix reduced volatility and enhanced profitability.

The net underwriting result improved by USD 14 billion to USD 412 million with an overall combined ratio of 984 percent an improvement of 51 percentage points from 2015. As of March 31 2020 the Z-ECM ratio is estimated at 101 2 and remains within the Groups targeted range. Zurich has today published its Financial Condition Report 2019 which highlights once more the Groups financial strength.

Zurich Insurance Group AGs EBITDA for the six months ended in Dec. The dividend payout ratio of Zurich Insurance Group AG is 095 which seems too high. 227 07 pts Combined ratio.

During the past 13 years Zurich Insurance Group AGs highest PE Ratio without NRI was 2187. While providing auto policies itself Zurich also owns Farmers which is a leading auto insurance provider in the United States. The exposure is transferred to Zurich.

Zurich Insurance Group AG OTCQXZURVY Q4 2020 Earnings Conference Call February 11 2021 7.

Zurich North America Risk Management Council Meeting Ppt Download

Zurich North America Risk Management Council Meeting Ppt Download

Zurich Insurance Group Company Profile Overview Financials And Statistics From 2014 2018 Template Presentation Sample Of Ppt Presentation Presentation Background Images

Zurich Insurance Group Company Profile Overview Financials And Statistics From 2014 2018 Template Presentation Sample Of Ppt Presentation Presentation Background Images

Https Www Zurich Com Media Project Zurich Dotcom Investor Relations Docs Results 2018 Consolidated Financial Statements Half Year Results 2018 Pdf La En Hash 66e078013b8c5e253447f7749dfb30d7

Zurich S P C Performance Drives 16 Rise In Profit For 2019 Reinsurance News

Zurich S P C Performance Drives 16 Rise In Profit For 2019 Reinsurance News

Pin By Ijam Core Design On Promo Adv Client Happy Birthday Birthday Happy

Pin By Ijam Core Design On Promo Adv Client Happy Birthday Birthday Happy

Zurich Exceeds All Financial Targets And Boosts Net Profit By 12

Zurich Exceeds All Financial Targets And Boosts Net Profit By 12

Zurich Insurance Entity Reports 348m Loss

Zurich Insurance Entity Reports 348m Loss

Zurich Insurance Group Is Our Helvetica Pick Otcmkts Zfsvf Seeking Alpha

Zurich Insurance Group Is Our Helvetica Pick Otcmkts Zfsvf Seeking Alpha

Zurich Insurance Reports Sales Growth Higher Rates Modest Covid 19 Claims

Zurich Insurance Reports Sales Growth Higher Rates Modest Covid 19 Claims

Zurich Insurance Group S 2016 Business Operating Profit Down In H1 Up In Q2 Over Prior Year Periods Canadian Underwriter

Zurich Insurance Group S 2016 Business Operating Profit Down In H1 Up In Q2 Over Prior Year Periods Canadian Underwriter

Dashboard Insurance Slide Team

Dashboard Insurance Slide Team

Https Www Elany Org Content Pdf Fs 21334 Pdf

European Insurers Sticky Expense Ratios Raise Doubts On New Cost Plans S P Global Market Intelligence

European Insurers Sticky Expense Ratios Raise Doubts On New Cost Plans S P Global Market Intelligence

To Insert A Zurich Picture Click On The Camera Icon In The Zurich Ci Toolbar And Follow The Instructions To Insert A Picture From Your Personal Files Ppt Download

To Insert A Zurich Picture Click On The Camera Icon In The Zurich Ci Toolbar And Follow The Instructions To Insert A Picture From Your Personal Files Ppt Download

Zurich Insurance Group Zfsvf Presents At Deutsche Bank Global Financial Services Conference Slideshow Otcmkts Zfsvf Seeking Alpha

Zurich Insurance Group Zfsvf Presents At Deutsche Bank Global Financial Services Conference Slideshow Otcmkts Zfsvf Seeking Alpha

Secrets Of Zurich Insurance Claims Exposed Stewart J Guss Injury Accident Lawyers

Secrets Of Zurich Insurance Claims Exposed Stewart J Guss Injury Accident Lawyers

Zurich Hit By 40 Slump As It Releases Interim Financials Insurance Business

Zurich Hit By 40 Slump As It Releases Interim Financials Insurance Business

Post a Comment for "Zurich Insurance Expense Ratio"