Car Insurance Subrogation Rights

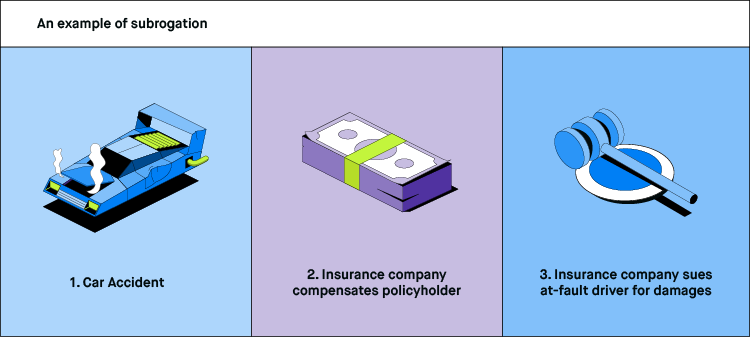

Subrogation is a legal right that allows your car insurance company to pay for your damages before pursuing the responsible party to collect the debt its owed. By law your insurance company must tell you if its going to pursue subrogation against another person or insurer.

Automobile Insurance Subrogation In All 50 States Second Edition Gary L Wickert 9781578233755 Amazon Com Books

Automobile Insurance Subrogation In All 50 States Second Edition Gary L Wickert 9781578233755 Amazon Com Books

This means you give the insurance company the legal right to sue the person who caused the accident to recoup the money paid to you for the damages.

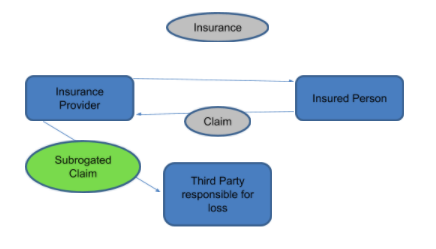

Car insurance subrogation rights. Subrogation also protects the insurance company from excessive financial losses helping to protect its bottom line and financial strength. Subrogation is defined as a legal right that allows one party eg your insurance company to make a payment that is actually owed by another party eg the other drivers insurance company and then collect the money from the party that owes the debt after the fact. The right of an insurer to be subrogated to the rights of its insured is typically based upon.

If the at-fault driver was uninsured however the other drivers insurance. However if you get a settlement from the defendant you may be required to repay your insurance company. Its common in auto health insurance and homeowners policies.

Heres an example of how auto subrogation works. Car insurance subrogation allows the at-fault drivers insurance company to compensate the other drivers insurance company for any claims they paid. It often refers to the insurance company seeking reimbursement from the party legally responsible for an accident after the insurer has already paid money on behalf of the insured.

The collateral source asserting a subrogation claim will not be entitled to greater legal rights than those possessed by the person who was entitled to receive the initial benefits. This is done in order to recover the amount of. Why does subrogation happen.

Subrogation sometimes shortened to subro is a way to protect you and your insurance company from paying for a car accident that wasnt your fault. Subrogation is when an insurance company recovers money that they paid out in a claim when their policyholder was not at fault and if the drivers involved are insured the process of subrogation will take place between their insurance companies. The doctrine of subrogation provides that if an insurer pays a loss to its insured due to the wrongful act of another the insurer is subrogated to the rights of the insured and may prosecute a suit against the wrongdoer for recovery of its outlay.

Simply put subrogation protects you and your insurer from paying for losses that arent your fault. If you are in an accident and it is determined you are not at fault the at-fault drivers insurer also known as a Third Party Carrier TPC would help pay the repair costs and medical bills. No you do not have to pay subrogation if you have car insurance.

The subrogation right is generally specified in contracts between the insurance company and the insured party. It lets your insurer pursue the person at fault to recover the money paid out for a claim that wasnt your fault. Subrogation is a term describing a right held by most insurance carriers to legally pursue a third party that caused an insurance loss to the insured.

When an insurance company pays out benefits to you in a situation where the other party caused the accident in question you must subrogate your rights to the insurance company. Insurance subrogation is when one insurance company must pay for injuries caused by another insurance providers customer. Insurers have to try to recover your deductible amount as well as what it paid out for your auto repairs or injuries.

Generally your insurer will have you sign a subrogation release that assigns your right to recover to them against the person responsible for your loss. In Benge the court considered whether an insurance carrier can exercise its subrogation rights under one policy against a party it insures under a different policy. Subrogation and Car Damage.

If you have a claim with a car insurance company however it is important to understand what subrogation is and how insurance companies use it to recover some of their expenses. Applied to car insurance the subrogation process is a legal mechanism used by insurance companies to get money from the at fault party in a car accident for reimbursement of expenses that the insurance company paid from a car accident. In turn subrogation makes it safer and more strategic.

Subrogation is one of the ways that car insurance companies recover money that was paid out in claims to drivers insured by them. If you were injured in a car wreck caused by someone else your insurance company may pay for medical care. Subrogation may be applied when your insurer settles your collision claim for damage to your vehicle due to another drivers negligence.

The definition of subrogation is the legal right of one party to collect damages or debt originally owed to another entity by a third party. Subrogation can be defined as the substitution of one person or entity for another in the settling of a claim or debt. By definition a subrogation claim allows the innocent paying party also known as a collateral source to stand in the shoes of the injured party.

The court held that the auto insurer could without violating the ASR or public policy assert a policys subrogation provision to avoid paying physical damage coverage benefits. Some insurers wont let you waive subrogation. The contracts may contain special clauses that provide the right to the insurance company to start the process of recovering the payment of the insurance claim from the party that caused the damages to the insured party.

What Is Subrogation And What Does It Mean For You

What Is Subrogation And What Does It Mean For You

Automobile Insurance Subrogation In All 50 States Matthiesen Wickert Lehrer S C Published Book

Automobile Insurance Subrogation In All 50 States Matthiesen Wickert Lehrer S C Published Book

Subrogation In Maryland How Does It Work

Subrogation In Maryland How Does It Work

What Is Subrogation 2020 Robinhood

What Is Subrogation 2020 Robinhood

Medical Insurance Subrogation And Personal Injury

Medical Insurance Subrogation And Personal Injury

What Is Subrogation In Car Insurance The Fitch Law Firm

What Is Subrogation In Car Insurance The Fitch Law Firm

Georgia Subrogation Law Who Pays Your Bills After An Accident

Georgia Subrogation Law Who Pays Your Bills After An Accident

Browse Our Example Of Quit Claim Letter Template Letter Templates Formal Letter Template Business Letter Template

Browse Our Example Of Quit Claim Letter Template Letter Templates Formal Letter Template Business Letter Template

Subrogation And Your Auto Insurance Claim

Subrogation And Your Auto Insurance Claim

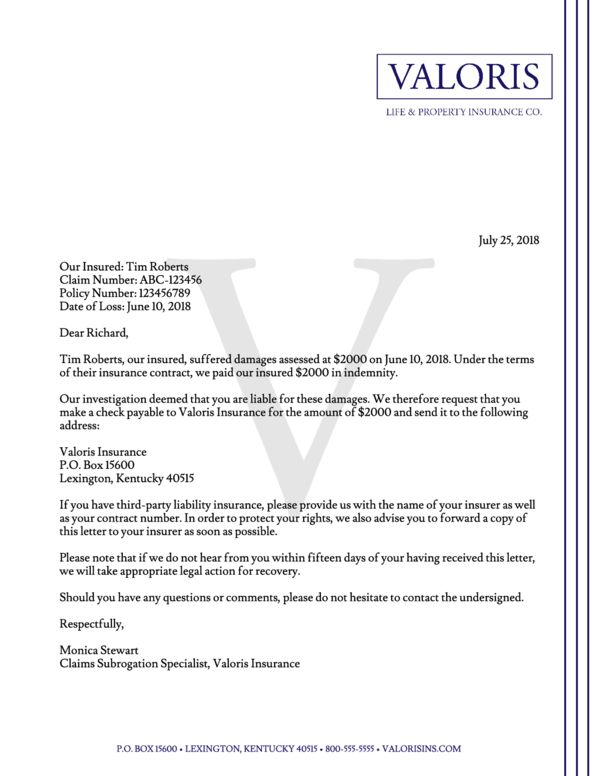

Demand Letter Template Free Unique Subrogation Demand Letter Template Collection Letter Templates Free Letter Templates Lettering

Demand Letter Template Free Unique Subrogation Demand Letter Template Collection Letter Templates Free Letter Templates Lettering

Trivia Tuesday Insurance Meme Independent Insurance Insurance Industry

Trivia Tuesday Insurance Meme Independent Insurance Insurance Industry

Insurance As A Financial Intermediary Is A Commercial Enterprise And A Major Part Of The Financial Life Insurance Quotes Insurance Quotes Home Insurance Quotes

Insurance As A Financial Intermediary Is A Commercial Enterprise And A Major Part Of The Financial Life Insurance Quotes Insurance Quotes Home Insurance Quotes

How Does Insurance Subrogation In Oklahoma Work

How Does Insurance Subrogation In Oklahoma Work

How To Deal With Insurance Subrogation Kapuza Lighty Pllc

How To Deal With Insurance Subrogation Kapuza Lighty Pllc

Insurance Subrogation What It Means And Why It Matters Phillips Law Firm

Insurance Subrogation What It Means And Why It Matters Phillips Law Firm

Subrogation Law Blog Law Blog Rule 24 How To Apply

Subrogation Law Blog Law Blog Rule 24 How To Apply

Post a Comment for "Car Insurance Subrogation Rights"