Can You Borrow Against Face Value Of Life Insurance

Policy loans are borrowed against the death benefit and the insurance company uses the policy as collateral for the loan. In the early years of the policy there may be little value if any to borrow against Risk of.

Loan Life Insurance Life Insurance Quotes Whole Life Insurance Quotes Whole Life Insurance

Loan Life Insurance Life Insurance Quotes Whole Life Insurance Quotes Whole Life Insurance

X Research source As for term life policies these are not loan sources since they dont have a cash value that can be borrowed.

Can you borrow against face value of life insurance. Depending on the length of time you have had your life insurance policy you may have built a large amount of savings you can cash out. There arent any loan requirements or qualifications other than the amount of cash value and the funds can be used for any purpose and paid back whenever you decide plus a life insurance policy loan has relatively low-interest rates. In this scenario youre not borrowing directly from your policy but the policy is your collateral.

It can take many years to build up any significant cash value in a permanent life insurance policy. If you can borrow against your life insurance policy it is the cash value that you borrow against not the face value. One of the benefits of cash value life insurance such as whole life and universal life is the ability to take out a life insurance loan against the cash value in your life insurance policy.

Life insurance doesnt have to only be used when you pass away. The two major types of permanent life insurance are Whole Life and Universal Life. You can usually borrow around 95 of a life insurance policys cash surrender value in any given year.

You can only borrow against a permanent or whole life insurance policy. This has been termed borrowing from yourself and while the interest you pay on such loans actually goes to the insurance company the fact that your remaining cash value continues to earn interest does make the process similar to being your own banker. However some Term life insurance has living benefits that allow the insured person to take part of the face amount in cash in case of critical or chronic illness.

You still have to pay back the loan and interest charges but there is no credit check required to get a loan against a life insurance policy. The money you borrow from the policy reduces the death benefit of the policy if you dont repay the loan while youre living. You can even borrow against your own retirement with a 401k loan.

Given to me as a child by my mothers father and with a modest death benefit the plan was to make sure that I would always have insurance and to give me an asset that I could borrow against if need be. You can borrow against a permanent life insurance policy with a cash value. You will only be able to borrow if you have permanent life insurance whole life or universal life which includes a cash component as opposed to term life insurance which does not.

You can borrow against permanent life insurance also called cash value life insurance policies that have enough cash value for borrowing. For example if the face value of your permanent life insurance policy is 100000 and you borrowed 5000 against the loan your insurance provider will subtract the outstanding 5000 loan from the face value meaning that your beneficiaries will receive 95000 instead of the full 100000 face value. More often than not we find that cash value causes undue stress.

Furthermore any unpaid interest will also be deducted. You can borrow against that value as needed as I did when I tapped my own policy for 500 decades ago. Well it wont affect your afterlife but your heirs might not appreciate it.

A permanent life insurance policy gains cash value which is money you can withdraw while youre still living. Universal life includes fixed universal life indexed universal life and variable universal life. Theyll say that you can borrow against your cash value use it to send your kids to college or even retire on it.

There is no cash value in a Term life insurance policy to borrow against. But what about a life insurance loan. Others have built in riders that allow the insured person to take part of the face amount in cash if.

For the most part you can borrow against a permanent life insurance policy since it has a cash surrender value. If you have term life insurance you cant take out a life insurance loan. The rules that govern life insurance policy loans do vary from company to company however so its important to understand a few basic rules about how much and when specifically youll have the option to borrow money against your policy.

Employer-based policies also known as group life insurance are slightly different then individual policies because your employer carries out a group policy either directly or indirectly. When you borrow based on your life insurance policys cash value you are borrowing money from the life insurance company. You can also cash out a permanent policy but doing so also leaves you without coverage.

Indexed universal life insurance IUL currently holds the hot spotif you have come across IUL do not buy it before reading this article. Its easy to borrow against the cash value of a permanent life insurance policy. When you need cash for an emergency or a big expense such as college tuition a loan from your life insurance policy can be a saving grace offering you advantages over credit card debt or personal loans from a bank.

Whole Life Insurance Quotes Whole Life Insurance Whole Life Insurance Quotes Life Insurance Facts

Whole Life Insurance Quotes Whole Life Insurance Whole Life Insurance Quotes Life Insurance Facts

Is Life Insurance An Asset Why It May Be The Most Important Asset You Own

Is Life Insurance An Asset Why It May Be The Most Important Asset You Own

What Is Cash Value Life Insurance Daveramsey Com

What Is Cash Value Life Insurance Daveramsey Com

How Does Whole Life Insurance Work Cash Value Explained

How Does Whole Life Insurance Work Cash Value Explained

What Is Universal Life Insurance Daveramsey Com

What Is Universal Life Insurance Daveramsey Com

What Does It Mean When A Life Insurance Policy Is Paid Up Life Ant

What Does It Mean When A Life Insurance Policy Is Paid Up Life Ant

Overfunded Life Insurance Pros And Cons

Overfunded Life Insurance Pros And Cons

Difference Between Cash Value And Face Value In Life Insurance

Difference Between Cash Value And Face Value In Life Insurance

Pin By James On Propagan Life Insurance Sales Insurance Sales Life

Pin By James On Propagan Life Insurance Sales Insurance Sales Life

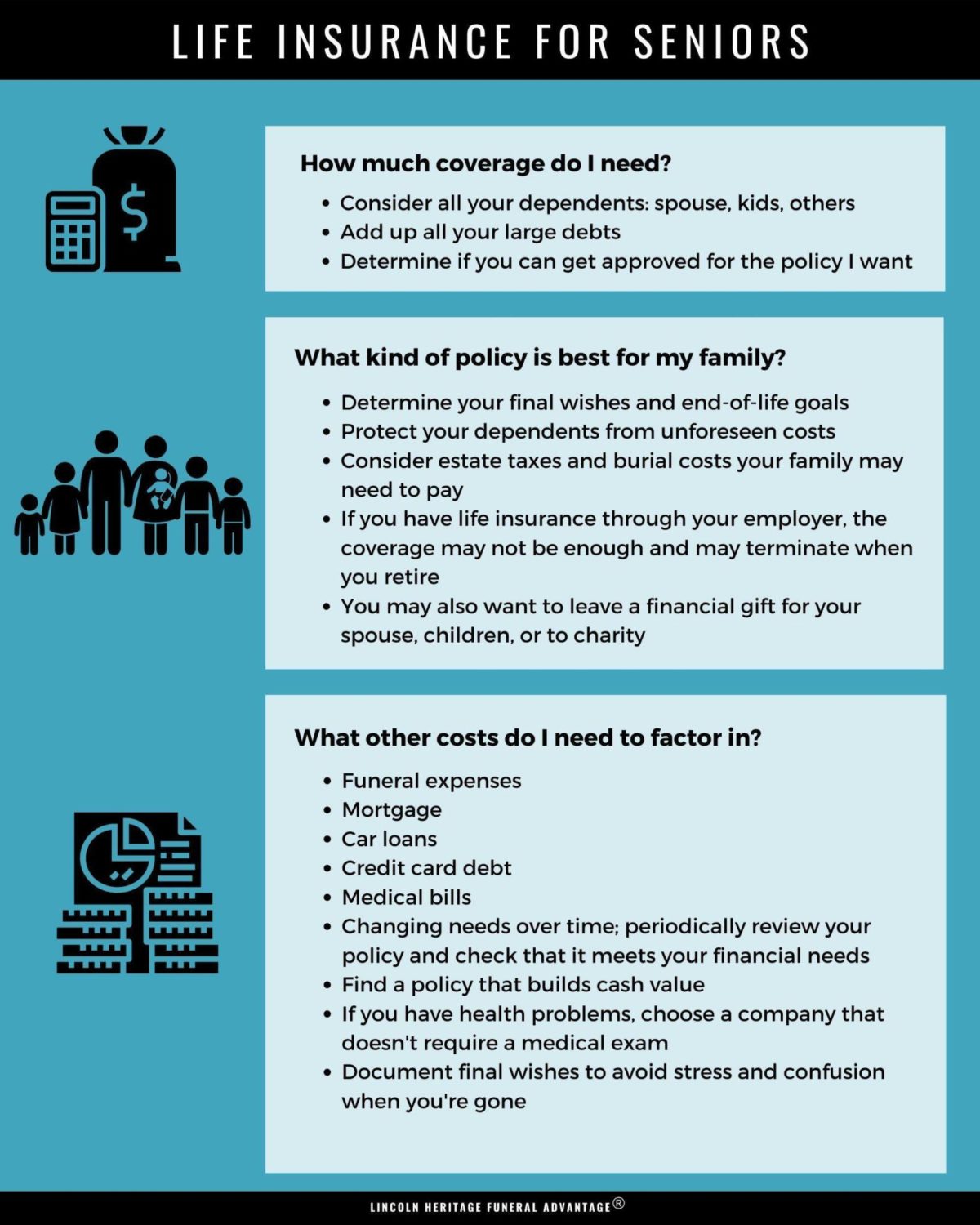

Best Life Insurance For Seniors Term Vs Whole Affordable No Exam

Best Life Insurance For Seniors Term Vs Whole Affordable No Exam

What Are Paid Up Additions Pua In Life Insurance

What Are Paid Up Additions Pua In Life Insurance

Life Insurance Loans A Risky Way To Bank On Yourself

Life Insurance Loans A Risky Way To Bank On Yourself

/life_insurance_87614098-5bfc37104cedfd0026c3e06a.jpg) 6 Ways To Capture The Cash Value In Life Insurance

6 Ways To Capture The Cash Value In Life Insurance

Borrowing Against Your Life Insurance Policy Should You Take Out A Loan Valuepenguin

When To Borrow Against Your Life Insurance Policy Nerdwallet

When To Borrow Against Your Life Insurance Policy Nerdwallet

2021 Guide To Term Life Vs Whole Life Insurance Definition Pros Cons

2021 Guide To Term Life Vs Whole Life Insurance Definition Pros Cons

Life Insurance Sba Loan Requirements Sba Loans Life Life Insurance

Life Insurance Sba Loan Requirements Sba Loans Life Life Insurance

Index Universal Life Insurance Get Flexible Universal Life Insurance Life Insurance Quotes Life Insurance Facts

Index Universal Life Insurance Get Flexible Universal Life Insurance Life Insurance Quotes Life Insurance Facts

Post a Comment for "Can You Borrow Against Face Value Of Life Insurance"